Rocky path for global growth and monetary policy normalization

Financial markets are assessing the scope for U.S. monetary policy normalization and the outlook for U.S. and global growth. The world economy still faces elevated public debt levels and challenging demographic trends in developed markets. In Emerging Markets, policymakers are attempting to adjust their economic models towards more domestic demand driven growth and less reliance on exports. Moreover, credit strains in Europe and China are impediments to higher global growth and policymakers in both regions hold the key towards more sustainable growth. From our investment lens, we are focusing on financial instruments with more visible cash flow and earnings profiles. In fixed income, we favor low duration non-agency MBS and we continue to shy away from more interest sensitive asset classes. In equities, we like late-cycle/secular growth opportunities e.g. in healthcare, technology, commercial aerospace and defense. In the medium-term, we favor the energy sector which has been benefiting from elevated oil prices. From a valuation perspective, we are more cautious on the consumer discretionary, consumer staples and utilities sectors.

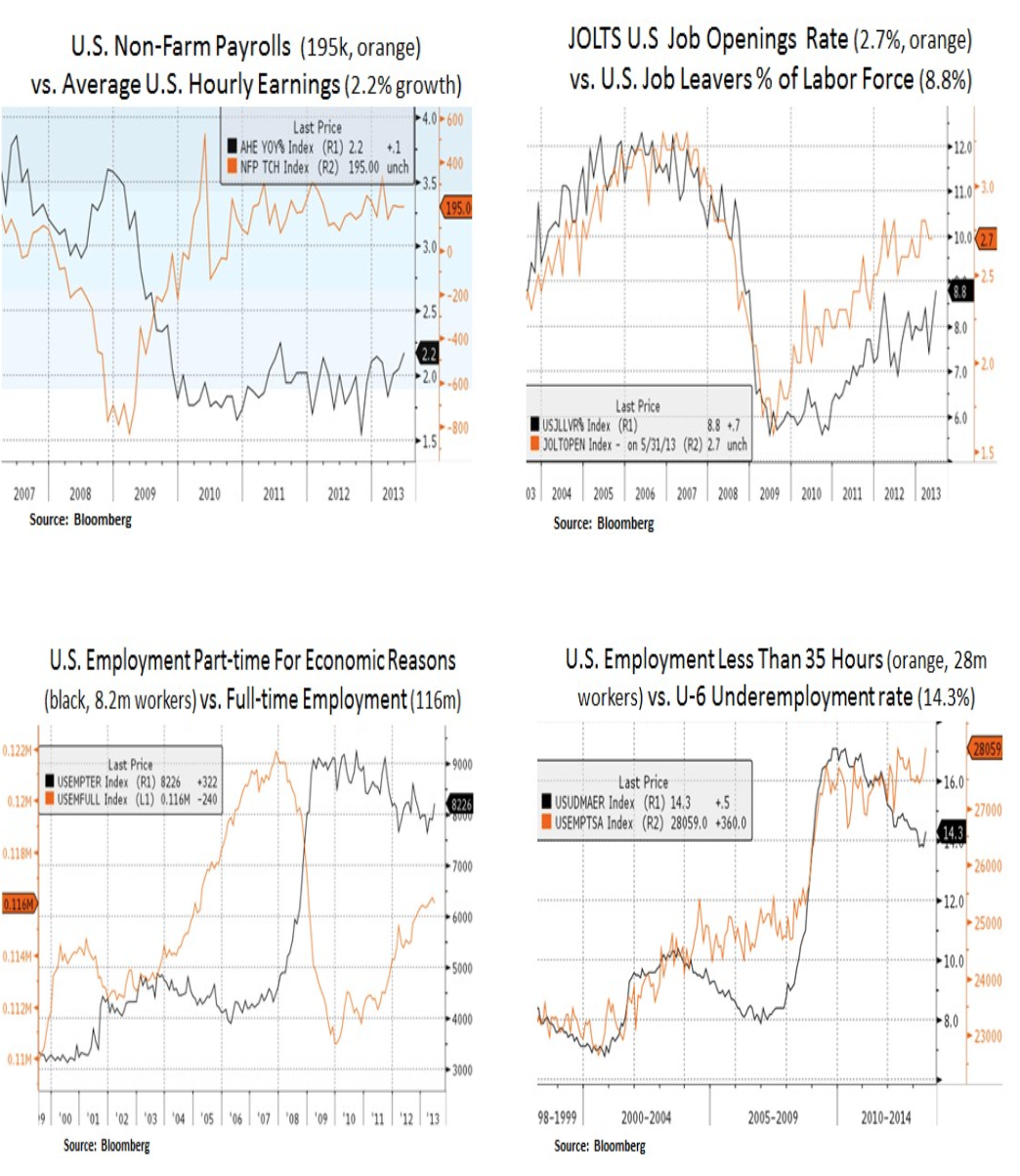

Firmer U.S. labor data and near-term easing of yield pressures in Europe and China have alleviated some recent market concerns. U.S. equities have rebounded from their recent low of 1573 on the S&P 500 to 1652. The 10 Year Treasury yield has remained elevated at 2.64% on rising monetary tightening expectations. As we can see below, recent hiring activity has been better than expected, averaging ~200k of monthly job additions. Total hours worked and average hourly earnings have been on the rise. Moreover, an increase in voluntary job leavers may indicate some confidence in the labor market. On the other hand, the composition of job creation has been more skewed towards lower paying industries such as leisure/hospitality and retail. We also note the increase in part-time employment due to economic reasons. Despite the disappointing quality of the recent labor report, market expectations for job acceleration have been rising in the context of an improving fiscal outlook in the coming quarters.

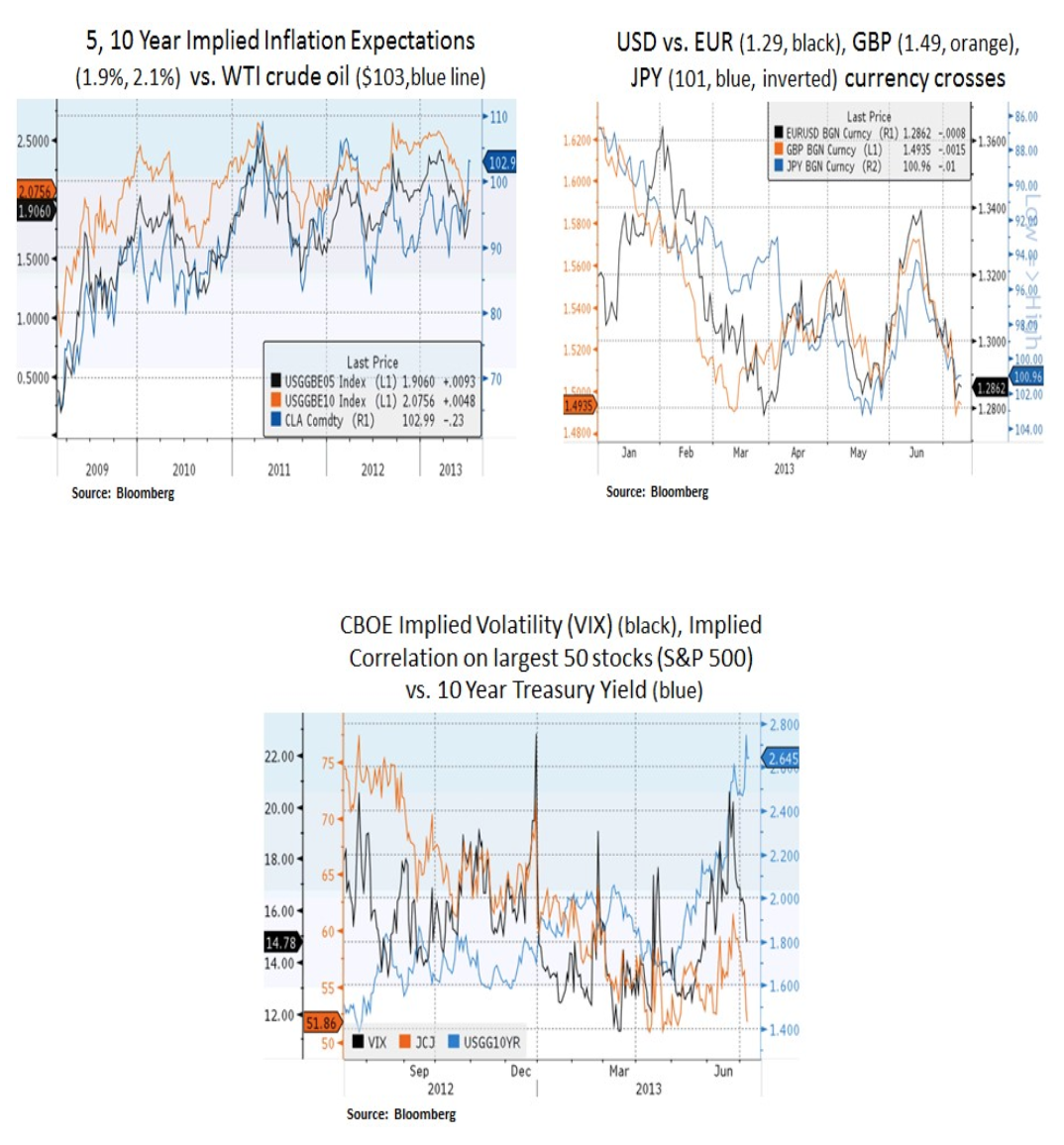

As a result of the above U.S. labor expectations, the U.S. dollar has been firmer against other major developed market currencies. On the other side of the below currency crosses, the EUR and the GBP have been weak due to more dovish language from the ECB and BOE. More specifically, in response to the steepening U.S. yield curve, the heads of the ECB and the BOE sought to provide forward guidance on even further monetary accommodation. In Japan, the JPY continued to weaken as the BoJ has already committed to a doubling of its balance sheet by the end of 2014. With regard to U.S. equities, we note that despite a rising 10 year Treasury yield, implied volatility and equity correlation measures have declined. Such a backdrop is more conducive for individual stock selection.

Arguably, the road to monetary policy normalization is likely to be long and uneven. Fundamentally speaking, the question is whether the U.S. economy can withstand a rising yield syndrome and transition to a more sustainable growth trajectory. From an equity point of view, amidst a slow global growth backdrop, investors are scrutinizing more intensively the corporate revenue lines. Thus, at this stage in the economic recovery, it will be important to assess whether CEOs will commit to more capital investments and labor hiring in order to grow their business activities. Given this cyclical uncertainty, we continue to seek sustainable growth themes. For example, aging demographics and expanding emerging market middle-class incomes are strong tailwinds for the healthcare sector e.g. pharmaceuticals and medical equipment firms. Similarly, with aging labor forces, we focus on productivity enhancing opportunities within the technology sector e.g. business analytics and data storage software. Other secular growth opportunities can also be found in industrial automation, commercial aerospace and in other niche industries with relatively high barriers to entry e.g. oil services which benefit from secular growth in global oil/gas shale formations and harsher oil exploration environments.

As the U.S. economy is largely driven by consumer spending, it will be important to see how households can cope with higher mortgage rates and other rising credit costs. The U.S. housing market is benefiting from investor fund flows and affordability is still favorable for first-time buyers. In the medium-term, rising mortgage rates (4.6%, 30 year fixed) are likely to act as a headwind to refinancing activity and first-time mortgage applications. However, given current home price levels, we expect a slow and steady housing market setting. With regard to consumer spending, we continue to avoid retailers and the broader consumer discretionary sector on valuation grounds. We also highlight the recent rise in WTI crude oil, which will likely lead to higher gasoline prices. Therefore, we favor more robust corporate balance sheets and corporate spending themes e.g. within the technology and industrials sectors.

On the global growth front, we continue to monitor global manufacturing and trade volumes. With slower credit creation in China, we expect some headwinds for emerging markets and global growth. As mentioned above, we are selectively positioned in more secular growth opportunities rather than pure cyclical plays. The U.S. ISM manufacturing leading spread indicator of new orders less inventories has been progressively pointing to a lackluster manufacturing backdrop and weak foreign demand. This has been confirmed by softer U.S. exports in the recent widening of the U.S. trade deficit.

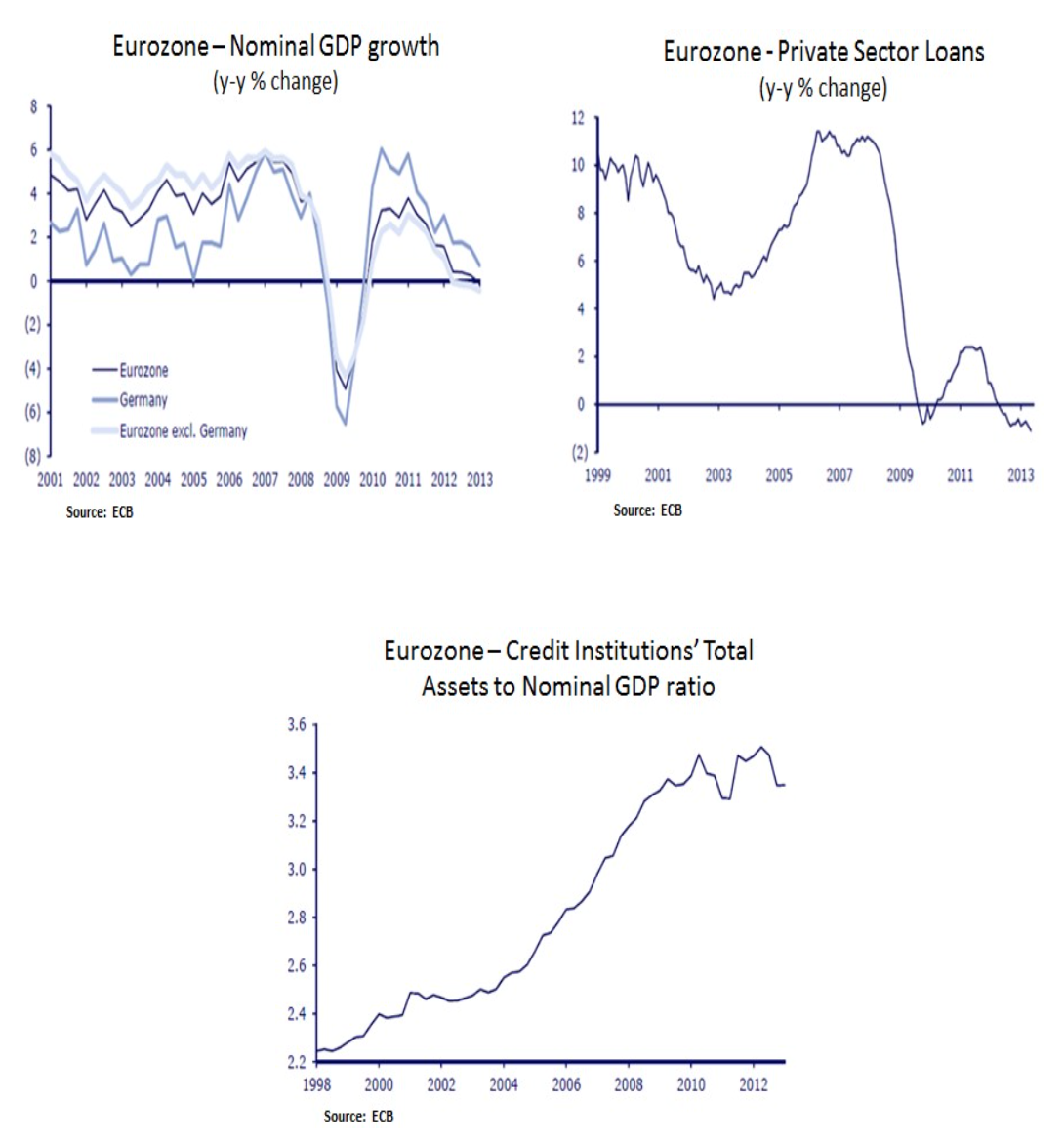

Lastly, despite numerous political hurdles, a potential support for a global growth rebound would be Europe. It is plausible that after the September German elections, the ECB may be endorsed in moving to more unconventional policies e.g. by lowering the funding costs of small and medium sized enterprises (SMEs). Hence, as two thirds of lending in Europe takes place via the banking system, the ECB may have the opportunity to repair the south European credit channel. Thus, low ECB base rates may be passed to corporations that suffer from tight credit conditions. Therefore, we remain on alert for a potential turning point in the European monetary transmission.

In conclusion, the global growth and policy outlook remains in transition. As developed and emerging economies deal with their structural issues, we expect a rocky path towards eventual policy normalization and more sustainable growth models. In such an uncertain growth and policy environment, we remain focused on more visible cash flow opportunities. We continue to favor cash rich industries and large-cap equities with defensible dividend growth profiles.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.