Long-term vision needed for U.S. fiscal policy

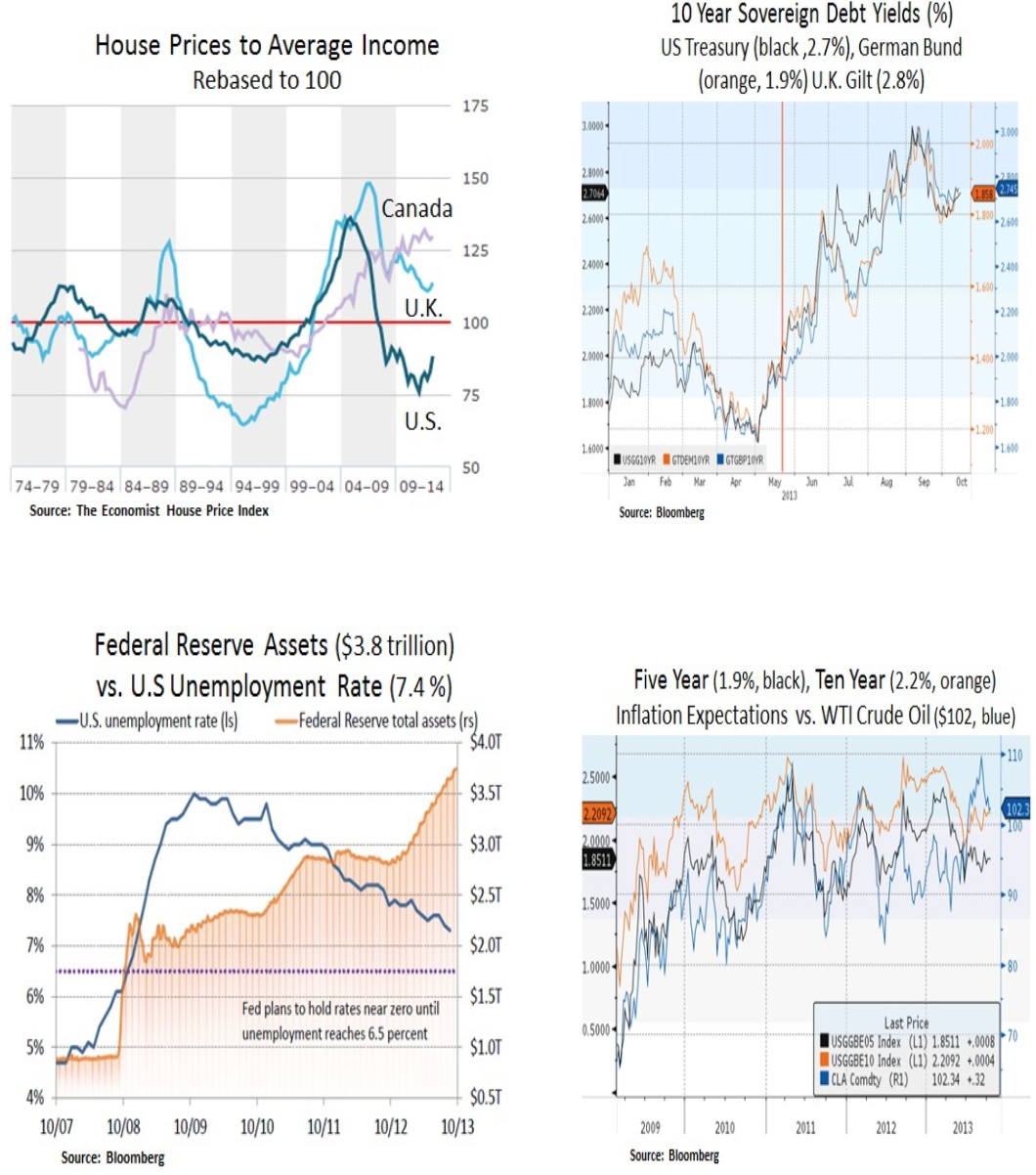

Financial markets continue to display resilience despite indecision in Washington over the Federal debt ceiling extension and the 2014 fiscal budget. Political gridlock will likely continue to frustrate investors in the short-term and its chronic nature undermines U.S. credibility in the sovereign debt markets. However, unlike the 2011 fiscal impasse, the budget deficit has witnessed material cyclical improvement in 2013. Thus, we expect politicians to follow the path of least resistance i.e. a continuing resolution and a debt ceiling extension. Moreover, they will likely agree to a negotiating framework over the medium-term in order to reach a final fiscal resolution over the 2014 budget. Protracted fiscal negotiations and labor market uncertainty will likely keep the Federal Reserve and its new head Janet Yellen on the defensive. Therefore, the Fed’s ‘tapering’ of its quantitative easing (QE) program will likely become a Q1 2014 affair. From our investment perspective, we continue to focus on low duration non-agency MBS and selected equities that offer a balance of income growth and earnings visibility.

As we can see below, the long-term U.S. fiscal outlook remains challenging as a result of heavy non-discretionary spending and demographic pressures as the Baby Boomer generation retires. Healthcare spending (Medicare/Medicaid) is the elephant in the room and entitlement reform is likely to be a pressing political issue over the back half of this decade. Instead of short-term fiscal patches, long-term growth initiatives are needed in order to stabilize the fiscal outlook. We view the energy sector as the most promising growth segment of the U.S. economy. Compared to other major economies, the U.S. has lagged on the export front. An aggressive energy export policy has the capacity to propel the U.S. economy to its 3-4% long-term growth trajectory. Thus, such a growth scenario is constructive for U.S. equities.

Apart from our favorable view on the energy sector, we view U.S. housing as another silver lining for the U.S. economy. The level of housing activity is still low from a multi-decade U.S. perspective. In addition, compared to other international housing markets, U.S. housing remains fundamentally undervalued. To be sure, mortgage rate normalization is a likely headwind for the sector but we retain our ‘slow and steady’ growth perspective. Thus, we continue to favor low duration exposure to the non-agency MBS sector.

The cost of servicing U.S. financial obligations remains a key issue for U.S. policymakers, entrepreneurs and our foreign creditors. The global rate environment remains fairly well correlated and a U.S. rate normalization scare in 2014 is likely to weigh on global rate sensitive asset classes and regions such as Emerging Markets. The Fed’s decision in September not to taper has raised fears of a ‘QE trap’ i.e. the Fed having difficulty exiting its monetary easing program. Realistically, the Fed’s balance sheet cannot grow in perpetuity but it’s not out of the question that ‘tapering’ of the current $85bn/month QE program gets pushed into Q1 2014. Another dimension is also the declining role of global Central Banks as marginal buyers of Treasury debt. Therefore, as we look into 2014, we continue to be cautious with regard to long duration fixed income assets. We are also avoiding direct exposure to emerging market asset classes that are more vulnerable to a global rate normalization phase.

In conclusion, as fiscal and monetary policies remain in flux, we continue to favor a balanced portfolio approach that is comprised of income generating assets (MBS) and large-cap equities that have attractive risk-reward profiles. Intra-market equity correlation remains subdued and this backdrop is more conducive for stock picking. We like secular growth opportunities in the energy, healthcare and technology sectors. Lastly, we view a healthy cash position as a prudent measure in the event of elevated market volatility.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.