Elevated market expectations as policymakers need to deliver

Financial markets continue to assess cyclical, secular and policy data points. The world economy has entered a major rebalancing phase and policymakers are attempting to deal with structural challenges that are causing the current global growth slowdown. In developed markets the debt deleveraging cycle is still in its early stage and in emerging markets leaders face the challenge of shifting their economic models away from export/infrastructure depended growth (e.g. in China). Investors expect policy execution by central banks and politicians in Europe, the U.S. and China. In the U.S. we look forward to the impact of the U.S. elections on the 2013 fiscal and growth outlook. In Europe, we await Spain’s response to the ECB’s call for a bailout request ahead of demanding debt maturities. Lastly, in China we anticipate a more aggressive policy response as new leadership takes over in late October. From an investment perspective, we continue to allocate capital as favorable risk-reward opportunities are presented to us and we maintain our income/late cycle bias.

Risk assets such as European and U.S. equities have benefited in the past few months from a risk premium reduction, driven by expectations for ongoing support by the Federal Reserve and the ECB. We are encouraged by the decline in peripheral sovereign borrowing costs and the gradual improvement in the broad European money supply. Looking ahead though, we remain cautious with regards to the collaboration of Spanish politicians with the ECB/IMF/EU. The latter group aims to impose strict fiscal conditions in exchange for ECB intervention in the Spanish sovereign bond markets. Failure to agree on a sustainable bailout framework may lead to renewed volatility episodes. The developed market deleveraging process is likely to be long and from an investment strategy view we seek to allocate capital in financial instruments that can offer reliable income generation and capital appreciation.

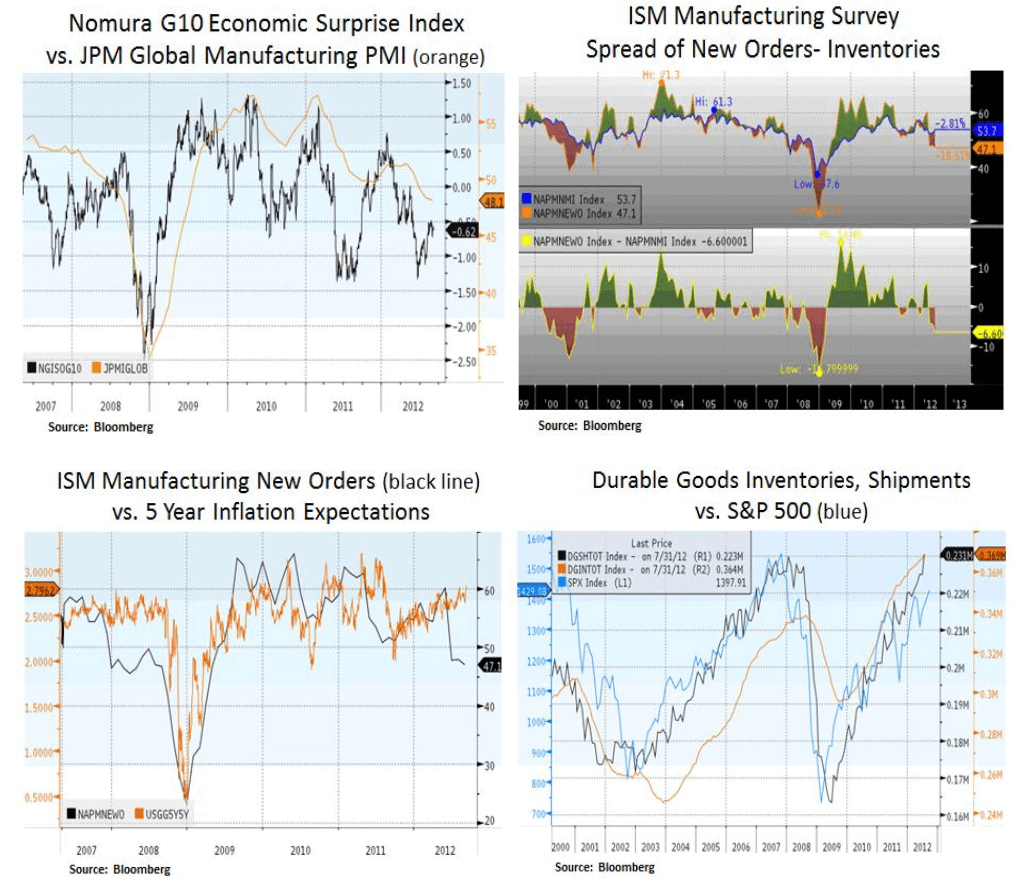

The global growth outlook continues to be challenging, especially at a time of elevated energy and food prices. At this juncture, we see downside risks to the economic cycle unless policymakers manage to revive the global growth outlook in an effective manner e.g. by fixing the credit channel in Europe and by stimulating growth in China after new leadership comes into place. We continue to assess coincident and leading economic indicators and as we can see below, manufacturing measures are sending some cautionary signs. The global economy has a high degree of interconnectedness and our equity sector positioning is tilted towards a mix of quality earnings growth and late cycle themes e.g. healthcare, global consumer staples and aerospace.

On a more positive note, we are encouraged by the nascent U.S. housing recovery. Relative to other housing markets, the U.S. appears attractive e.g. by comparing house prices to average incomes. Stabilizing house prices are a major boost for household and bank balance sheets; thus impacting credit and job creation.

The U.S. elections and resolution of the fiscal cliff uncertainty are critical catalysts for U.S. economic growth. The U.S. consumer still faces high unemployment, low income growth and elevated gasoline prices that erode disposable income. We look forward to sustainable solutions to major issues such as tax reform, healthcare spending, energy policy and the U.S. sovereign debt outlook. Interestingly, we note that the Conference Board spread of current and 6 month consumer expectations is implying positive expectations in the coming months. This may seem at odds with the current pessimism over the 2013 fiscal outlook. Perhaps there is an implied expectation that policy reform may boost household and business sentiment

On the emerging market front, despite elevated oil prices, we note that declining inflation measures in China may be allowing scope for a more aggressive monetary easing by the Chinese authorities i.e. by reducing the required reserves held by banks. Moreover, as we can see below, foreign direct investment has been on the decline alongside with GDP growth. It is plausible that after a reduction in ‘hot money’ flows, Chinese leaders may take more aggressive fiscal measures after the Oct. leadership change in an attempt to stimulate growth. Such a major policy response may mitigate fears for a hard landing. To be sure, a reduction in oil supply risk would be a big relief for emerging markets and it would enable further monetary easing on reduced inflation fears.

From a sector perspective, we continue to be cautious on areas of that show high cyclical sensitivity such as consumer discretionary and materials. We continue to favor a healthy mix of income generating and quality growth equities that exhibit earnings and cash flow visibility. The utilities sector in particular is becoming more attractive after recent underperformance vs. the broader market; as shown by the green chart area below.

In conclusion, we remain disciplined in allocating capital in a timely manner. We continue to assess the macroeconomic backdrop and specific bottom-up opportunities that offer favorable risk-reward features.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.