Fed’s Inflation Fight Not Over Yet

The S&P 500 and Nasdaq continue their ascent with both indices hitting new all-time highs. The hysteria surrounding artificial intelligence stocks has sent Wall Street strategists scurrying to increase their year-end price targets to keep up with a market that has already surpassed their expectations. Records are also being set in bond markets, with February being the busiest month ever for bond sales. U.S. companies sold over $172 billion of debt last month, surpassing last February’s record of $151 billion according to Bloomberg.

Despite the record pace of supply, U.S. corporate bond spreads remain tight. The demand for lower-rated debt remains particularly firm, with the spread on CCC rated bonds being the tightest since May of 2022 when the Federal Reserve was just beginning its most aggressive tightening cycle in decades. Rates are likely to remain considerably higher than they were then as a re-accelerating U.S. economy, coupled with a rise in underlying inflation, has pushed back expectations on when the Fed will begin to ease the policy rate. These higher-risk companies will have to pay significantly more for funding than they did two years ago.

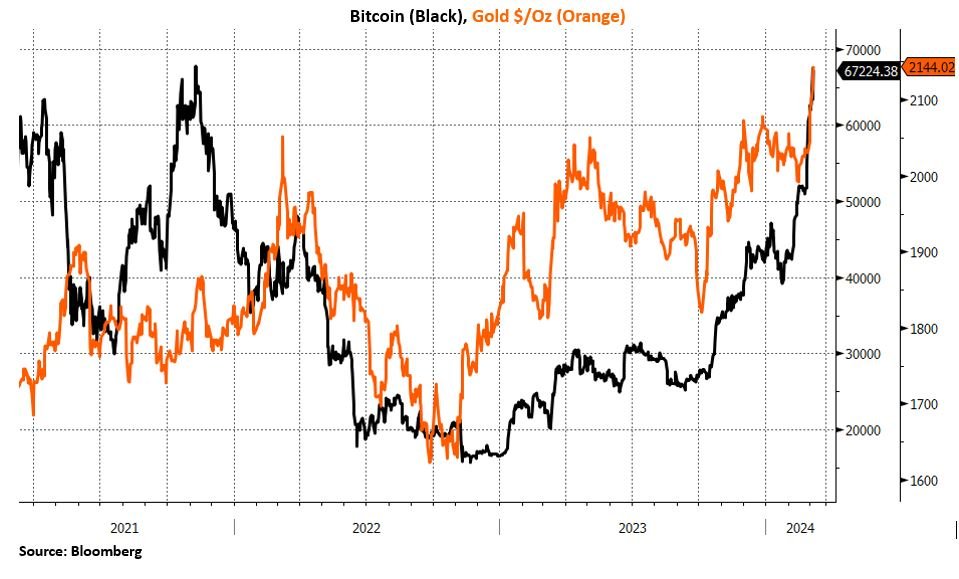

The U.S. Dollar had started the year off strong but has begun to reverse course thanks in large part to Treasury’s willingness to run persistently titanic deficits. Large fiscal deficits are a long-term detriment for the currency as they are inflationary, and since the U.S. deficit is one of the largest in GDP terms, it presents greater downside risk to the dollar relative to other currencies. While the dollar has struggled as of late, Bitcoin and gold are each making new highs. Typically, the two assets have different fundamental drivers, but both seem to be enjoying expectations of looser monetary policy and a larger appetite for risk-taking.

Fed Chair Jerome Powell testified before the House Financial Services Committee and Senate Banking Committee this week. In his remarks he reiterated that the U.S. central bank is in no rush to cut rates until they are confident that inflation has been contained. Powell said it will likely be appropriate to begin to lower borrowing costs “at some point this year,” but emphasized they’re not ready yet. “The committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%” Powell said.

The strength of the economy and labor market have provided the Fed with time to wait for more confirmation that the battle on inflation has been won before cutting interest rates.

Tomorrow’s employment report for February will represent the conclusion of a busy week. The headline figure has surpassed expectations for three straight months and has been one of the pillars in the “soft or no landing” narrative that has helped propel risk assets. Another significant beat on jobs and earnings could confirm that stubbornly high wage growth will stoke inflation and push Fed expectations out even further. The Fed’s preferred inflation metric, the core personal consumption expenditures recently showed an increase of 0.4% in January, the fastest pace in nearly a year.

The U.S. is facing a deficit that’s becoming unsustainably difficult to finance should rates remain at current levels. Markets have largely discounted the fiscal overhang as robust U.S. growth driven by the deficit and the drawdown in household savings have been major support for corporate profits. Politically, as we approach the November elections, the Fed will be hesitant to commence with rate cuts to avoid the appearance of partiality. Without the tailwind of easing policy this year, markets will have to reprice.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product directly or indirectly referenced will be profitable, equal any corresponding indicated historical performance level, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. This content does not serve as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. If you have any questions about the applicability of any content to your individual situation, we encourage you to consult with the professional advisor of your choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request or by selecting “Part 2 Brochures” here.