2013 U.S growth and fiscal outlook take center stage

Global financial markets remain in anticipation mode ahead of potentially critical policy milestones such as the U.S. elections. 2012 witnessed ongoing monetary support and pledges for further unconventional measures by central banks such as the Fed and the ECB. Yet, 2013 is likely to be a year whereby the performance of risk assets will be determined by the degree of fiscal reform and political compromise; especially in the context of a fragile global growth backdrop. One can only wish that the recent calamity of hurricane Sandy will be a catalyst for bi-partisanship and progressive fiscal measures that will give businesses and households the necessary confidence and visibility ahead of their 2013 spending plans. From our investment perspective, we continue to favor a late-cycle and income growth oriented portfolio.

The U.S. economy still accounts for a large portion of Global GDP (~21%) and the 2013 U.S. growth outlook is likely to impact the global economy. The most recent global economic data point to some tentative signs of stabilization, following a soft patch in Q3. Some stability is appearing with regards to emerging market export economies. This stability may prove ephemeral though, unless we witness renewed policies in the main economic zones (U.S., China and the Eurozone).

As we can see below, prior to the recent hurricane Sandy, U.S. indicators pointed to a low but stable growth backdrop. U.S. manufacturing orders and the U.S. labor market have shown some signs of stability.

To be sure, even though the unemployment rate dipped below 8% we are skeptical on the true improvement in the labor market as the labor participation rate has been on the decline. The trend has also been in recent years for employment gains in part-time or low paying jobs, which has led to declining median household income. Therefore, despite recent gains in consumer confidence we pay more attention to business sentiment which is more forward looking. Thus, assuming some fiscal visibility for 2013, we are more optimistic on the capacity of the corporate sector to be a key driver of economic and earnings growth in the medium-term.

With regards to the outlook for further monetary policy action, a continuation of the political status quo will likely keep the low rate environment well anchored. As we discussed in past articles, we have been cautious on the true effectiveness of the Fed’s extreme monetary accommodation (as seen below by the drop in the velocity of money and rising excess banking reserves) and we continue to monitor inflation expectations that are implied by the Treasury market. In general, the longer term inflation expectations have been stable but on an upward sloping trajectory. The key question is whether businesses and households see inflation changes as transitory or as more permanent in nature. Likewise, household savings behavior may also be at risk due to ongoing expectations of zero rates. In the medium-term, our expectation is for high yielding and dividend growth instruments to remain in strong demand as savers are seeking alternative income sources.

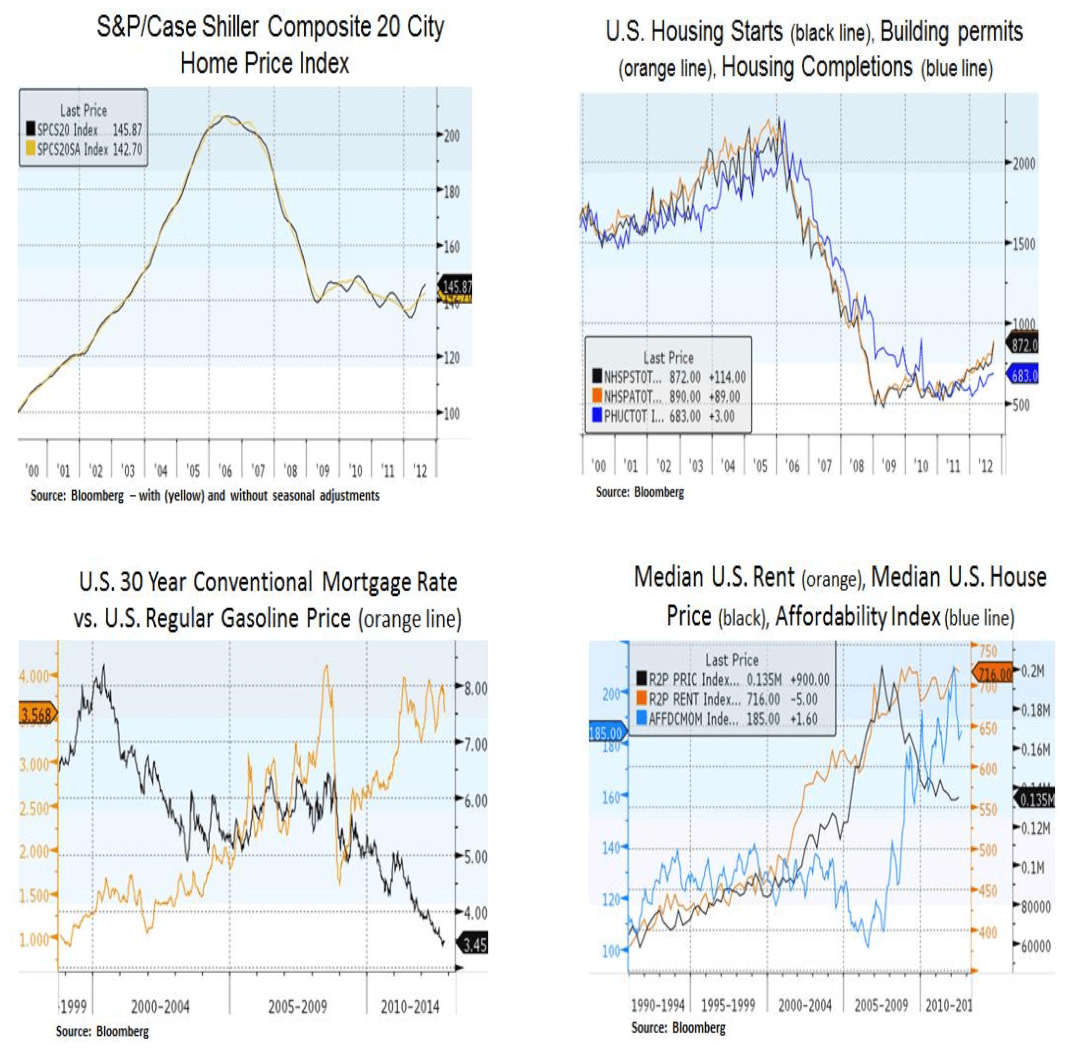

The main bright spot of the U.S. economy continues to be the housing market. At a minimum, there has been some stability in house prices as a result of suppressed mortgage rates and investor demand for high yielding housing opportunities. Perceptions of wealth are important for U.S. households and housing stability helps the overall credit and banking conditions. Looking ahead though, we need to see sustained employment and income growth. Hence, this is where sustainable fiscal, energy, tax and entitlement policies come into play. All of which will be determined in the next 2-4 months after the U.S. elections.

As the European crisis has clearly demonstrated, deleveraging is not an easy process. Excess debt (>90%) has historically led to very low growth rates, often leading economies in negative growth feedback loops. The political situation in Europe is certainly one of the biggest hurdles to the debt crisis that is becoming a chronic issue. Abundant liquidity by itself does not ensure healthy credit conditions. The recent ECB lending survey has shown that the Eurozone is facing tighter credit conditions and weak reported demand for credit. Prolonged tight credit conditions for the private sector can continue to dampen domestic demand in the Eurozone. Our expectation however is for more forceful action by the ECB as it has generally lagged other major central banks. More conventional (rate cuts) and unconventional (sovereign bond purchases) are likely in store for 2013. Hence, financial market participants will be looking for concrete action in 2013 by both the ECB and U.S. fiscal policymakers in an attempt to boost global growth expectations, along with policy action from the new political leadership in China.

In conclusion, we continue to be opportunistic in allocating capital in fixed income and equity instruments that offer visible cash flows and growing income streams in a zero-rate environment. Our equity sector positioning has a late-cycle bias with a tilt towards industries such as software, aerospace and healthcare. We also seek to use weak cyclical entry points in secular investment themes such as aging developed market demographics, emerging market consumer spending, information technology and the rising global supply/demand for more efficient fuels such as natural gas. Lastly, we seek to adapt our investment stance as we gain more visibility into the 2013 fiscal and growth outlook.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.