Mixed Signals

The major averages closed out the first quarter last week posting the first negative performance in two years. Market participants continue to navigate an environment dominated by the Russian invasion of Ukraine and the Fed’s sharp hawkish pivot. While the S&P 500 and Nasdaq have now recouped all of the losses since the Ukraine invasion, investors have been disappointed by a lack of progress in peace talks.

Equally notable has been the inversion of the yield curve. This occurs when the yield on shorter-term maturities on the front end exceed that of longer maturities. Negative term spreads have preceded most recessions in the post-World War II era, with the 2 to 10-year segment of the Treasury curve (known as 2s 10s), predicting all six recessions since 1978. While inverted curves do tend to predict future recessions, there is often a significant lag between the signal and subsequent economic downturn. According to Bloomberg the median amount of time between the initial inversion of the yield curve and the onset of a recession is 18 months, and the median return of the S&P 500 from the date in each cycle when the yield curve inverts to the market peak is 19%. So, while it’s an important indicator, it should be taken into context and the spread between the 10-year and 3-month Treasury yields has recently widened. Credit broadly rallied last week with both investment grade and high yield spreads narrowing to their tightest levels since mid-February, before Russia’s invasion of Ukraine.

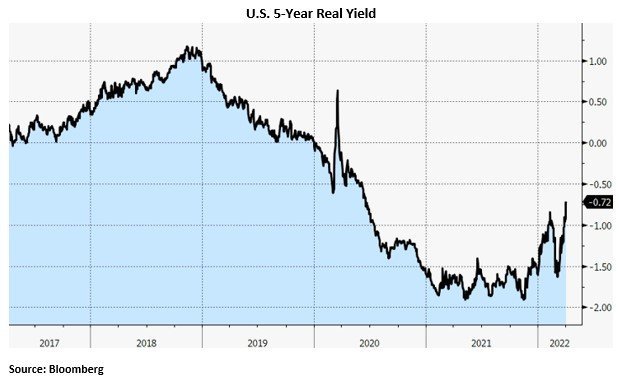

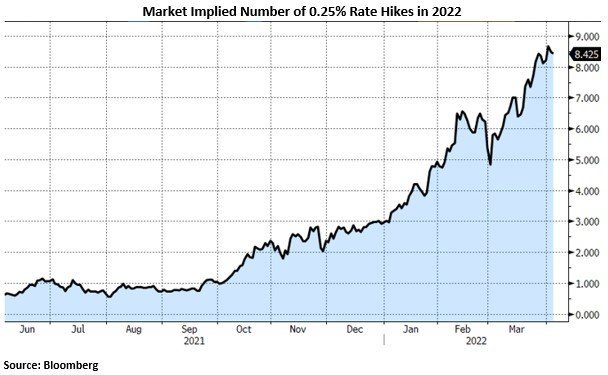

Also significant is that real yields (nominal yield minus inflation rate) have now retraced their war-related decline, with 5-year real yields trading at its highest levels since 2020. What’s worth watching here is that equities struggled when real yields were last at these levels. For now, stocks have become comfortable with volatility declining significantly despite the headwinds of geopolitical conflict, Fed tightening, and the weakest consumer sentiment as measured by the University of Michigan over the last decade. The global economy is faced with a stagflationary supply shock that is negative for growth and will likely exacerbate inflation. This is in large part due to higher energy and food prices, tighter financial conditions, and supply chain disruptions. Given the robust jobs market, the general thought is that this will provide the Fed cover to hike aggressively and the market now expects 8 rate hikes in 2022.

Economic conditions in large part, however, remain strong with a tight labor market. We are in the late stage of the cycle, with underlying growth momentum still strong but increasingly vulnerable. In this environment, earnings will be relied upon as the primary driver for returns going forward, favoring high quality companies.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request