A view on U.S. Consumer Staples

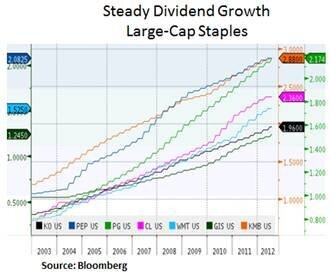

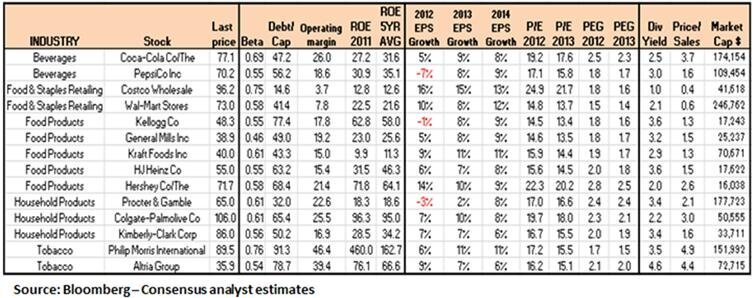

In an uncertain global macro environment the consumer staples sector has been a safe haven for investors over the past three years. The sector offers classic defensive qualities such as low earnings volatility and healthy dividend yields (3-3.5%). Despite their low market beta nature, staples also offer steady earnings and dividend growth; especially by large-cap U.S. multi-nationals with exposure to emerging markets. Tactically, given the sector’s strong performance and elevated valuations, we seek to be nimble in our stock selection. Within staples we seek exposure to companies that can maintain pricing/volumes, have room to cut costs and companies that can leverage broad geographic and category exposures.

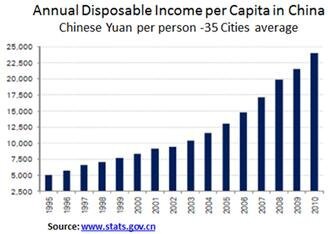

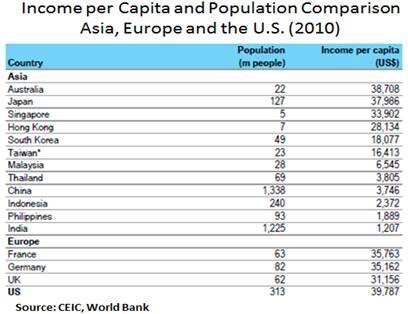

In developed markets, the broad cyclical environment remains sluggish as a result of weak employment trends, challenged consumer credit creation and consumer uncertainty with regards to fiscal issues. Emerging markets have also been experiencing a growth slowdown but we note that secular disposable income trends remain firm and inflation pressures have been subsiding. The main challenge for U.S. multi-nationals has been strength in the USD and there is a re-inflation risk due to oil price volatility and rising food prices (corn, soybeans, wheat) as a result of the recent U.S. drought. Therefore, with regards to the consumer staples sector we are mindful of any margin pressures that a stagflationary environment may cause i.e. weak economic growth accompanied by energy/food inflation due to supply constraints.

Industry Outlook:

The consumer staples sector is comprised of beverage/snack companies, food/staples retailers, household/personal care products and tobacco companies.

Beverages & Snacks: We have a relative preference for beverages vs. beers whereby the latter’s volumes in the U.S. remain weak as they lose share to wines and spirits. The global spirits industry is attractive but highly fragmented. In a volatile macro environment, we see downside risk to spirit sales. According to AC Nielsen market data and recent earnings results, U.S. pricing trends in beverages have been firm (e.g. 3% for Coca-Cola (KO)), whereas volumes remain stable (+1%). Western Europe has recently seen negative sales growth with weakness in both pricing and volumes. From a margin perspective, weakness in aluminum is a tailwind for beverage sellers. However, the recent spike in corn prices is likely to hurt corn based fructose syrup which is a main ingredient in sodas. In addition, for PepsiCo (PEP), corn based snacks are likely to face some cost inflation in the medium-term which should be passed to consumers given the small value nature of snacks. PepsiCo is also likely to be investing heavily in marketing in order to revamp its franchise and boost market share as it lags Coca-Cola (KO). For both KO and PEP, emerging markets organic beverage sales continue to be strong with strength in Eastern Europe, the Middle East and Africa.

Food Products & Staples Retailing: North American supermarkets continue to experience volume pressures due to structural shifts to fresher and more natural products. In addition, the industry is witnessing some price elasticity due to price promotions e.g. recent price cuts by Kroger (KR) and Supervalu (SVU). Food retailing margins are notoriously low and discount companies like Wal-Mart (WMT) or Costco (COST) have sought to grow profits by pinning their fortunes to higher margin international growth. In addition, they have recently been attempting to improve margins by cutting their SG&A costs (selling, general & admin costs). U.S. exposed packaged food companies on the other hand have been battling input cost inflation and low volumes (e.g. cereals, crackers) as consumers react to price increases, elevated gas prices and lagging wage growth. Therefore, given tepid domestic growth, we continue to favor names that exhibit low price elasticity in developed markets and high emerging market exposure e.g. Kraft (KFT).

Household & Personal Care Products: In the household products industry we like companies with a high emerging market exposure, better earnings visibility and greater strategic potential (e.g. P&G). We also like companies with limited demand elasticity and product innovation e.g. Colgate (CL). From a secular perspective, we recognize the material growth potential in emerging markets e.g. India represents 3% of Colgate’s sales and 1% of Procter & Gamble’s sales. We also like P&G’s higher margin opportunities as P&G captures market share in emerging markets i.e. as P&G sells higher margin oral care, health care, feminine care and shaving products. This secular trend may offset some cyclical price sensitivity that P&G has in developed markets. Lastly, from a business model perspective, we prefer large-cap players with strong distribution chains vs. direct selling (door-to-door) players such as Avon (AVP).

Tobacco: The tobacco industry continues to enjoy strong pricing power and a benign competitive pricing environment. Excise tax risk and regulatory concerns remain moderate. Input cost pressures are limited and the industry continues to be a strong cash generator. This supports steady dividend growth and sustains high payout ratios (e.g. 80% payout ratio for Altria (MO) and Reynolds American (RAI)). For the U.S. tobacco industry it has been a story of high margins/low volume growth. For international players such as Philip Morris Int’l (PM) it has been a steady volume growth backdrop; notwithstanding weakness in Southern Europe. From a secular viewpoint, we prefer emerging market exposed names (such as PM) due to fewer regulatory and tax headwinds.

Investment and Valuation perspective:

Healthy dividend yields provide downside support for consumer staples. In addition, the sector is trading below levels seen in the 2003-2007 timeframe. Yet, valuation metrics for names with firm fundamentals remain elevated. For example, international names such as Coca-Cola (KO), Colgate (CL) and Philip Morris (PM) trade at a market premium due to their emerging market growth potential. On the other hand, packaged food manufacturers trade at a relative discount as they face cost inflation pressures and subdued volume growth. Therefore, although we recognize the strong secular trends in emerging markets, we remain nimble in timing our stock selection as favorable opportunities arise.

Conclusion:

In a low interest rate environment, consumer staples will continue to see high investor demand for steady income growth and low earnings volatility. We continue to assess the risk-reward in the sector and we remain opportunistic in buying into our favorite secular investment themes.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.