The Storm Before the Quiet

This week brings a deluge of meaningful events and data beginning with today’s Presidential Election, Thursday’s FOMC meeting, followed by Friday’s October payrolls report. This comes on the heels of a tumultuous few trading sessions last week that saw the S&P 500 sell off nearly 4% as markets grappled with renewed European lockdowns as a result of rising COVID-19 cases, and the uncertainty surrounding the election results. The lockdowns across the Atlantic could foreshadow a similar scenario playing out here, which even in a “targeted” lockdown scenario would translate into slowing economic activity threatening an already fragile recovery.

No significant policy action or change in tone is expected at this week’s FOMC meeting. The sustainability of the recovery going into next year remains an open question. Delayed fiscal aid will undoubtedly weigh on growth in 2021, and Federal Reserve officials have been increasingly vocal at imploring Congress to get a package passed; with Fed Chair Powell earlier this month warning yet again about “tragic” consequences if they don’t provide additional aid.

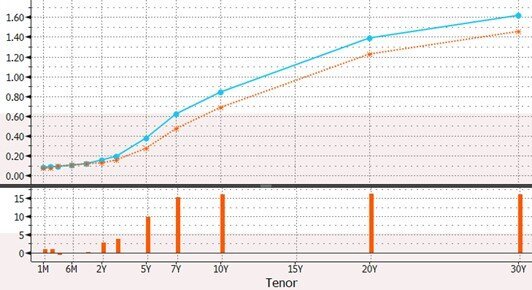

One of the more heavily discussed talking points the last few weeks is the increasing possibility of a “Blue Wave” election result in which Democrats take both the Senate and the presidency, and then proceed with an enormous fiscal expansion. This has fueled the conviction in a coming “reflation” trade, in which growth and inflation return, prompting further dollar weakness and higher global equity markets. The thinking is that this immense spending by a Democratic government would require significantly more government bond issuance, and while the front end (shorter maturities) of the yield curve is firmly anchored by the Fed, this would drive yields on the long end (longer maturities) higher. Any further “bear steepening” (selling of long dated bonds) post-election if we do see a “Blue Wave” election result will most likely be limited given this view appears to be the consensus, and the most recent move and levered investor positioning indicates such.

U.S. Treasury Curve as of 9/30/20 (ORANGE), U.S. Treasury Curve as of 11/02/20 (BLUE) - Source: Bloomberg

Bloomberg U.S. Dollar Spot Index - Source: Bloomberg

U.S. Fed FRED of St. Louis 5yr 5yr Forward Inflation Expectation rate - Source: Bloomberg

Investment-grade corporate bond spreads reached their widest levels in weeks in the U.S. and Europe, while U.S. high-yield bond spreads were at their widest in over a month as COVID-19 cases increased globally and hopes for a U.S. stimulus package vanished. U.S. high-yield bond funds experienced the biggest outflows since the end of September as investors were repositioning portfolios ahead of the U.S. election and growing COVID-19 infections. Credit default swaps also followed suit, reaching their widest level last week since September 18th.

Bloomberg Barclays U.S. Corporate High Yield Average Option Adjusted Spread (BLACK) Bloomberg Barclays U.S. Agg Corporate Average Option Adjusted Spread (ORANGE) - Source: Bloomberg

Another conversation that continues to draw a lot of attention that we’ve previously discussed is the long-awaited rotation from growth stocks into value stocks. While there have been several head fakes confirming this rotation the last several months, the S&P 500 Equal Weighted index and Russell 2000 have outperformed the S&P 500 since 10/28 gaining 3.04%, 1.65%, and 1.22% respectively. After the tremendous run in growth stocks and their dominance in the major indices as a result, traditional 60/40 portfolios may be disproportionately exposed to growth. This in turn would make them more susceptible to drawdowns in inflationary scenarios as a result of both their elevated P/E ratios and their longer duration, as most growth companies pay out little-to-no dividends when compared to value-oriented stocks. This dynamic is worth watching if inflation begins to truly take hold.

S&P 500 (BLACK), S&P 500 Equal Weighted Index (ORANGE), Russell 2000 Index (BLUE) - Source: Bloomberg

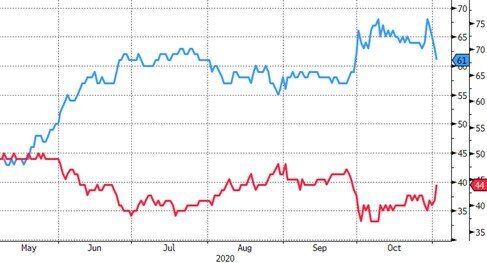

U.S. PredictIt 2020 Implied Probability of the Winner of U.S. Presidential Election. Joe Biden (BLUE) , Donald Trump (RED) - Source: Bloomberg, www.predictit.org

Unfortunately for both markets that dislike uncertainty and for the sanity of the American people, there’s an increasing likelihood that we will not know the outcome of the election later this evening. Over two-thirds of the 2016 vote total were already cast prior to Election Day. With a record number of mail-in ballots, and some critical swing states that can take days to tally them, the table is set for a long delay in determining the winner. While volatility is likely to pick up briefly during that time, historically S&P 500 returns on average are relatively muted for the months of November and December in election years. We feel our portfolio is positioned well for the long term regardless of the new administration and hope for a swift conclusion to the election cycle.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request