Central banks ease tail risks in the face of fiscal challenges

Financial markets are looking out for turning points in a challenging global growth backdrop. Monetary institutions such as the Fed and the ECB have continued to extend their accommodative stance amidst difficult fiscal and credit conditions. In Europe in particular, the ECB may be closer to a policy framework that at the very least acts as a buffer against tail risks. Suggested easing of credit conditions, even at the short-end of peripheral yield curves, is certainly helpful in buying time as national governments implement structural reforms in an attempt to achieve a sustainable debt/growth balance. A lack of policy consensus however on both sides of the Atlantic is still a material headwind; as potentially costly political decisions have to be reached. Therefore, although we keep an open mind to the direction of risk-assets, we seek to be selective and nimble as favorable risk-reward opportunities appear.

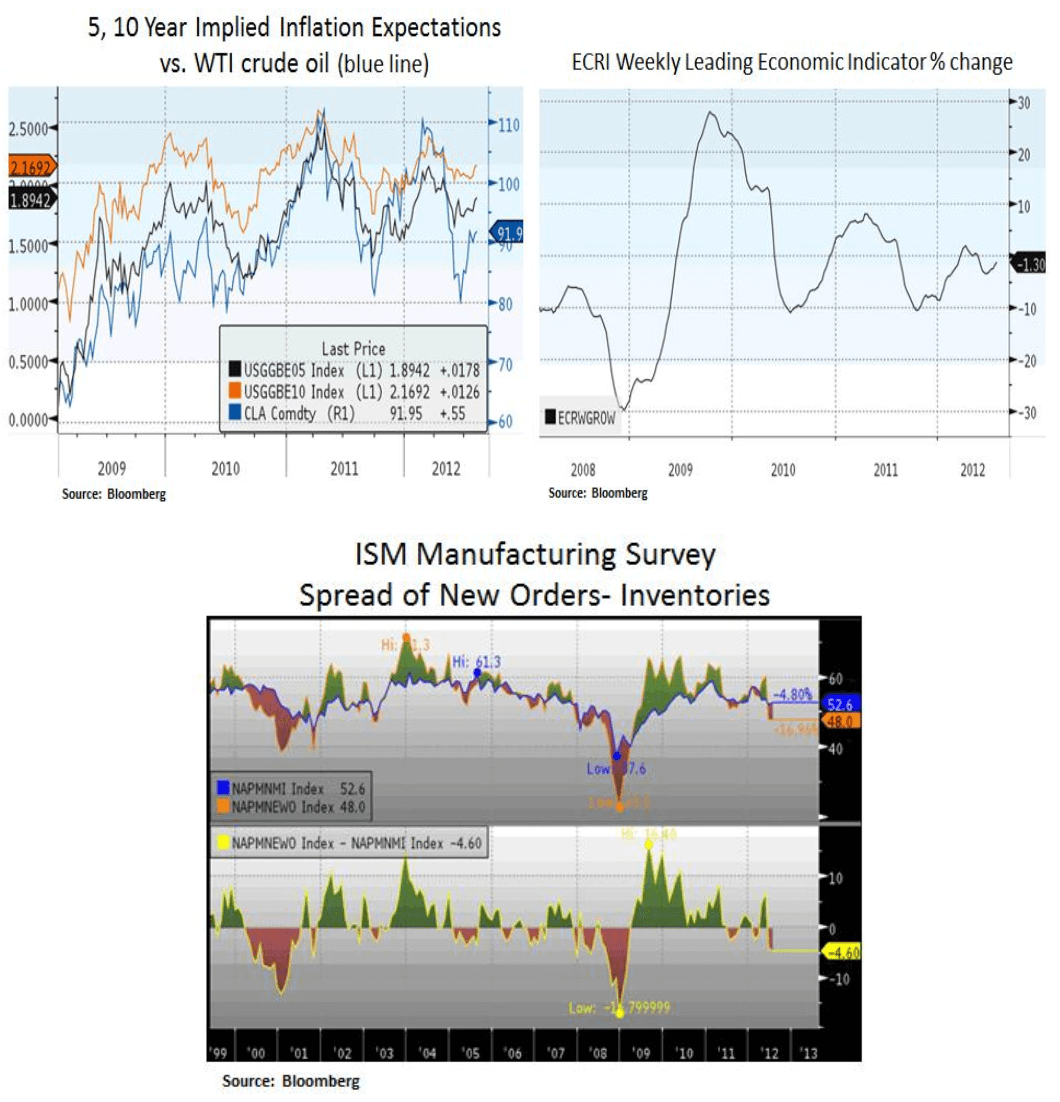

As we can see below, the global growth backdrop has been disappointing. This can be attributed to the debt crisis in Europe and challenging economic conditions in the U.S. and China. In addition, elevated energy and food prices are an ongoing issue, especially in emerging markets that are more susceptible to inflation pressures. Therefore, for a true turning point in emerging markets we need to see stabilization in the debt/growth dynamics in developed countries; especially in Europe. In such a scenario, U.S. multi-nationals in the industrials, technology and energy sectors would be prime beneficiaries.

On the U.S. front, the growth outlook remains in a ‘muddling through’ condition. The latest Fed senior loan officer survey was encouraging. On balance, domestic U.S. banks have continued to ease their lending standards across most loan categories in the past three months, even though lending standards at branches of foreign banks are tightening. Commercial and industrial credit conditions seem healthy and U.S. corporations have ample balance sheet capacity as they reduced debt levels and refinanced remaining debt facilities at lower rates. In addition, the U.S. banking system is well capitalized and on a better footing than their over-levered European peers.

On the job side, actual hiring and wage growth have been relatively muted but we are encouraged by the ongoing trend in job openings as a leading indicator of corporate demand for labor. The declining trend in weekly jobless claims is also encouraging as companies seem to already have lean workforces.

We also note that the ECRI weekly leading indicator is showing signs of stabilization. Moreover, inflation expectations don’t seem to be indicating a recessionary backdrop. Lastly, the spread of manufacturing orders and inventories points to a weak growth environment but does not seem to be at levels seen during recent recessions.

The months ahead are critical for the U.S. economy and financial markets. The outcome of the U.S. Presidential and Congressional elections is likely to have major repercussions to important issues such as fiscal sustainability, energy, healthcare and tax policies. Businesses and households are seeking visibility on these critical issues as they will influence the 2013 growth outlook; especially as the currently projected fiscal drag is ~4%. Moreover, the debt ceiling currently stands at USD 16.394 trillion and it may be tested again in early 2013; possibly putting pressure on America’s credit ratings if there is a repeat of last year’s political tussle. Therefore, fiscal sustainability at the federal, state and municipal level will become the main focus for the rest of this year and into 2013.

On the European side, a new conditional framework of government/ECB policy is starting to emerge despite a lack of policy consensus amongst Eurozone leaders, with Germany still resisting debt mutualization. Yet, the proposed framework of peripheral bond purchases could be necessary as the existing EU rescue funds (EFSF) simply do not have the lending capacity to meet Spanish and Italian funding needs. Once account is taken of the Spanish bank bailout and the EUR 15bn support for Cyprus, the EFSF is left with lending of EUR 135bn. The ESM which is to replace the EFSF has yet to be ratified by Germany (the constitutional court meets on Sept 12th). The ESM has a lending capacity of EUR 500bn but it only reaches this level by mid-2014. Given the ESM shortfall, there has been talk of granting a banking license to the ESM which would allow it to borrow from the ECB and leverage its resources. Germany remains opposed to this. Funding needs for both Spain and Italy out to the end of 2014 are estimated to amount to EU 1.05 trillion and Spain also faces a heavy debt redemption schedule in October i.e. 32bn EUR.

The new ECB framework that is currently under discussion may not be a silver bullet but it may lead to less tail risk and provide more time for structural reforms to be implemented. Moreover, the reason this is not a silver bullet is because European credit markets are based on loans. Lowering government bond yields across the Eurozone will not produce the same results as in the U.S., where companies fund 60% of their debt with bonds vs. 10-20% in Europe. In addition, financial fragmentation is increasing as interbank and commercial lending markets are diverging from each other. The ECB has been loosening monetary policy in the past year but counterparty risk in the Eurozone banking sector ensures that the transmission mechanism to the real economy is impaired. Money supply growth is subdued and credit demand is weak. Thus, we are cautiously optimistic on a more sustainable policy framework in Europe but we are cognizant of the political divisions and the drag on economies, as more austerity measures are undertaken in return for the ECB’s support. Lastly, from a currency perspective we still believe that the path of least resistance is lower for the Euro and consequent USD strength keeps us cautious on USD sensitive sectors such as materials.

Lastly, from a U.S. equity perspective, we note that the second quarter reporting season indicated a mid-cycle slowdown in the profit and revenue cycle. To be sure, the stock market is based on relative expectations and after a series of analyst downgrades, the EPS downgrade cycle seems to be bottoming. We caution though that the profit cycle is largely dependent on the 2013 global growth outlook that still remains uncertain. Therefore, we prefer equities and sectors that offer good late-cycle exposure e.g. healthcare.

From a technical point of view, the S&P 500 has recently benefited from a reduction in volatility and a reduction in equity correlation. The latter provides us with more latitude for individual stock selection.

In conclusion, we remain open-minded to fundamental turning points in the global economy and the profit cycle. We continue to have a bias towards income generating instruments and we seek to take advantage of favorable risk-reward opportunities e.g. in large-cap dividend paying equities that offer earnings and cash-flow visibility.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.