Rising Inflation and Slowing Employment Put FOMC in a Bind

The month of August saw the S&P 500 notch five record highs amid optimism surrounding corporate earnings, U.S. trade policies, big tech’s continued spending spree on artificial intelligence, and the expectation that the Federal Reserve is going to begin lowering interest rates later this month. Market breadth has improved notably in recent weeks with the S&P equal weight index outperforming its market cap weighted peer by more than 0.60% last month.

While August has historically been the month where stock market volatility rises the most, with the VIX index rising by an average of 8.4% since 1990, 2025 was an exception with the VIX falling to year-to-date lows. In fact, the S&P 500 hasn’t endured a 2% selloff in 91 sessions, its longest stretch in over a year. Volatility in the bond market, however, has not been as subdued. Treasury market volatility is growing on anxiety regarding U.S. government finances and concern tomorrow’s payrolls number may disrupt the Federal Reserve’s ability to cut rates.

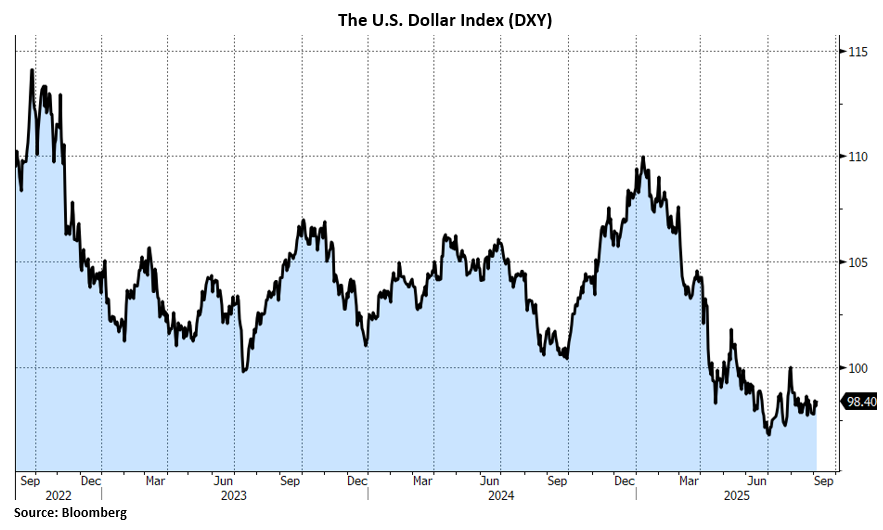

The U.S. dollar continued its downtrend amid continued global trade uncertainties. The DXY index, which measures the dollar against a basket of currencies, declined 2.2% during the month, and is now down over 9% on the year. The primary drivers of the dollar’s fall continue to be rate differentials from other global currencies and prolonged tariff uncertainty.

Inflation has remained above the Federal Reserve’s 2% target, with last week’s reading of PCE inflation coming in at 2.6%. The continued pressure on inflation and inflation expectations from tariffs and dollar depreciation put the Federal Open Market Committee (FOMC) in the unenviable position of trying to weigh rising inflation against a weakening labor market. While Fed Chair Jerome Powell opened the door to a September cut in his remarks at Jackson Hole, market participants may have gotten carried away with the messaging as there are now over four rate cuts priced in by next June. This rate path neglects any inflationary impulses from tariffs, or any expansion of economic growth.

With the VIX at recent lows and credit spreads historically tight, complacency may be returning to the market. While Q2 corporate earnings results were solid, consensus earnings growth projections of 14% for next year seem optimistic. The U.S. August employment report, a key inflation reading, and the Federal Reserve’s interest rate decision will cross the tape over the next 9 trading sessions. These events will all undoubtedly play a critical role in setting the course for markets for the remainder of 2025, and they all arrive with markets seemingly at a crossroads. Tomorrow morning’s jobs report is first up, and investors will look for further evidence of a more subdued U.S. labor market to justify monetary support as the data will be a crucial input for Fed officials before their September policy meeting.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product directly or indirectly referenced will be profitable, equal any corresponding indicated historical performance level, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. This content does not serve as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. If you have any questions about the applicability of any content to your individual situation, we encourage you to consult with the professional advisor of your choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request or by selecting “Part 2 Brochures” here.