Market Confidence is Conditional on Policy Execution

The December expansion of the ECB’s balance sheet and consequent supply of 3-year bank loans has brought a much needed liquidity relief to the European banking system and has probably prevented bank failures of over-leveraged institutions. In addition, there has been some short-term borrowing cost relief in the EURUSD swap and European sovereign debt markets. Thus, this policy action has given some confidence to financial markets. In order to sustain this confidence and address effectively the challenging debt and growth dynamics in the global economy further policy actions need to be undertaken.

In the medium-term, a front loaded credit crunch needs to be averted in Europe by relaxing the European Banking Authority’s June deadline for banks to boost their core capital ratio to 9%. Forcing banks to raise funds (EU 115bn) or shed assets at a time of overzealous fiscal austerity may put substantial strain on growth via a pullback in credit creation. Thus, policymakers need to balance their timing between austerity and bank deleveraging. In addition, following the recent S&P sovereign credit rating downgrades, political imbalances in Europe need to be carefully tackled. Germany now has the only AAA sovereign debt rating amongst Europe’s core economies. Moreover, capital outflows from stressed southern European economies to the German debt safe haven need to be addressed, as they may further perpetuate current and trade account imbalances within the Eurozone.

On the U.S. front, signs of housing market stability and declines in initial jobless claims have likely contributed to a recovery in consumer confidence. Further policy actions are needed though as the U.S. economy faces low labor participation, aging demographics and increasing entitlement spending as a % of federal outlays. Policymakers need to address these issues as they are becoming more imminent while the baby boom generation is starting to retire.

The Federal Reserve continues to be accommodative and low rates certainly support the duration of the current business cycle. In addition, the Fed has been very active in the refinancing of U.S. Treasuries through past quantitative programs and Operation Twist. Yet, policymakers need to put in place a credible plan for long-term fiscal sustainability. They need to achieve the right tax structure that will promote private investment and also put in place policies that will promote exports, reduce the nation’s energy bill and improve critically needed infrastructure. Such policy actions will come to the forefront in this year’s election and as U.S. debt remains in doubt by credit rating agencies such as S&P.

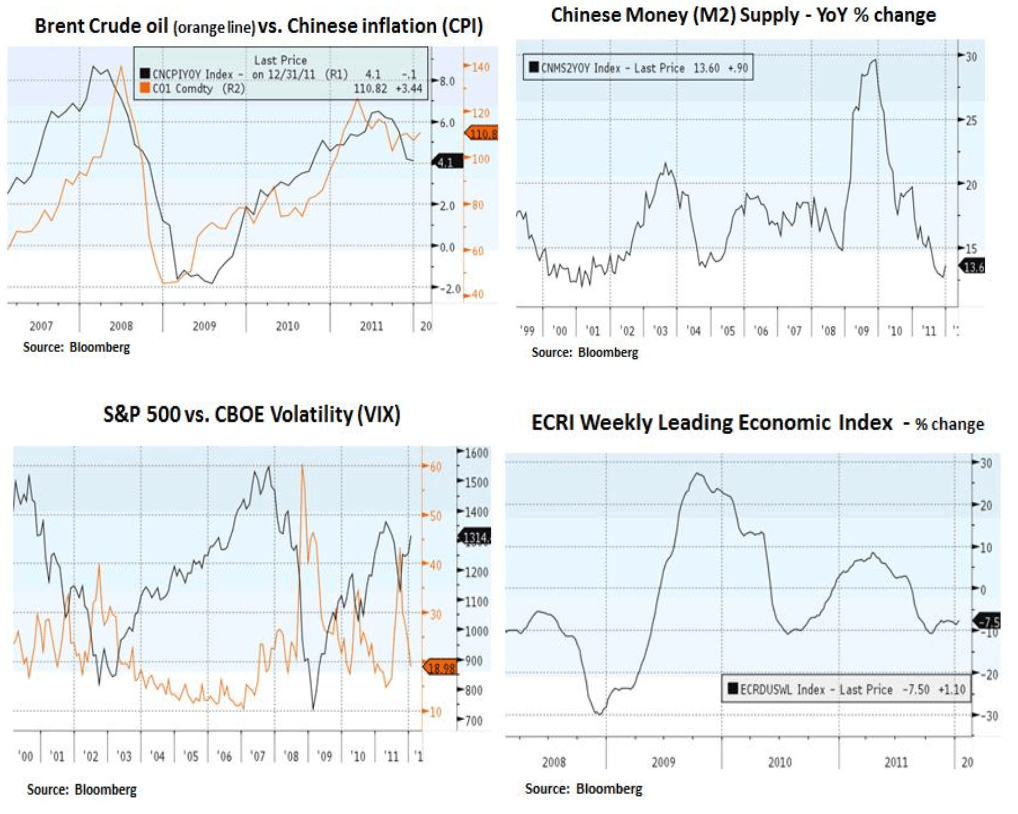

Market confidence will also depend on how much leeway the Chinese authorities have to ease monetary policy. Elevated oil prices due to geopolitical risks in the Middle East are not conducive for a substantial reduction in Chinese inflation. Of great interest is Saudi Arabia’s recent declaration that $100 is a fair price for oil. This is only a year after they suggested $70-75 is a fair range. The issue is not the cost of extraction for oil but potential social instability which forces the Saudis to increase their social spending. In energy intensive emerging markets, a high oil price is a hurdle for further monetary easing. In addition, even at a phased pace, an EU embargo against oil imports from Iran (OPEC’s second largest producer) is bound to have an impact. Therefore, as you can realize, political and policy decisions across the globe are interlinked. If geopolitical risk declines and if Libyan oil production gradually returns, then easing energy costs may give China the chance to be more accommodating in its monetary policy and thus promote global growth.

In conclusion, we note that the U.S. equity market has recently experienced a decline in volatility and the ECRI’s leading economic indicator appears to show some tentative signs of bottoming. As discussed above, market confidence is conditional to a large degree on policy actions and our own investment positioning is contingent on the right risk-reward offering. Therefore, we maintain a balanced portfolio mix between income generation and selective undervalued securities.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.