A View on U.S. Oilfield Services

Oilfield service companies provide services and products to the energy industry related to the exploration, development and production of oil and natural gas. They perform a variety of specialized services throughout a well’s lifecycle such as seismic testing, reservoir evaluation, well drilling/completions and production. The oilfield services industry is well positioned to benefit from a number of secular trends. As spare capacity in the global oil market remains challenged, major oil companies are increasingly seeking to grow their production from deepwater reserves. Moreover, as a result of drilling technology advancements, major oil companies are seeking to build on the U.S. success in exploiting unconventional resources e.g. tight and shale formations. Global natural gas demand is growing in importance e.g. in Asia and Latin America, as low cost conventional oil is depleted and countries seek lower carbon sources of energy. Thus, the oilfield service industry stands to benefit not just in terms of volume but also from a profit margin perspective as deepwater and unconventional wells are more capital intensive due to their complexity.

International Energy Sector Landscape:

The international oil service upcycle is in full swing. The marginal barrel of oil is increasingly coming from deepwater or unconventional resources. Wood Mackenzie predicts a huge deepwater drilling spending increase over the next decade from $43bn in 2012 to $114bn in 2022. Seadrill (SDRL) believes the floating rig market could nearly double this decade with demand for over 450 units. On the other hand, international onshore well drilling and completions remain mostly conventional. Most parts of the oil producing world have old, inefficient rigs and rely on antiquated technology to capture hydrocarbons. As the secular shift to unconventional drilling continues (e.g. horizontal drilling), demand is increasing for oilfield equipment that can handle higher pressures/temperatures and higher torque. We expect activity to increase in countries with ample recoverable resources and significant domestic needs e.g. China, Middle East.

The Middle East is the fastest growing region today for Exploration & Production (E&P) spending (+28% 2013). S.Arabia is seeking to exploit its unconventional gas & oil resources. Saudi Aramco’s strategic shift in capital employment aims to increase its gas production in order to decrease oil consumption for industrial and residential uses. As such, it aims to increase its oil exports, especially as it is supporting spare capacity for OPEC; at a time where geopolitical volatility has reduced Iranian and Libyan oil supplies. Oilfield service companies such as Halliburton (HAL), Baker Hughes (BHI) and Superior Energy Services (SPN) have recently highlighted expansion plans in Saudi Arabia. Moreover, off-shore driller Rowan Companies (RDC) has indicated optimism with regard to increased shallow water (jack-up) rig demand.

Latin America is also a promising region for unconventional resource development. Argentina’s Vaca Muerta shale reserves are viewed as having the most promising geology outside North America. Politics and insufficient infrastructure are currently hampering well economics but the large-cap Big-Four oil service companies (Schlumberger (SLB), Halliburton (HAL), Weatherford (WFT), Baker Hughes (BHI) stand to benefit over the long-term as more foreign majors such as Chevron get more involved.

Mexico is another promising region for oil services. The country recently proposed energy reforms aimed at boosting domestic production after years of decline and underinvestment. As Russia’s ‘brownfield miracle’ illustrates below, oil service companies are able to reverse production declines dramatically even from existing reservoirs. Therefore, Mexico is likely to be another positive catalyst for the broader oil service industry (WFT, HAL, SLB, BHI, NOV, Cameron International (CAM)) with particular opportunities for deepwater drillers and ultra-deepwater pure-plays such as Transocean (RIG), Ocean Rig (ORIG) and Pacific Drilling (PACD).

Asia/Pacific is displaying acceleration in activity with robust markets in China and offshore. Coal demand appears to have peaked in China and environmental concerns have led China in raising the share of natural gas in its energy mix to 7.5% in 2015 from 5% in 2012. Asia's largest refiner Sinopec has been in advanced talks with oilfield services player Weatherford International to form a joint venture to unlock the potential of China’s vast shale resources.

North America:

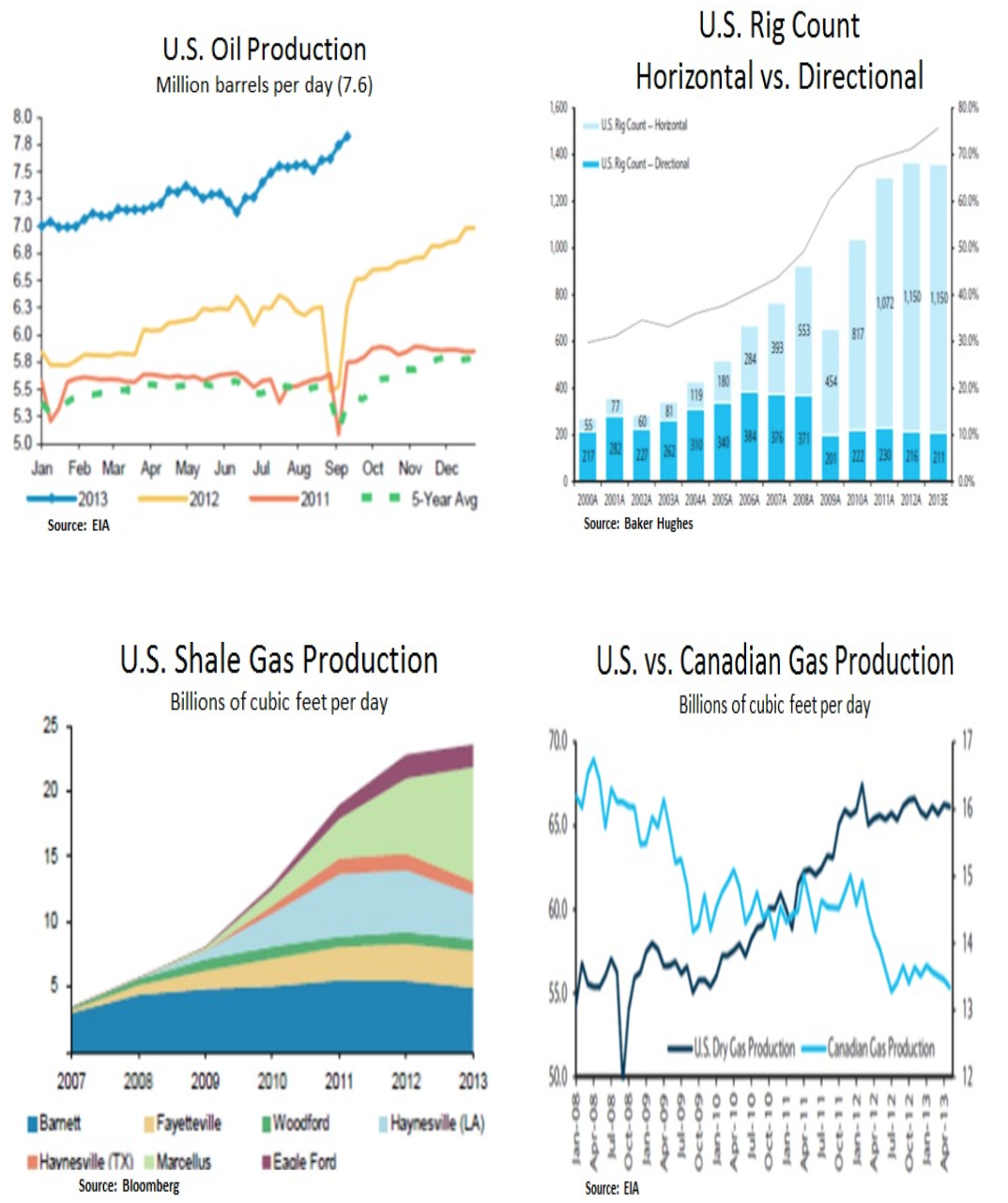

The U.S. energy sector has staged a rather dramatic oil/gas production turnaround in the past four years by exploiting its vast unconventional (e.g. tight, shale) resources. Oil production in particular has reached levels last seen in the late 80s. Unconventional resource development lends to 2-5x greater intensity of oilfield services, including horizontal drilling and hydraulic fracturing. This industry shift has led to larger, more expensive wells and the concept of ‘manufacturing in the oilfield’ i.e. by standardizing practices across potentially thousands of wells in a given basin. Moreover, after the natural gas price collapse in 2009, oil companies have shifted their drilling activities to more oil/natural gas liquids (NGL) rich basins. More oil directed activity has benefited oil services due to its asset intensity and increased production visibility has decreased earnings volatility. Despite some over-supply in pressure pumping equipment, the outlook for onshore drilling activity appears steady. Major oil companies are in resource harvesting mode in the U.S. and their activities are picking up in Canada as liquefied natural gas (LNG) exports gain traction.

The Gulf of Mexico is recovering strongly following the 2010 BP spill and it is currently viewed as one of the best deepwater markets in the world. Off-shore drilling enjoys secular growth prospects and contract backlogs remain elevated for high-spec deepwater rigs (e.g. semi-submersible, drillships) and subsea equipment. Global deepwater discoveries have outnumbered shallow water finds by more than 9 to 1 in the last 5 years. The offshore drilling industry is witnessing a bifurcation as the market prefers new generation rigs (e.g. 6th, 7th gen) over older rigs. Another recent trend has been for ultra-deepwater rigs to be hired for drilling in shallower waters as they offer greater efficiency and security. Thus, the outlook for offshore operators such as Transocean (RIG) remains robust.

Conclusion:

In a resource constrained world, the oilfield services industry offers attractive exposure to a variety of secular growth themes. We have a preference for well positioned industry leaders with leverage to international market growth, differentiated technology offerings and scope for incremental capital allocations.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.