A Delicate Path to a Soft Landing

The month of April was a trying one for markets with the S&P 500 down almost 9% while the Nasdaq fell over 13%, marking their worst monthly performances since 2020 and 2008 respectively. Investors have continued to grapple with a 40-year high in inflation, war in Eastern Europe, a slowdown in China, and a Fed that is poised to ramp up rate hikes and normalize its balance sheet.

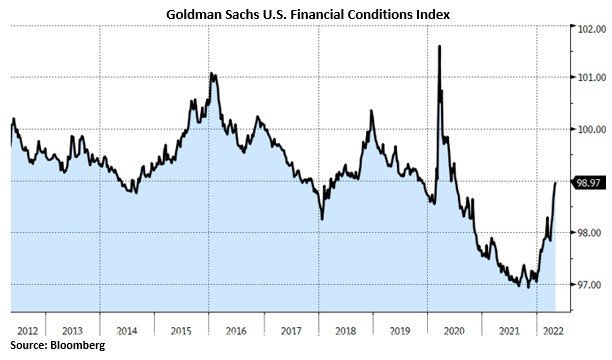

Later this afternoon all eyes will be on the Fed as they announce what is assumed to be a 0.50% increase in the funds rate and provide further clarity on plans to reduce the $8.9 trillion balance sheet. Several FOMC participants have hinted recently that the committee is determined to hike quickly to the neutral rate, which the median participant currently estimates at 2.4%. With the global economy slowing and financial conditions tightening, the policy path after that is uncertain. The challenge for Powell at the post-meeting news conference will be to provide more clarity on how the committee views the headwinds from abroad. Inflation is in part a negative feedback loop. If investors, employers, and workers believe inflation will be high far into the future, they will behave in ways that boost inflation in the near term. It is key for the Fed to shape beliefs about future inflation with credible policy guidance to instill confidence that price pressures will abate. This will, in turn, make lower inflation easier to achieve. Longer-term expectations have only moved up slightly as reflected by the 5-year, 5-year forward breakeven inflation rate, which remains near levels from the early 2010’s.

The situation in China is dismal. Their “zero tolerance” COVID policy currently has Shanghai and 45 other cities locked down with over 350 million people unable to leave their homes. This has prompted a sharp downgrade in expectations. More bad news on the scope and duration of China’s Covid lockdowns, or renewed fears about yuan weakness and capital outflows, could change market sentiment. A China supply shock as lockdowns force factories and ports to operate at less than full capacity could add additional inflationary pressure to goods prices.

The April jobs report on Friday is estimated to show a decrease in the unemployment rate to 3.5% as the economy continues to add workers at a strong pace. A tightening labor market means the Fed will continue to see upside risks to the price outlook. While the latest consumer spending report showed a moderate deceleration in core PCE inflation, and higher services spending will relieve some pressure on goods prices. In corporate earnings, of the S&P 500 companies that have reported thus far, 69% have reported actual revenues above estimates and 79% beat EPS estimates according to Factset.

Of the past 13 rate hiking cycles, 10 have resulted in a recession. The combined impact of a shrinking central bank balance sheet and higher interest rates presents an extraordinary challenge for a global economy already navigating the Russian invasion and China’s new lockdowns. Already rising bond yields and a stronger U.S. dollar are tightening financial conditions even before the Fed’s new policy path gets into full swing. Given the uncertain environment we continue to favor large cap companies with strong balance sheets that are well capitalized in this new rate regime.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request