Political compromises are needed for growth turnaround

Risk assets, such as U.S. and European equities, have been enjoying a period of low volatility as a result of ongoing Central Bank support across both sides of the Atlantic. This has been important at a time of a challenging growth and fiscal backdrop. Financial markets are expecting a minimum degree of political compromise after the U.S. elections with regards to resolving ongoing fiscal challenges. In China, the markets expect renewed leadership when the new administration comes into place. Moreover, in Europe, the markets expect fiscally challenged countries to agree to a more permanent bailout mechanism; whereby the ECB in particular implements a more effective monetary policy. Therefore, in light of these elevated expectations, we seek to add value by selecting both fixed income instruments and equities that offer a margin of safety and favorable risk-reward profiles. Our investment tilt remains towards growing income streams and late cycle sector exposures on the equity side.

In the U.S., residential housing continues to see fundamental traction, as a result of record low mortgage rates and as investors seek attractive yield opportunities. As we highlighted in our last article, U.S. housing appears attractive on various valuation metrics such as price/income. Stability in housing has important implications as household perception of wealth improves consumer confidence. In addition, bank balance sheet stability will help small and medium sized businesses that are facing relatively tighter credit conditions vs. large corporations. This may explain the recent increase in hiring intentions by small businesses which account for ~ 50% of hiring in the U.S. labor market. An improving labor market matters for income growth, which has been lagging in the current business cycle.

The U.S. consumer has been facing high gasoline prices and weak wage growth. Low borrowing costs have eased household financial obligations. This has been a positive for U.S. consumer spending, which accounts for ~70% of U.S. GDP. Yet, we must note that low savings income has contributed to an increase of 4.4m jobs since 2007 in the >55 years of age cohort. Employment also increased by 1.4m in the >65 years of age cohort. Therefore, there are side effects to the low rate environment and the younger generations are experiencing higher unemployment rates. Lastly, elevated healthcare costs have also been a factor for the increased demand for employees beyond 65 years of age; as they are eligible for government healthcare benefits. Therefore, the U.S. consumer is facing a mixed income outlook as older workers settle for lower wages. We are thus cautious on the consumer discretionary sector and have a preference for global consumer staples equities.

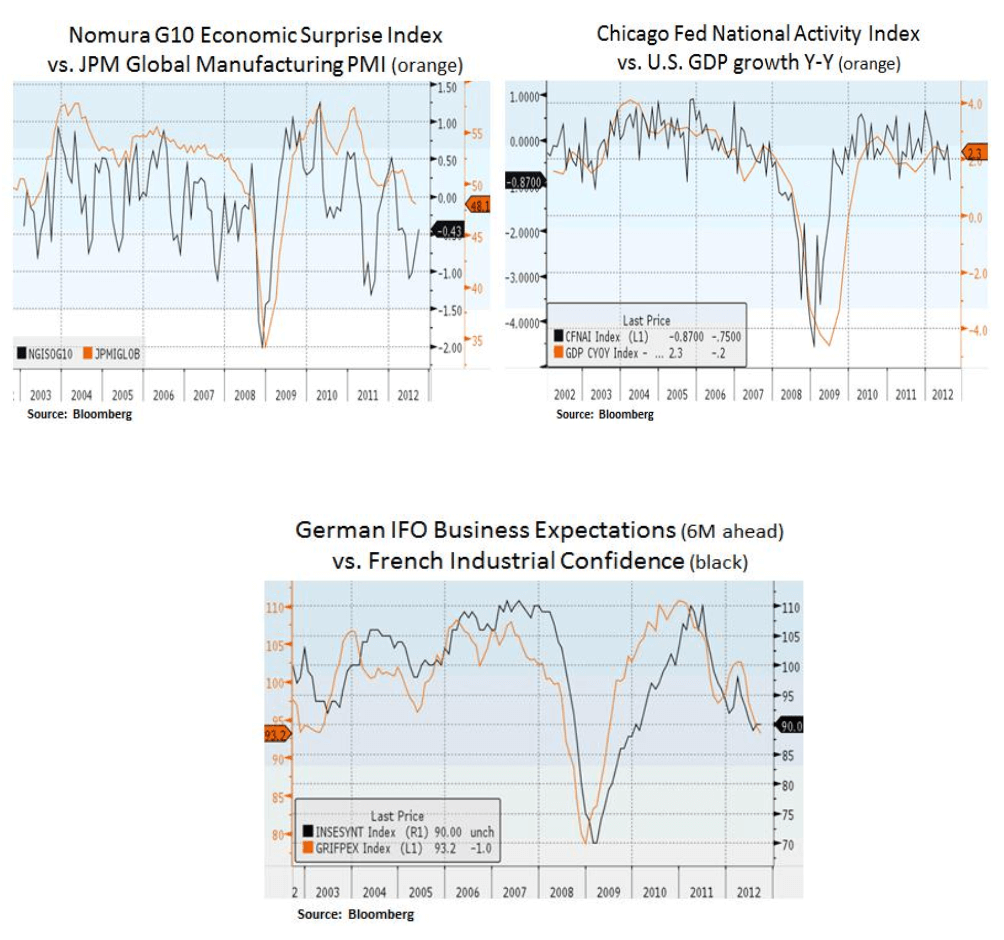

Despite ongoing monetary support by the Federal Reserve and the ECB, the global growth environment remains challenging due to fiscal uncertainty in Europe, the U.S. and a growth slowdown in China. Political compromise needs to be achieved in the U.S. with regards to the 2013 fiscal drag. In Europe, steps have to be taken towards more uniform fiscal policies. We are cautious to the degree to which politicians will be willing to cede sovereign control of their budget policies. Hence, given elevated expectations, there may be more volatility ahead as politicians drag their feet. In the meantime, this uncertainty is weighing on business sentiment as seen below for key economies such as Germany and France. Therefore, from a sector perspective, we have a preference for growing dividend streams/late cycle exposure e.g. in healthcare, aerospace, software and global consumer staples.

Arguably, the markets seem to be taking for granted that the currently projected 2013 fiscal drag (-4% GDP) in the U.S. will largely be pushed into the future. To be sure, businesses and households need the necessary visibility with regards to important policy decisions and reforms e.g. tax code reform, healthcare and energy policies. Although political compromise is possible after the U.S. election, there may be some uncertainty; particularly as the federal debt ceiling will need to be raised in early 2013. Therefore, we certainly hope for pragmatic political compromise by both Democrats and Republicans but given the embedded expectations we lean on the cautionary side and we seek to be opportunistic in a risk-off scenario.

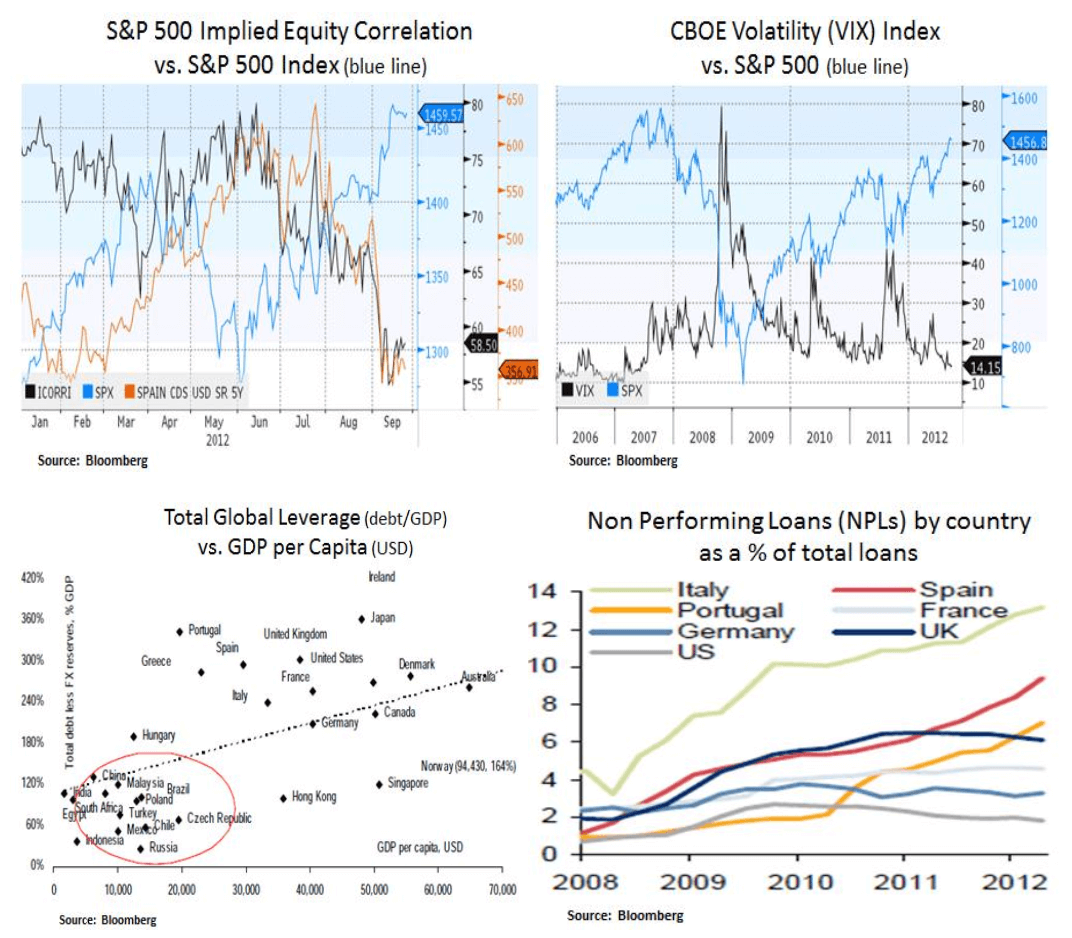

From a technical point of view, we note that equity volatility and correlation have been subdued. This can be attributed to reduced tail risk perception due to the ongoing support by the Federal Reserve and the ECB. Apart from the recent QE3 program by the Fed, the reduction in the European risk premium has been a major contributing factor to low volatility e.g. as seen below by the decline in 5 Year Spanish credit default swap costs (orange line). At this stage, politicians in Spain and Italy need to agree to a renewed bailout mechanism. Fundamentally, the challenging growth/debt dynamics in Europe keep us guarded in our cyclical exposures. For example, non-performing loans in Europe are not seeing any improvement. Moreover, the debt deleveraging path for developed economies is likely to be long; although we expect positive secular debt/GDP dynamics in developing markets to be an offsetting factor to a certain degree.

In conclusion, in an uncertain growth environment, we continue to seek favorable risk–reward opportunities in fixed income and equities. In addition, we seek to allocate capital in instruments that offer a margin of safety from a valuation perspective. Strategically, we have a preference for dividend/income growing instruments and late cycle equities that have more visible revenue and cash flow profiles.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.