Geopolitical Shocks Compound Market Uncertainty

Financial markets were shaken last week when Russia formally invaded Ukraine. The S&P 500 fell briefly into correction territory before making a sharp recovery, and the U.S. bond market has been on a roller-coaster ride. The military action heightened volatility in global bond markets already roiled by inflation and tightening monetary policy. Initially, U.S. Treasury bonds rallied as investors sought safe-haven assets. However, the initial drop in yields was largely reversed in the subsequent 24 hours. Ten-year Treasury yields plunged from nearly 2% to as low as 1.82% before rebounding briefly but now stand around 1.70%. The conflict in Ukraine is a human tragedy first and foremost, but the economic fallout from Russia’s actions will be substantial.

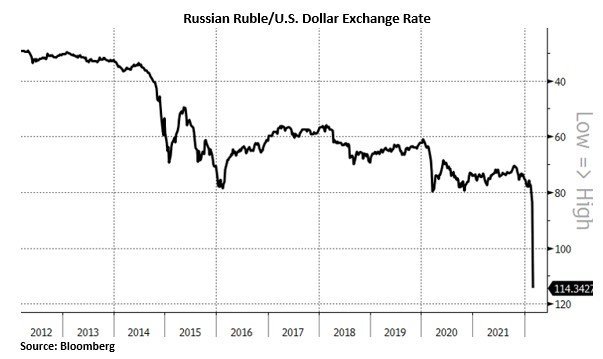

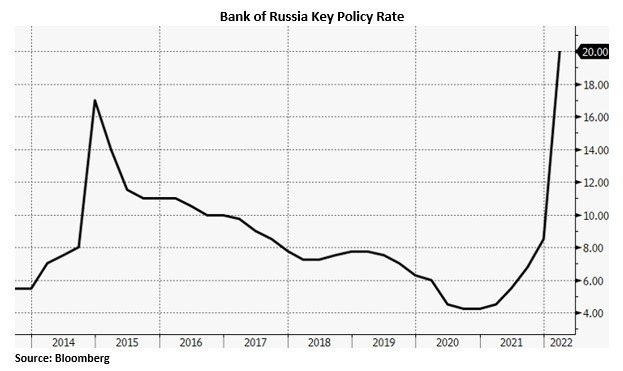

Vladimir Putin’s overwhelming military advantage has not translated into a quick victory yet thanks to the bravery of the Ukrainian resistance. Meanwhile, Western sanctions have been ramped up to unprecedented levels including: cutting off Russian banks from the SWIFT system; sanctions on the central bank and freezing most of its FX reserves; restrictions on port access; Turkey closing the Bosporus to Russian naval vessels; the closure of UK/EU airspace for Russia and vice versa; visa restrictions; and restrictive measures on officials and elites. Sanctions operate with a lag, but the severity of these measures will create a financial crisis in Russia that many are comparing with the break-up of the Soviet Union in 1991.The removal from SWIFT on Saturday, (the high security network that facilitates payments among 11,000 financial institutions in 200 countries) is aimed at cutting Russia off from the international financial system. The Ruble hit record lows Monday, sliding more than 30% against the dollar. This has left Russia scrambling to keep the economy running with the Russian central bank more than doubling interest rates to 20%, the highest in almost two decades.

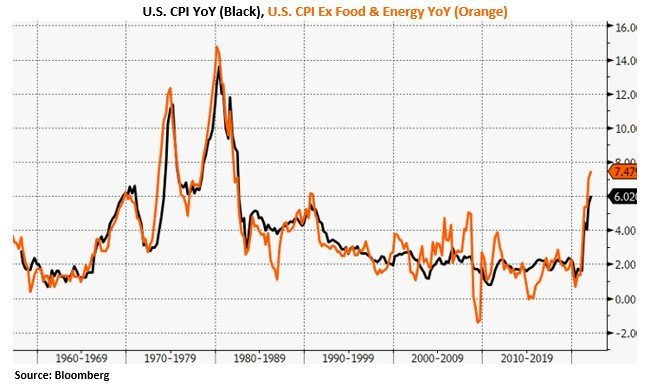

The war in Ukraine comes at an important inflection point for the Federal Reserve as it contemplates lifting its policy rate for the first time since Covid shuttered the U.S. economy in March 2020. Investors who are currently grappling with geopolitical uncertainty will next have to grapple with central bank uncertainty over the first half of March. With the next FOMC meeting approaching, market expectations continue to fluctuate. A tight labor market and high inflation on the back of lingering supply bottlenecks clearly support a more rapid pace of monetary tightening. But, the sharp escalation of the Russia-Ukraine conflict has injected high uncertainty into markets, which if prolonged, could drag on growth. Physical supply disruptions combined with sanctions will see substantial and sustained price increases, on top of already high CPI numbers. Energy and food prices, both key forces behind inflation, may be pushed even higher by the escalating Russia-Ukraine conflict. That will flow back to households across Europe and the U.S., where shoppers have already faced sticker shock on everything from cars to groceries. Market participants will listen closely to Fed Chair Powell’s semiannual testimony tomorrow and Thursday for any clues regarding shifts in the policy landscape. Attention will still be focused on the eastern borders of Europe, and rightfully so, but markets remain concerned about a generational increase in inflation. In economic terms, the Russian invasion of Ukraine is a negative supply shock that will have a downward impact on US GDP growth and an upward impact on inflation. In particular, being a new shock, it will extend the duration of elevated inflation. While the invasion of Ukraine may have reduced the probability of an outsized first hike, it may add to the need for monetary policy tightening in the second half of the year, as the projected decline in inflation will be slowed down by this new supply shock. If high inflation lingers and continues to erode real income, consumer demand could slow at a faster pace.

Stepping back, we realize that geopolitical risk is likely to amplify volatility, particularly as elevated inflation and the uncertain path of interest rates has deteriorated liquidity in most markets. Central banks are returning to a neutral policy stance by removing emergency stimulus put in place when the pandemic first hit. It is unlikely that they go much further than that to curb inflation because of high costs to growth and employment in an economy that is still recovering. Additionally, central banks may face less political pressure to contain inflation as the conflict becomes an easy excuse for higher prices. This should allow them to move more cautiously as they normalize rates, reducing the risk of policy error. As we watch the events unfold in Eastern Europe our thoughts are with the innocent civilians of both nations whose lives have been upended.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request