Seeking answers to known unknowns

Investors and business leaders are looking for clarity with regards to the degree of political compromise in the U.S. and Europe. As global growth remains challenged, pragmatic leadership is needed in order to avert cyclical and systemic risks. In the near-term, time is limited for any dramatic changes to U.S. fiscal and entitlement policies. Realistically, one should expect partial postponement of certain components of the ‘fiscal cliff’ that will keep U.S. economic growth above water. Moreover, we expect the debt ceiling to be lifted. Long-term fiscal and entitlement sustainability negotiations will likely be pushed into the first six months of 2013. A sufficient policy framework will likely give the necessary confidence to business leaders. Corporate balance sheets have the capacity to move the needle on the economy and promote the next leg in the current business cycle. Clearly, one cannot ignore the growth and systemic challenges faced by Europe. In the face of economic and social adversity, we expect European policy action to reach ‘critical mass’ levels in 2013; especially via unconventional ECB measures. From a portfolio perspective, we remain opportunistic in allocating capital and we seek investments with visible cash flows and favorable risk/reward profiles.

As we can see below, the ‘fiscal cliff’ math is fairly simple and a partial agreement is likely to be achieved in the short-term. Despite the recent sell-off in risk assets after the U.S. election, we haven’t seen any meaningful moves in volatility or equity correlation measures. At moments of macro/policy uncertainty, both measures tend to move up as risk aversion increases. From a contrarian point of view, one could argue the market is complacent and we cannot preclude some elevated volatility. Therefore, we would use any short-term market volatility and add to attractive risk-reward opportunities.

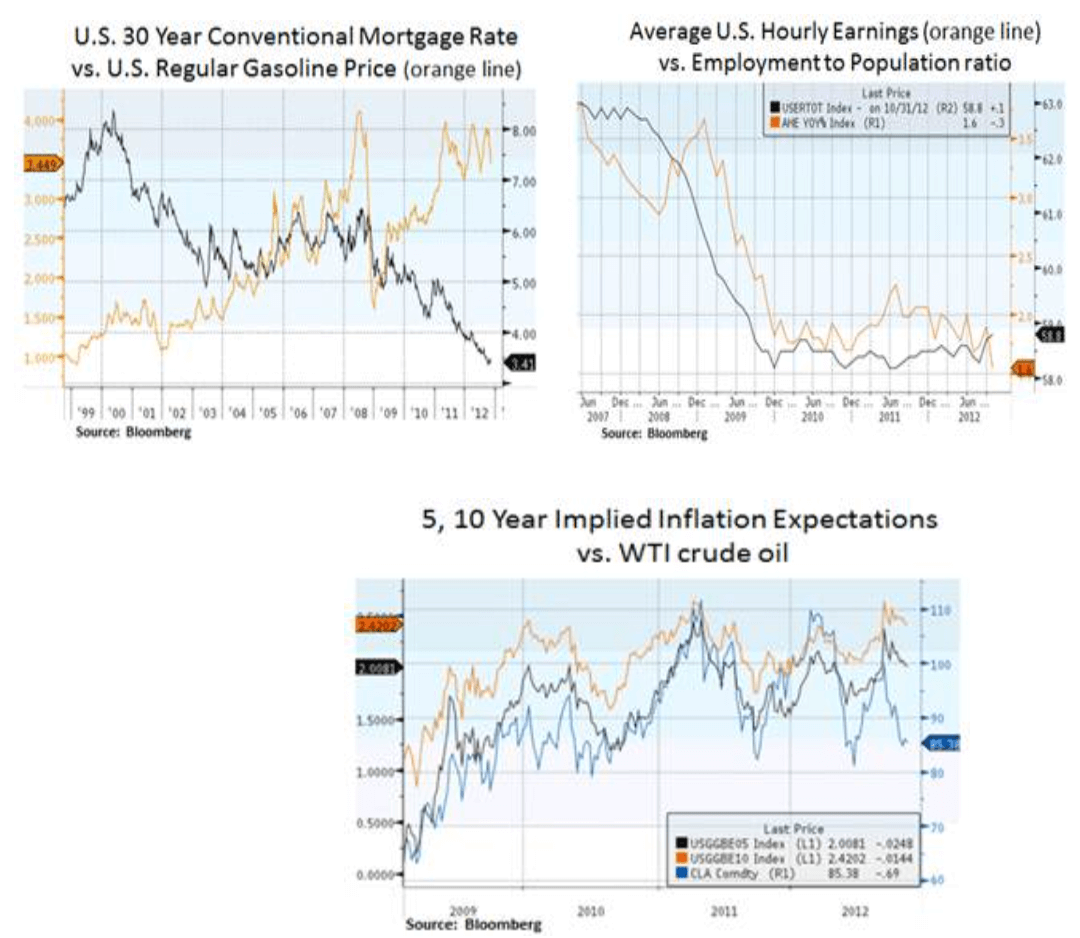

From a cyclical point of view, the U.S. economy has already experienced a ‘soft patch’ as we can see in the below ISM manufacturing survey. Capital expenditures by major corporations have been on hold in recent quarters. Healthy corporate balance sheets can be put to use, as long as business leaders feel comfortable with long-term fiscal sustainability. Naturally, capital will flow where it can earn the best returns. Thus, it remains to be seen how business friendly the current administration will be in its second term. From a structural perspective, we remain optimistic with regards to the prospects of the U.S. energy sector. As the IEA highlighted recently, there is potential for the U.S. economy to achieve energy adequacy by 2020 and surpass Saudi Arabia in oil production. From our lens, the extent of this scenario hinges on the opening of federal lands for shale oil drilling. Given the vast U.S. natural gas and oil reserves, we are optimistic the energy sector can become a global competitive advantage for the U.S. economy and ultimately contribute to economic growth and fiscal sustainability.

The energy scenario seen below could alleviate consumer income and spending pressures. Along with a steady recovery in the housing market, there is scope for a more constructive economic growth backdrop. Policy execution is key however.

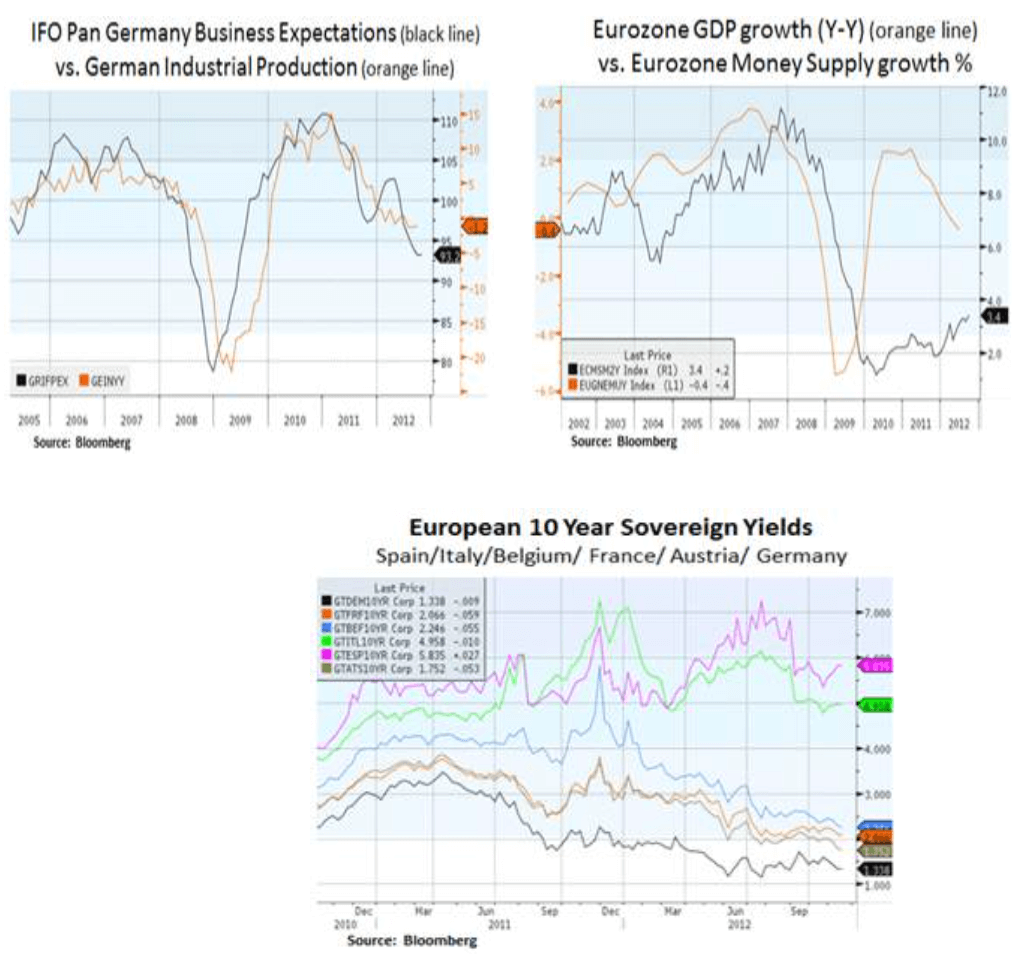

In Europe, weakening growth is still evident as a result of the ongoing credit and fiscal austerity. Loss of external traction is hurting the German economy as its exports account for 50% of its GDP. We expect the ECB to take a more aggressive stance in 2013 in an attempt to loosen monetary policy, especially in peripheral countries such as Spain, which suffers from high unemployment (25%) and high private debt levels.

Given the above cyclical challenges, we maintain our late-cycle tilt to our equity exposures. We like secular growth themes such as commercial aerospace and global healthcare spending. We are only at the beginning of a long replacement cycle for old aircraft. At a time of elevated fuel costs, airlines are seeking more fuel efficient planes. In addition, there is a significant passenger traffic opportunity in emerging markets; as the nascent middle classes earn more disposable income. Thus, we are seeking exposure to the commercial aerospace theme via industrials such as General Electric (GE) and United Technologies (UTX).

In Healthcare, we favor global names such as Merck (MRK), Pfizer (PFE) and Medtronic (MDT). These names are well positioned for the secular growth in emerging market healthcare spending. The EM population is still fairly young in comparison to developed markets and healthcare expenditures per capita are at very low levels. As standards of living rise and diet regimes change, healthcare spending is becoming a larger portion of household and national budgets e.g. heart diseases and diabetes are becoming more common due to obesity and higher protein diets.

In conclusion, we continue to assess the macro environment and micro opportunities in various financial instruments such as MBS, preferred shares and large-cap equities. We seek to be opportunistic in allocating capital and we have a preference for late-cycle/secular growth investments that offer long-term free cash flow and earnings growth potential.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.