Federal Reserve policy converging to market expectations

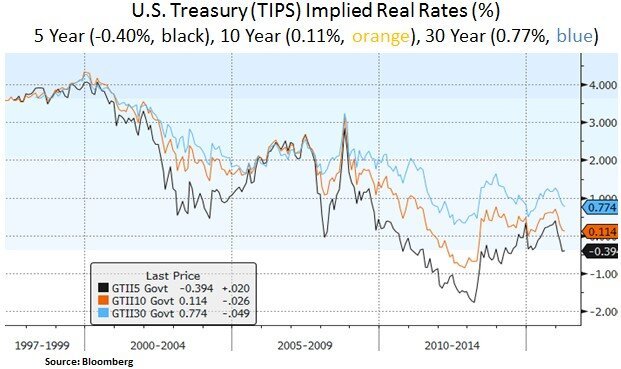

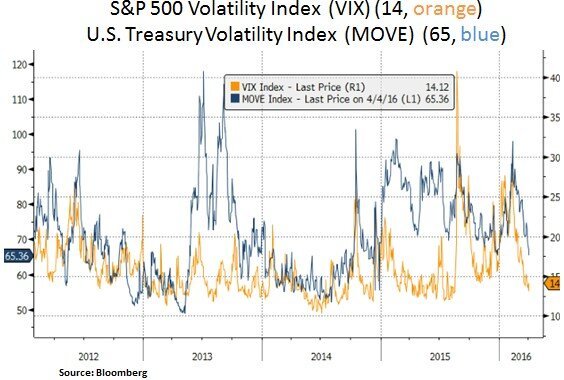

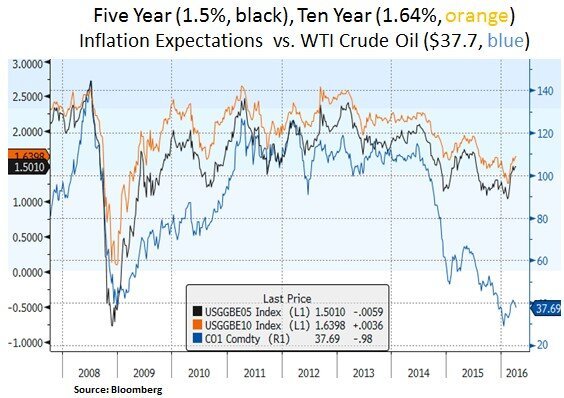

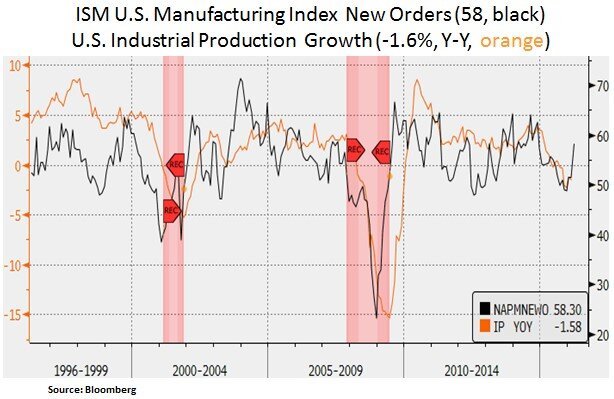

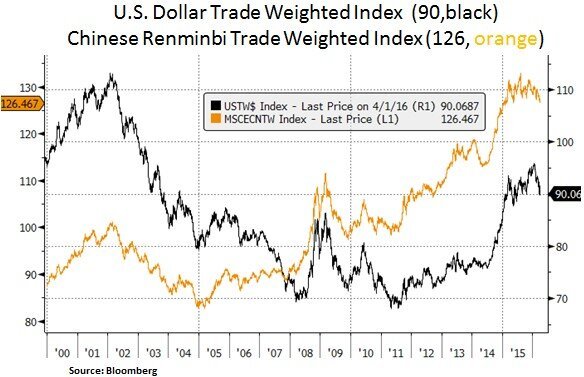

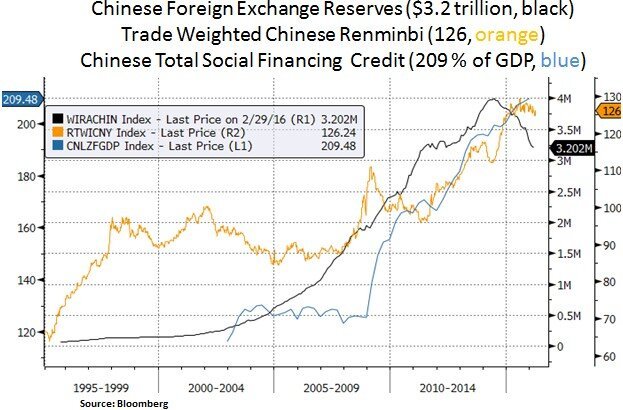

U.S. asset price volatility declined further in March, on the back of a rebound in U.S. manufacturing data and a more dovish stance by the Federal Reserve on March 16th. Real or inflation adjusted interest rates witnessed a steep drop and inflation expectations rebounded. In addition, a softer U.S. dollar and recovering Chinese manufacturing data lifted sentiment for the commodity complex and emerging market assets. Corporate credit spreads have been stabilizing and cyclical equities such as industrials have continued their outperformance. As we argued in past articles, U.S. dollar strength is a deflationary agent for global growth and the quasi-peg to the Chinese yuan increases domestic deflation pressure for China. In our view, two of the market overhangs such weakness in oil prices (excess supply) and USD strength (hawkish Fed) can gradually moderate. The third overhang, Chinese growth slowdown and Yuan devaluation risk, may necessitate some coordinated fiscal action by developed market governments; particularly as sovereign yields remain subdued. From our portfolio perspective, we continue to focus on sustainable sources of income and earnings generation; while paying attention to security valuations.

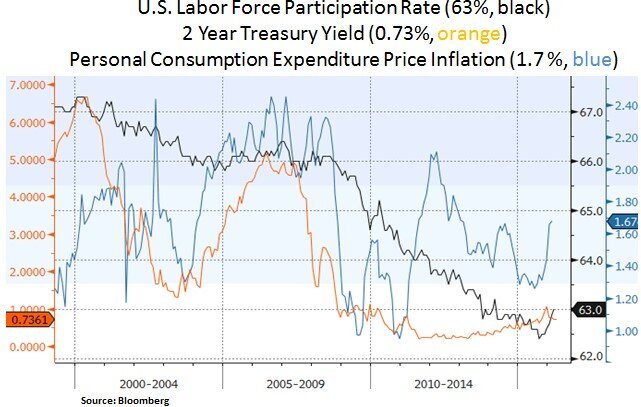

As we enter the 7th year of the current U.S. business expansion, we expect the Fed to continue to focus on leading indicators such as credit conditions and corporate profitability. With soft global growth and inflation metrics, the Fed is likely to balance domestic and external factors in their policy path. Elements such as credit/FX/oil/asset volatility can have a direct impact to corporate and consumer confidence/spending intentions. Low real interest rates and a range bound U.S. dollar can put a floor on deflationary concerns. We expect secular demand for income generating instruments to remain robust. At the sector level we favor secular growth themes in sectors such as healthcare and technology. We also favor the energy sector as supply/demand gradually gets rebalanced to economically viable levels. We continue to lean on mega-cap equities with robust cash flow and dividend growth.

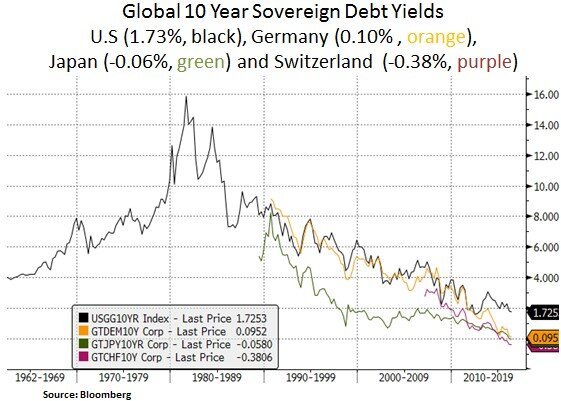

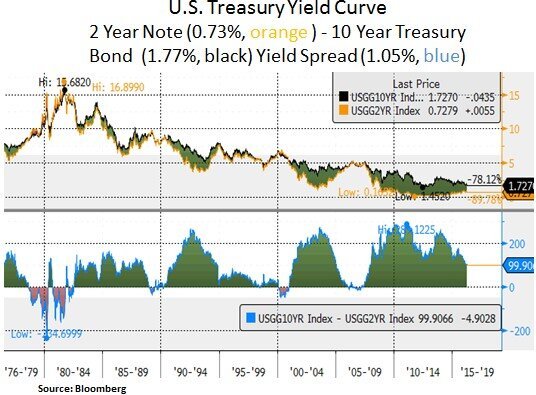

At the sovereign debt level, we note that declining sovereign debt issuance and Central Bank asset purchases are keeping key sovereign yields suppressed. Mixed growth/inflation data in Europe and Japan have also kept yields subdued. Along with appreciating currencies, European and Japanese equities have been weak. The Euro Stoxx and Nikkei year-to-date equity performance is -11.1% and -16.7% respectively. In contrast, large-cap U.S. equities are in positive territory i.e. S&P 500 (+0.8%), DOW Jones (+2.1%). Fed policy re-converging with other Central Banks and wide yields spreads will likely keep healthy demand for U.S. Treasury debt. From our portfolio perspective, we still view non-agency Mortgage Backed Securities (MBS) as a steady source of yield.

From a big picture perspective, the direction of the trade weighted USD and Yuan currency indices is a key focus for global growth expectations and U.S. corporate profitability. A softer USD is positive for U.S. multinationals; especially for ones with higher emerging market/energy/materials exposure. We note below that USD market positioning is now more neutral. In our view, a soft USD facilitates a more gradual Yuan devaluation; as China transitions to a consumer led growth model. A more abrupt Yuan devaluation would be disruptive to global growth and inflation expectations. Therefore, we expect global financial conditions to be a key variable for the Fed’s decision making process.

Lastly, on the U.S. labor front, we note that U.S. labor force participation rate has continued to expand. An expansion in the labor force is positive for U.S. GDP growth and from a wage inflation point of view, increased labor supply can keep wage pressures in check. Q1 2016 GDP growth is currently tracking ~0.5%. Such an economic backdrop is likely keeping the U.S. Treasury yield curve flattish.

In conclusion, a more patient Federal Reserve will likely benefit global growth and inflation expectations. We continue to favor a balanced mix of income generating instruments and well positioned U.S. mega-cap equities that have sustainable cash flows.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.