Countdown to Liftoff

The year has gotten off to a bumpy start with the S&P 500 suffering its first 10% correction since 2020, and the tech-centric Nasdaq 100 dropping over 15% from it’s record high as long-duration equities were punished. Bond yields rose around the globe amid hawkish policy signals and strong economic data. Inflation continues to surprise to the upside and central banks are quickly pulling back emergency stimulus. The European Central Bank (ECB) suggested it would conclude its asset purchases earlier than expected and did not rule out a rate increase this year, while the Bank of England (BoE) again raised rates.

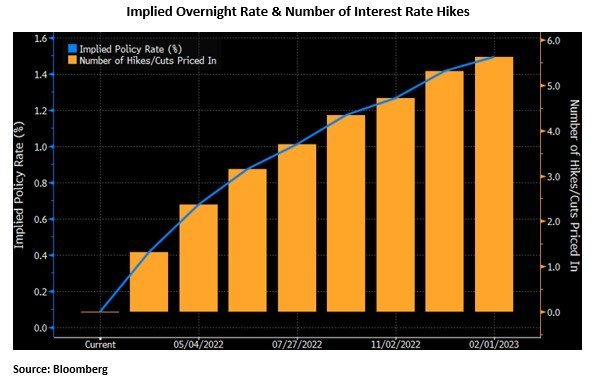

The majority of the focus, however, has been on the Federal Reserve. At their meeting last week, they began to lay the groundwork on what to expect in the coming year. As they are data dependent, they do not yet know the pace or size of rate hikes, but Fed Chair Powell shared his view that there is “quite a bit of room” to raise rates without threatening the labor market and damaging the economy. It remains to be seen whether the Fed will commence this hiking cycle when they meet again on March 16th with a standard 0.25% increase or raise rates 0.50% in an attempt to smother red-hot inflation. Either way, the market appears to have interpreted Chair Powell’s hawkish post-FOMC press conference as evidence the central bank is admitting it is behind the curve and will have to catch up by hiking rates aggressively this year. Financial markets are now pricing in five 0.25% rate hikes for 2022.The Fed has also told us that it will not only stop its asset purchases, but will also start to allow bond holdings to mature without replacing them, thus reducing the size of the balance sheet. This mention of balance sheet reduction caught markets by surprise.

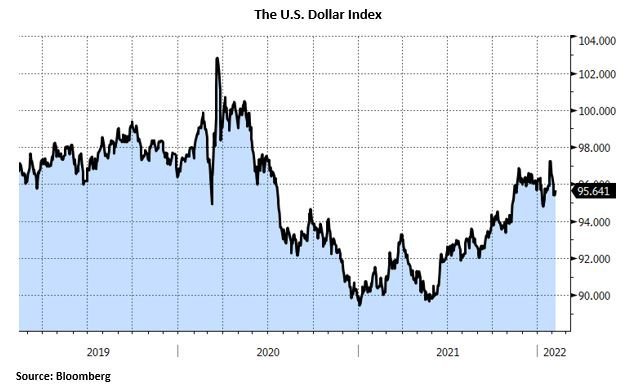

In January, the spread between the 2 and 10-year Treasury yields compressed to the narrowest since October 2020. While the move on the front end of the yield curve can be attributed to the forthcoming change in interest rates, a flattening curve may be a warning that U.S. economic growth won’t be as robust as many had anticipated. The dollar is in search of more clarity amidst mixed signals. The greenback, which rallied in January during the selloff in equities, has erased those gains, failing to capitalize on expectations for Fed rate hikes, typically a catalyst for foreign buyers in search of higher yields. With the dollar primarily rising in periods of market turbulence, and not on rate-policy expectations, foreign exchange investors appear more worried about the Fed’s hawkish stance on the economy than on improved carry trades.

In the labor market, momentum in wage gains could create problems for companies’ operating margins; however, some of the key drivers of inflation are beginning to subside. While backlogs and chip shortages linger, shipping costs are falling and the U.S. producer price index decelerated in December. Central banks are talking tough to appear to be responsive to surging inflation. Normalizing policy rates to pre-pandemic levels and removing additional stimulus is prudent and necessary, but the Fed must strike the balance of containing inflation without inflicting too much damage on growth. This delicate dynamic is likely to bring continued bouts of volatility along with it. Typically, stock market advances do not end this early in a Fed tightening cycle. The combination of slower economic and earnings growth, along with tighter fiscal and monetary policy, points to a positioning in high-quality large-cap stocks which remains our core focus.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request