Are Central Banks at a crossroads?

Developed market Central Banks (Fed, ECB, BoJ, BoE) have long embarked on an unprecedented journey to ease credit conditions; in an attempt to promote economic growth and prevent the deflationary forces of debt deleveraging. Yet, despite near zero base lending rates and a series of unconventional liquidity measures, disinflation and muted credit growth are prevalent. The dilemma for Central Banks is how they can balance price stability (price inflation) with financial stability (asset inflation). The challenge is perhaps more immediate for the sustainability of the Federal Reserve’s $1 trillion/year quantitative easing (QE) program. In Europe, the ECB’s challenge is how they can implement a uniform conventional or unconventional monetary policy across a fragmented economic and political union. From our investment perspective, as this medium-term policy uncertainty lingers, we have a preference for a balanced portfolio mix and a healthy cash position. We favor exposure to short duration non-agency MBS securities and equity securities that offer dividend growth, solid balance sheets and a valuation cushion from a bottoms-up perspective. Moreover, in a low intra-correlation environment for U.S. equities, we aim to take advantage of stock-picking opportunities.

After a very low Oct. inflation point (0.7% CPI), the ECB surprised financial markets last week by reducing its key lending rate by 25bps to 0.25%. Ample spare capacity, high unemployment rates in the Eurozone, an elevated trade-weighted Euro currency and weak credit creation most likely contributed to disinflation. In our view, the prospect of deflation within Germany is likely to be a key determinant for unconventional measures (despite legal constraints) such as asset purchases by the ECB; in an attempt to unclog credit channels and improve the ECB’s transmission mechanism. Such a scenario has the potential of enhancing the earnings outlook for U.S. cyclical multi-national companies e.g. technology, industrials and energy.

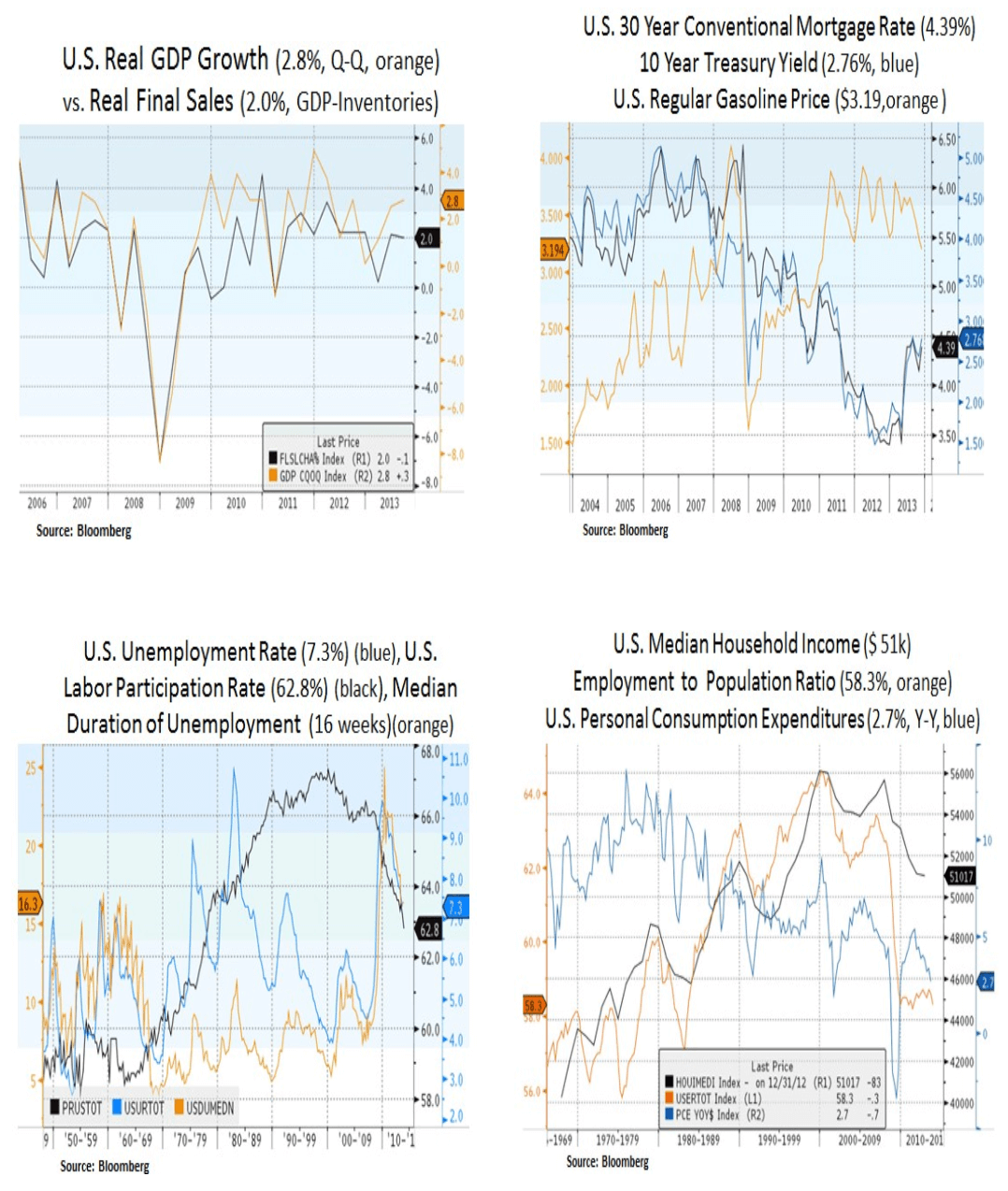

On the U.S. front, after better than expected Q3 GDP (2.8%) and Oct. non-farm payroll (204k) numbers, expectations have increased for an earlier tapering of the Fed’s QE program. As a result, the 10 Year Treasury yield increased to 2.76%. In our view, the Fed finds itself in a delicate position. On the one hand, the Fed is undershooting its inflation target (1.2% core PCE inflation vs. ~2% target) and the U.S. consumer is still facing a number of challenges (e.g. rising mortgage rates, low labor participation rate, muted income growth, uneven aggregate demand, and Obamacare uncertainty). On the other hand, with decreasing Treasury issuance (due to a declining budget deficit to ~$700bn), the Fed runs the risk of monetizing the bulk of the Treasury’s issuance i.e. $540bn/year in Treasury purchases. Therefore, sooner or later, the Fed has to normalize its monetary stance in a manner that attempts to balance price and financial stability. In our view, as this normalization phase plays out, it is prudent to avoid longer duration low yielding fixed income securities e.g. U.S. Treasuries, agency MBS, high grade corporate debt and municipal bonds. Thus, we maintain our preference for short duration non-agency mortgage backed securities.

In conclusion, in a low consumer/producer inflation and high financial asset price environment, Central Banks have the challenge of balancing price and financial stability. In our view, more visibility on monetary and fiscal policies would give CEOs and households the necessary confidence to invest and spend respectively in 2014. In equities, late-cycle industrials and technology names exposed to enterprise spending would be particular beneficiaries of a rebound in capital expenditures. Lastly, a higher than expected economic growth environment would be an opportunity to uncover value opportunities in the energy sector.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.