Fed Facing Slipping Inflation Expectations

Financial markets are currently at a crossroads as they are gauging the outlook for global growth and inflation expectations. The more immediate issue is the apparent impasse in U.S. – China trade negotiations. As a result, the U.S. has threatened to raise tariffs on US$200bn of Chinese goods to 25% from 10% currently by Friday. A lack of a trade deal will likely dent global business sentiment, especially as recent manufacturing readings (e.g. German and U.S. manufacturing orders) missed expectations. From our perspective, regardless of the binary outcome of the current trade negotiations, we view current asset prices as fair and we continue to focus on specific security selection – with a mix of income generating instruments and undervalued equities. We seek to be more aggressive allocators of capital as value opportunities arise.

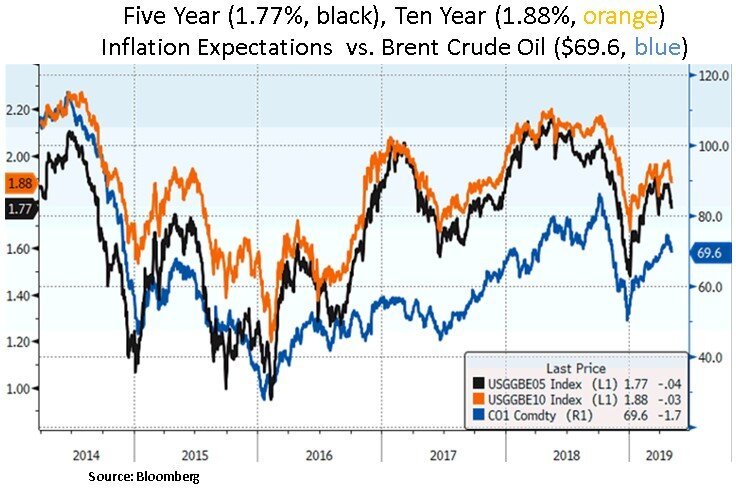

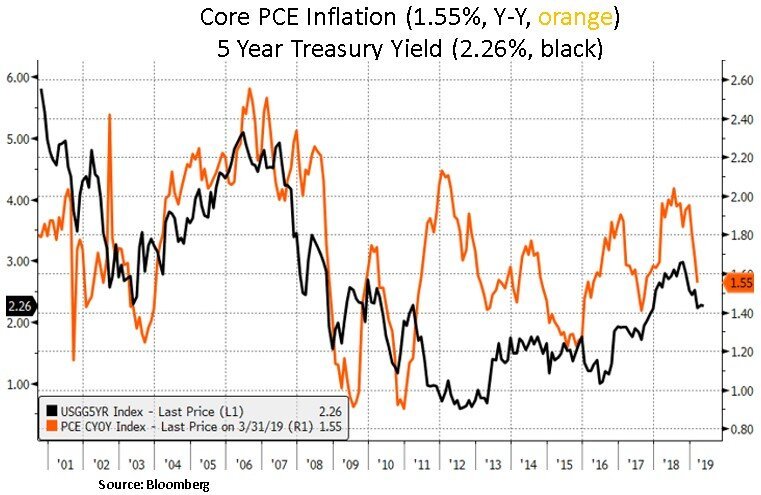

Apart from global growth uncertainty, market participants have also been focusing on the Fed’s ability to fulfill its inflation mandate; especially after the Fed’s recent policy normalization pause. A number of investors are debating whether the Fed has over-tightened and whether the Fed’s policy might stay too tight for too long. The issue is the Fed’s recurring inability to reach its 2% core PCE (personal consumption expenditure) inflation target. As we can see below, forward inflation expectations are starting to soften and core PCE inflation in particular is at 1.55%. We also note that recent manufacturing and services surveys have pointed to weaker pricing. In addition, key CPI components such as the owner’s equivalent rent of residences (OER) (24% CPI weight) are likely peaking out.

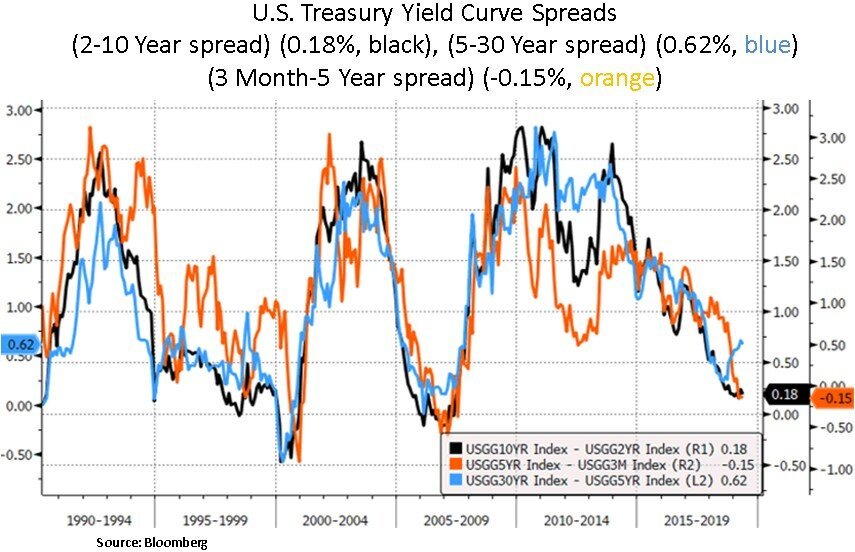

Barring a successful trade resolution (or a negotiation extension), one should expect Global Central Banks to continue on their current policy pivot and as such to remain more accommodative. The Fed in particular would likely respond to a potential tightening in financial conditions and a further decline in inflation expectations. As we can see below, U.S. leading economic indicators and certain segments of the Treasury Yield curve are already pointing to some growth uncertainty. After a year-to-date lull in volatility across asset classes, we are seeing this week a burst in equity volatility (+63% in the past 5 days) – primarily due to market positioning (record VIX shorts observed in the recent month) and market expectations for U.S. earnings acceleration into the second half of 2019. Depending on the global trade outlook, there is scope for interest rate and currency volatility to pick up from currently depressed levels.

From our portfolio perspective, we maintain our preference for secular growth themes e.g. within the technology, communication services and healthcare sectors. We also lean on solid balance sheets and high margin corporations that can sustain dividend growth and capital return in the form of share buybacks. As discussed in recent articles, street EPS and profit margin expectations are still on the high side for 2020 and 2021. Expectations for margin expansion in particular seem elevated. In our opinion, it will be hard to achieve sustained margin expansion as labor costs increase and if revenues don’t surprise on the upside. We continue to avoid labor intensive companies.

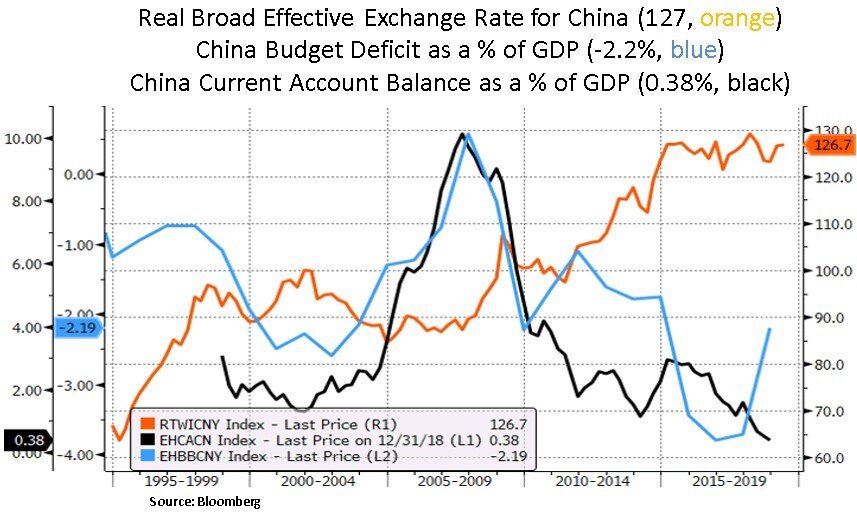

Lastly, we note that key components for the global inflation outlook are the USD and the Chinese Yuan. Contrary to public rhetoric, the Chinese currency has been appreciating in the past few years and has likely impacted China’s current account balance. A trade escalation may give rise to FX volatility and a potential Chinese currency devaluation could have a meaningful deflationary impact on global growth. If that scenario comes to play, the Fed would likely be more aggressive in cutting interest rates, which in turn would engineer a USD devaluation. A weaker USD and contained real rates would likely have a reflationary impact across the global economy. U.S. multinationals will likely benefit in that scenario, especially more cyclical sectors such as energy, industrials and materials.

In conclusion, global growth and financial markets are currently at a crossroads due to global trade tensions. Even though the risk of tariff escalation is increasing, one should expect more monetary accommodation by Global Central Banks and especially the Federal Reserve; in order to cushion growth and inflation expectations. Given current asset valuations, we look forward to deploying capital more aggressively in our favorite investment themes at better levels.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.