Defensive investment posture in an uncertain political and growth environment

The economic and policy landscape continues to be uncertain. Global cyclical economic indicators are showing signs of stress and developed economies face fiscal, structural and political challenges. Growth and credit pressures in Europe are impacting the developing market growth outlook. In addition, the U.S. growth profile is softening as a result of a potentially tight election outcome and uncertainty over the 2013 fiscal outlook. Political divisions are a big overhang for financial markets and a policy vacuum is weighing on U.S. business and household sentiment. Particularly in Europe, national interests appear to be a major hurdle for a true European political and economic union. Therefore, given the above challenges, our investment positioning is tilted towards income oriented instruments and defensive sectors that offer cash flow and earnings visibility.

As we can see below, global cyclical indicators are showing weakness. Several cyclically sensitive companies (e.g. FedEx, Texas Instruments, Bed Bath & Beyond) are starting to give a more cautionary earnings and revenue outlook. They are citing weak European demand, promotional pressures on profit margins and customer uncertainty that is causing delayed orders. From a U.S. perspective, corporations have enjoyed a fairly strong cyclical recovery since 2009 with a material rebuilding of inventories. At this stage of the cycle, a mid-cycle slowdown is to be expected with earnings growth converging towards GDP growth. As fiscal and monetary support gets stretched, the corporate sector would normally be reinvesting its recovered profits into capital and labor. Corporate balance sheets are in solid shape and they enjoy very low financing costs. However, uncertainty over the U.S. elections and the 2013 fiscal outlook is keeping corporations and households on the cautious side.

On the monetary side, we note that the Federal Reserve downgraded its growth, inflation and unemployment forecasts last week. In addition, they extended their Maturity Extension Program until Dec 2012. The Fed plans to purchase $267bn worth of long-term Treasury securities by selling short-term notes. This action was the path of least resistance for the Fed as economic data and inflation expectations are not weak enough for another round of quantitative easing (QE3). At the upcoming August 1st Fed meeting, it is possible that a more aggressive monetary response is enacted, but in our view the main issue for financial markets and businesses is the fiscal and tax outlook for 2013. Thus, the pivotal point for corporate and household visibility is likely to be the Nov. Presidential and Congressional elections.

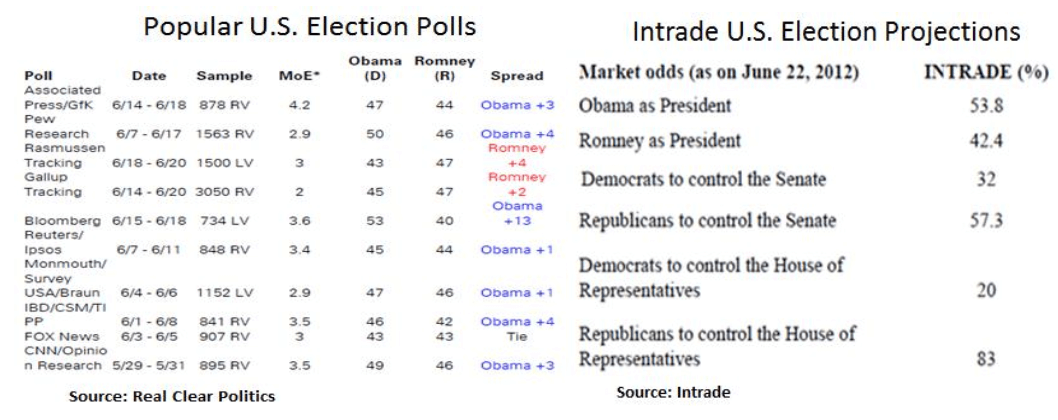

From a market perspective, a Republican President or a Republican controlled Congress may bode well for an end to political gridlock which has been an obstacle to urgent issues, such as fiscal sustainability and reforming the tax and healthcare systems. In addition, excessive regulation of the energy and financial sectors may be reduced. Therefore, even though fundamental data may be weakening, the outlook for the U.S. elections is likely to be a big catalyst for the financial markets and business/household sentiment. As we can see below, President Obama holds a narrow lead and it is possible that economic weakness may tilt the odds for a Romney win and a Republican controlled Congress.

Clarity over the 2013 fiscal outlook will likely provide large and small businesses with the confidence to engage in capital expenditures which are now lagging. Thus, fiscal certainty may bode well for job and income growth. Currently, initial jobless claims have started ticking up and the pace of job creation has been lackluster. Job growth is critical for big ticket spending (housing, autos) and for overall consumer spending, which accounts for 70% of U.S. GDP. Recent indications are showing that consumer spending has been partly financed by personal savings and credit card debt. Therefore, corporate cash deployment and genuine income growth is critical at this juncture of the current business cycle.

From a sector perspective, we have been cautious on cyclically leveraged areas such as materials, energy, consumer discretionary and early-cycle industrial names. Global economic weakness has weighed on these sectors and a strong USD has been a headwind for energy and commodities. Barring a further Federal Reserve Quantitative Easing program, our view is for a broadly strong USD especially as there is ample room for ECB interest rate cuts in July. Therefore, tactically we remain cautious on materials and energy. We note however that energy sector valuations are becoming progressively attractive as shown by the sector’s Price to Book ratio (orange line). Fundamentally, increased oil supplies and soft demand have weighed on oil prices but it is likely that Middle East tensions will provide a floor for oil prices.

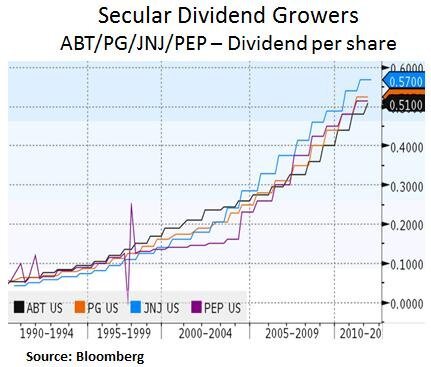

In conclusion, given the above market risk-reward profile, our investment positioning is tilted towards securities that offer cash flow and earnings visibility. We have a preference for defensive sectors such as utilities, healthcare, telecoms and consumer staples. In addition, we like secular dividend growers and companies that have healthy cash positions and balance sheets.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.