Deflationary winds support demand for income

The global economy remains in a state of transition as the developed markets are continuing their debt deleveraging process and emerging markets are adjusting their economic models. With lower employment levels in developed markets and a declining demand for commodities in emerging markets, deflationary forces are a tailwind for income generating instruments. Thus, in an ongoing low rate environment, we still see healthy demand for steady cash flow from MBS and large-cap dividend growing equities. Moreover, in an uneven growth environment, we have a preference for secular growth themes such as global demand for pharmaceuticals which is driven by favorable global demographics. We also favor late-cycle themes such as commercial aerospace, software and energy infrastructure. Lastly, we have recently warmed up to lagging industries such as defense and cash heavy sectors such as technology which is primed to benefit from a rebound in enterprise spending.

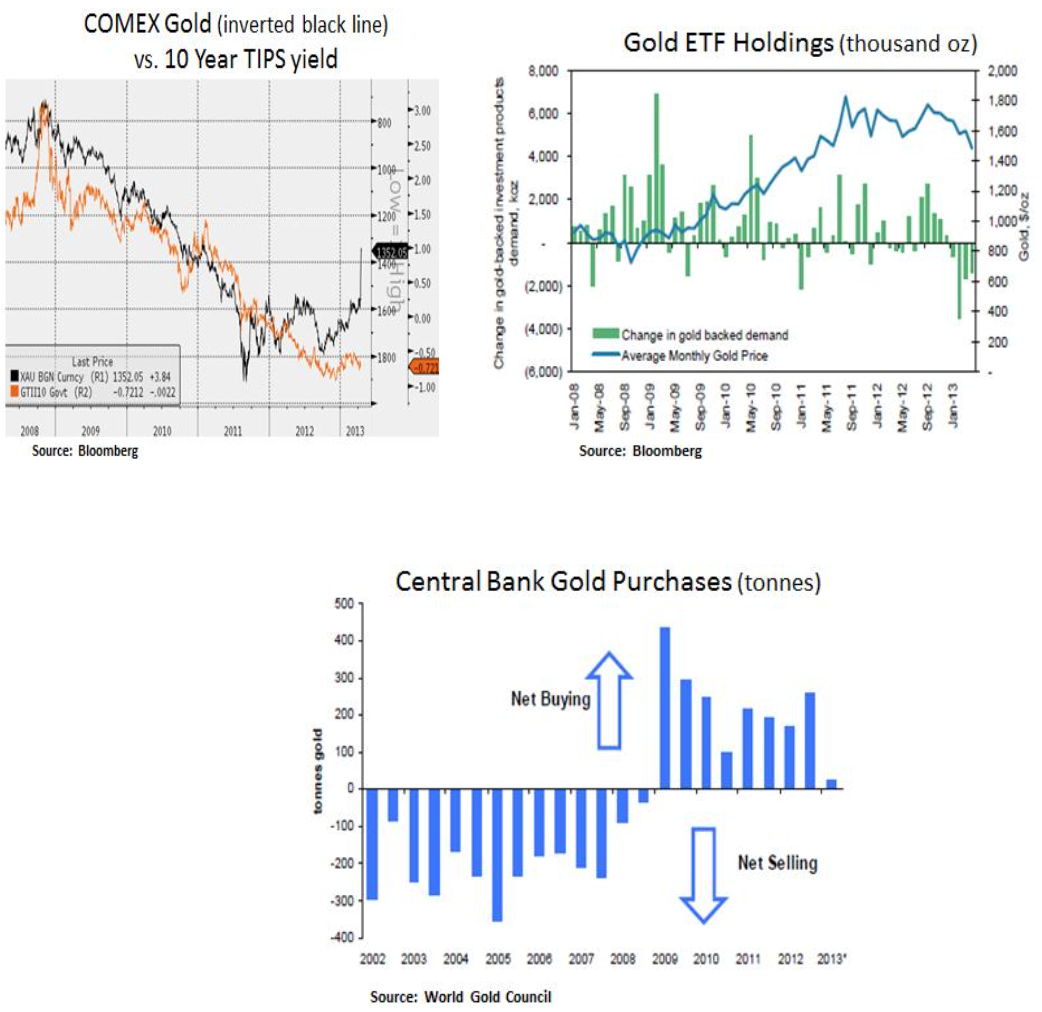

Financial markets witnessed a volatile episode in the gold market in recent days. Gold incurred a 14% 2-day drop as a result of central bank selling fears in Europe and ETF/hedge fund liquidations. The physical market was also impacted to a degree by higher import tariffs on gold by India; one of the biggest global buyers of gold. Real rates are likely to remain low in the medium-term, as central banks still have leeway to continue expanding their unconventional policies. Therefore, even though gold may experience a technical rebound, we maintain our preference for cash flow generating instruments.

As we can see below, inflation expectations in the U.S. appear to be in check. Commodity prices such as oil, copper and iron ore have been weak recently as a result of the softening global growth outlook. The U.S. labor market is also showing signs of softening and wage inflation remains subdued. This deflationary backdrop is supportive for further monetary accommodation by the Federal Reserve. Low rates are likely to support the ongoing housing market recovery and broader household deleveraging as debt service costs stay low.

In Asia, we are monitoring capital flows and China’s transition to a more consumer driven economy. After a decade long investment boom we are now seeing China slowing to a 7.7% growth rate in Q1 of 2013. Apart from controlling consumer inflation, the Chinese authorities are attempting to curb excess house price appreciation that is taking place due to a surge in shadow bank financing (white bars on the chart below). From our perspective, we are avoiding the materials sector as certain base metals seem to be in over-supply e.g. copper, aluminum and iron ore. We prefer emerging market consumer exposure via the healthcare sector.

In Europe, despite low sovereign yields, we are observing a challenging growth and credit backdrop. The Eurozone is a fragmented economic and political landscape. The Southern countries continue their austerity drive which is weighing on growth and their domestic labor markets. This is causing inflation to be subdued and we expect the ECB to finally do more on the monetary front in order to unlock the credit markets; especially for local small and medium sized businesses. The ECB has been lagging behind the Federal Reserve and its balance sheet has been contracting; whereas the Fed’s has been expanding. Therefore, in relative terms, the ECB has been running a tighter monetary policy. Germany holds the key to a more aggressive ECB response. We expect a softening German growth backdrop to prompt the ECB to a more accommodative stance. Political challenges remain but in such a scenario we would be willing to increase our cyclical exposure to Europe in order to take advantage of significant pent-up demand.

In conclusion, the global growth backdrop remains soft and deflationary forces are a tailwind to further central banking accommodation. In a low rate environment and as the baby boomer generation is starting to retire, we see healthy demand for income generating instruments such as MBS and large-cap dividend growing equities. We continue to prefer sectors with strong secular trends and late-cycle positioning e.g. healthcare, commercial aerospace and software.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.