Bond Market Growth Warning to Policy Makers

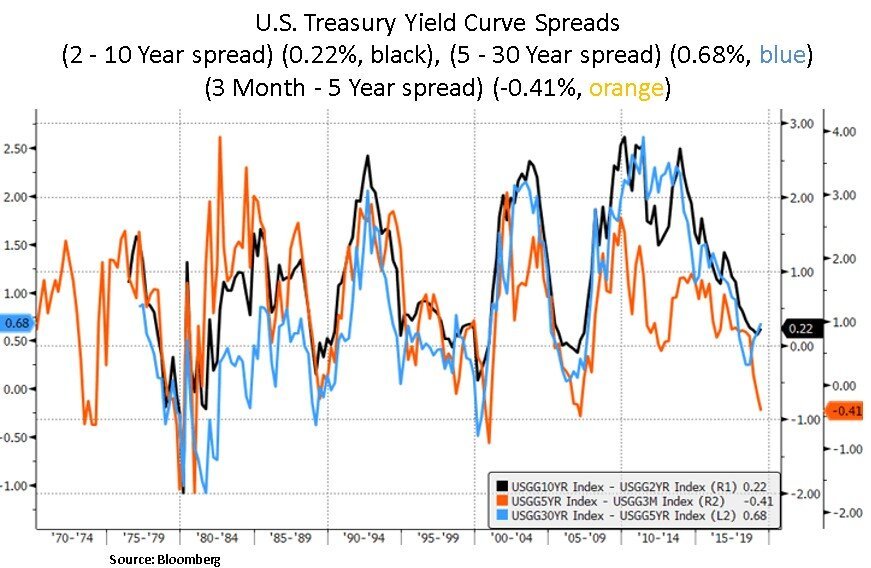

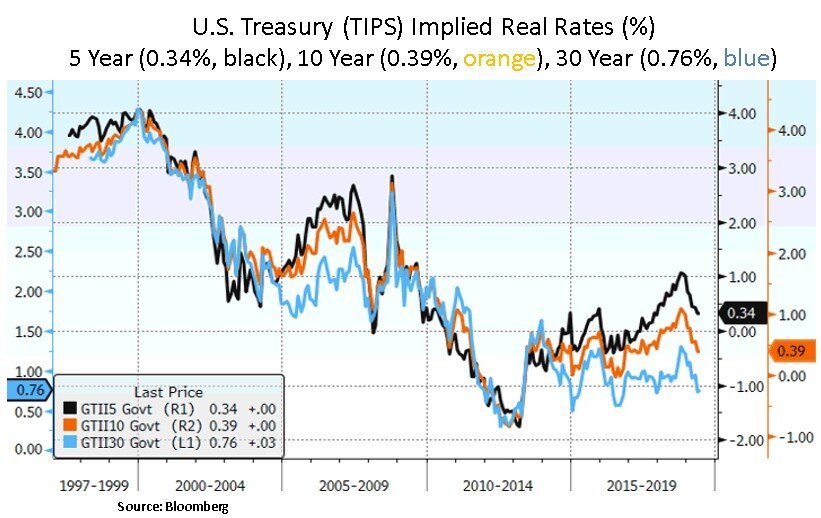

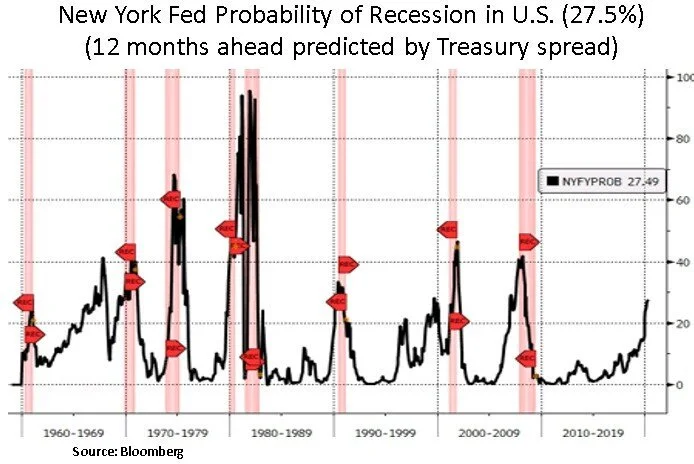

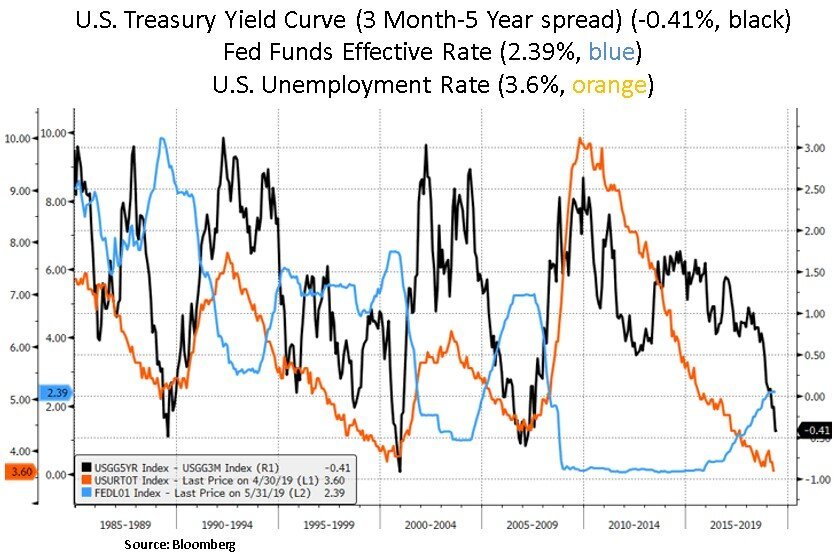

During the past month, financial markets witnessed a material rally in global sovereign bonds; as inflation expectations continued to drift lower, on the back of rising global trade tensions. Front-end portions of the U.S. Treasury yield curve continued to invert further e.g. the 3-month bill – 5-year note yield spread declined to -0.41% (decade low). Moreover, expectations are rising for Fed interest rate cuts (i.e. at least 2 rate cuts in 2019) in order to stave off declining inflation expectations and tightening financial conditions. The Fed’s language has started to shift away from ‘patient’ regarding policy action to a realization that low inflation may not be ‘transitory’. The question is, why should the Fed cut rates now? The answer is likely twofold - 1. repercussions from the U.S/China trade deal impasse and 2. the increasingly consensus view that the Fed over-tightened via a combo of interest rate hikes and quantitative tightening (i.e. balance sheet reduction from a peak of $4.5 to $3.85 trillion).

What’s important to realize is that there can be a big lag from when policy action takes place and when it starts impacting the real economy. Historically, most recessions were preceded by yield curve inversion with a lag of 12-18 months. Therefore, the Fed really needs to look ahead preemptively – assuming they agree with the bond market’s signal. Compared to past volatility episodes, the Treasury yield curve is now displaying strong inversion signals. Historically, the 3 month bill - 5 year note yield spread has been a reliable indicator regarding economic growth concerns. We also note below that the 2 Year Treasury yield is now below the Fed Funds effective rate.

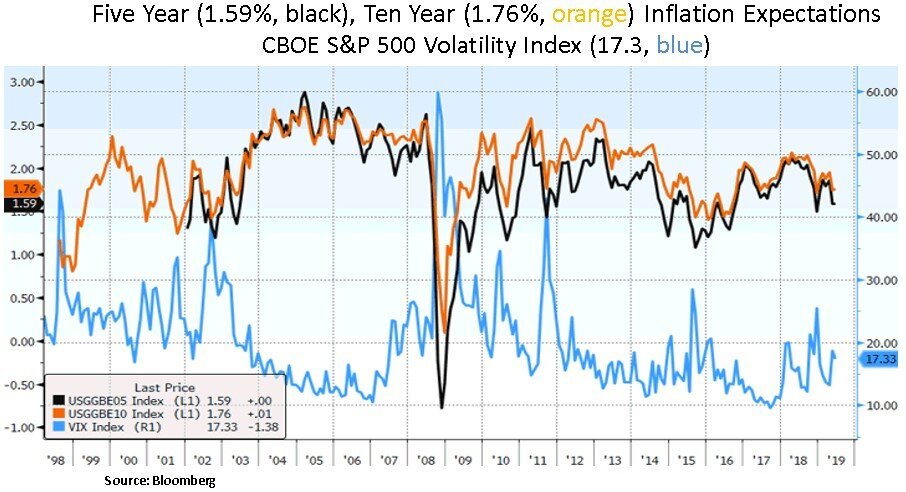

Inflation expectations matter as they can be harbingers of a turning point in the corporate profit cycle. As we can see below, during episodes of a material drift in inflation expectations equity volatility rises. In the past month, interest rate volatility outpassed equity volatility. The Fed has historically been very responsive to inflation expectation declines and financial conditions tightening (which include a decline in equity prices). We also note that the most recent ISM manufacturing survey indicated a contraction in the order backlog despite a better than expected new orders reading. This implies order cancellations which could point to a deceleration to corporate profits and U.S. GDP growth in the coming quarters. The question remains how severe trade tensions could get and how global supply chains may get disrupted. In the absence of a U.S./China trade deal, corporations with global footprints face additional downward pressure on growth and profitability from their international operations. Moreover, companies may not be able to fully pass on higher tariffs; which can erode profitability.

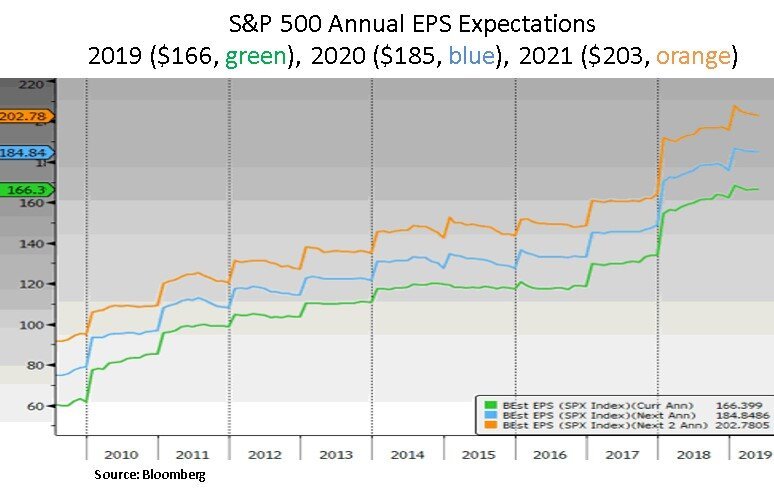

The question is how corporate confidence will evolve in the coming quarters and whether management teams may seek to rein in consensus earnings (EPS) expectations. As we can see below, forward EPS expectations are still on the high side for the broader U.S. equity market. To be sure, expectations vary at the company and industry level; but overall consensus expectations are on the high side for H2 2019 and the next 2 years. We suspect that the coming earnings seasons may create attractive stock picking opportunities; as we may witness mismatches between management forward EPS guidance and sell-side EPS expectations.

Lastly, we note that the markets and the Fed will likely monitor very closely the health of the U.S. labor market; as it has been a strong bastion of U.S. domestic growth and underlying demand for goods and services. The labor market has been cyclically tightening for several quarters; with rising wage inflation. We are keen to see whether the Treasury yield curve is also sending an early warning signal regarding the pace of labor market growth. The Fed will likely become very dovish if the U.S. labor market decelerates. From our perspective, we have been avoiding labor intensive companies such as retailers that may have a hard time passing tariff costs to customers.

In conclusion, investors are currently observing a growth warning from the U.S. Treasury market. As such, the market has witnessed a large move in interest rate volatility. In the absence of a material U.S./China trade deal (at the G20 summit or soon after), one should expect the Fed to preemptively start easing monetary policy in the coming months; in order to safeguard inflation expectations and keep real interest rates low. From our portfolio perspective, we continue to be selective in our capital allocation with a preference for income generation and strong balance sheets.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.