Global policy execution risk keeps us in opportunistic mode

The summer rally in risk assets has largely been based on elevated expectations for major policy action in Europe, the U.S. and China. The market expects the ECB in Europe to limit systemic risk within a new bailout framework. Troubled countries such as Spain are expected to apply for fiscal assistance which will be accompanied by ECB containment of its borrowing costs. This view has led to risk premium reduction across the broad risk asset spectrum. Moreover, in the context of a synchronized global growth slowdown, investors are expecting U.S. and Chinese policymakers to take measures that will prevent a global hard landing. At this stage, policymakers need to deliver on these expectations. Political risk and elevated energy/soft commodity prices may present policy hurdles in the coming weeks/months. Therefore, we remain opportunistic in allocating capital.

As we can see below, there has been a notable volatility reduction in risk assets such as U.S. and European equities. This has largely been triggered by a reduction in European sovereign debt yields and a subsequent reduction in various European credit instruments. Moreover, there has been a notable reduction in correlation within e.g. S&P 500 equities. This condition renders individual stock selection more feasible, as equities are allowed to trade on their own idiosyncratic fundamentals.

With regards to Europe, the acid test will be to what extent politicians would be willing to compromise in order to find an enduring solution to the European debt/growth crisis. There is simply no free lunch for peripheral countries as any bailout/ECB agreement will only be achieved on certain conditions. Ideally, the Eurozone should be working its way towards a fiscal union with uniform fiscal and entitlement policies. We see an element of political/execution risk as peripheral leaders may resist ceding sovereignty control over their fiscal budgets. Thus, although we see the ECB as capable of containing systemic risk, we are skeptical as to the necessary compromise that European politicians will actually achieve in upcoming negotiations.

Fundamentally, apart from credit challenges, we see elevated oil prices as an additional constraint for the Eurozone and the broader global economy. Geopolitical risk in the Middle East will likely remain elevated and emerging market economies in particular may be hesitant to further loosen monetary policy due to inflation fear.

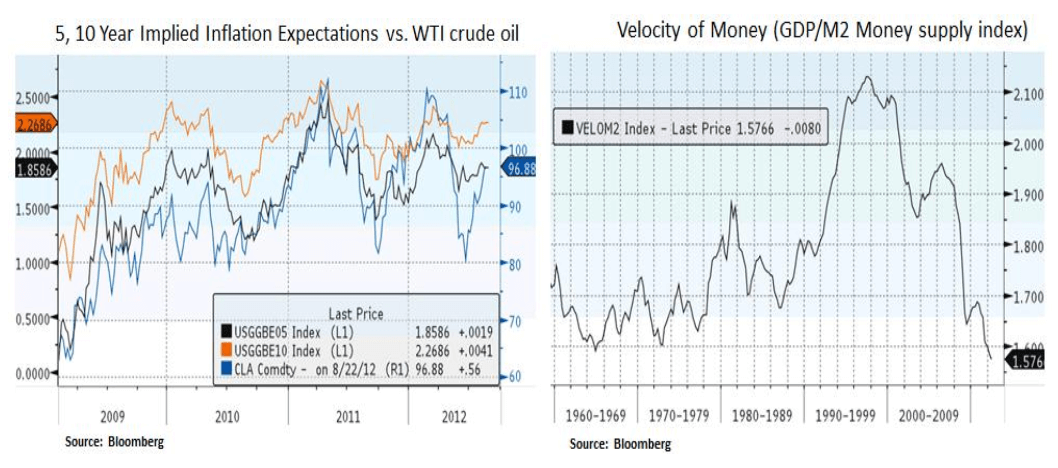

In the U.S., the Treasury market seems to be pricing in stable inflation expectations, amidst elevated energy and soft commodity prices such as corn/soybeans. To a certain degree, inflation expectations are stable due to hopes for a further round of quantitative easing (QE) by the Federal Reserve.

U.S. economic data may not justify an imminent Fed intervention and the Fed will likely weigh the risk-reward impact of further QE; especially as risk assets such as U.S. equities have been more sanguine on financial conditions. From our lens, we are skeptical with regards to the actual benefit of further monetary easing at this point. As we can see above, the velocity of money has been subdued. This means that money is not changing hands fast enough from one transaction to another. Velocity of money tends to be an indicator of how robust an economy is. Thus, we question whether additional monetary easing will be beneficial beyond the Fed’s existing Operation Twist program which is helping in keeping borrowing and mortgage rates low.

Looking in the months ahead, the market is likely to shift its attention to the potential outcome of the U.S. elections and consequent policy decisions with regards to the projected 2013 fiscal drag. In the face of this uncertainty, the market will also pay particular attention to incoming labor and income data. U.S. consumer spending accounts for 71% of the economy and recent trends in earnings, personal savings and gasoline have not been encouraging. From a structural point of view, we also deem the skills and education gap in the labor force as a major economic hurdle that has not been sufficiently addressed by the current U.S. administration.

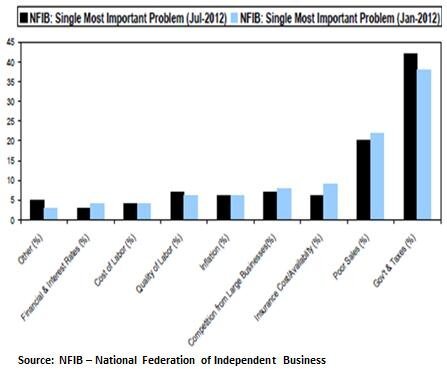

As we discussed in past articles, businesses and households need visibility over critical issues such as fiscal sustainability and taxes. The recent July NFIB survey clearly indicates that (apart from poor sales), government & taxes is deemed to be the single most important problem for businesses. The outcome of the U.S. elections is likely to provide answers over the 2013 and long-term fiscal outlook, which is currently a confidence overhang. Therefore, we look forward to a pick-up in investment spending by the corporate sector. This would be an important step as we approach the mid-point of the current business cycle. From an equity point of view, sectors such as industrials and technology would be prime beneficiaries of corporate balance sheet deployment.

In conclusion, although we are open-minded to fundamental turning points in the global economy, we currently remain nimble in allocating capital as we see some policy execution risk ahead. Our investing bias is tilted towards steady income generation from instruments that offer cash flow and earnings visibility.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.