The Fed’s Trade-off

The S&P 500 has rallied over 9% since the May low which, aside from an oversold bounce, can be ascribed to hopes the Federal Reserve has engineered a soft economic landing. The Fed indicated in the minutes for the May 4th FOMC meeting that aggressive tightening in the first half of 2022 could provide them with flexibility in the second half of the year to moderate or even pause with rate hikes. This notion was quickly walked back by Fed officials, but the market interpretation of a potential dovish policy pivot in September was enough for a substantial move higher in equities.

Last Friday, the US Bureau of Labor Statistics published their job market figures for May, which showed faster-than-expected employment growth despite slowing economic activity. The U.S. added 390,000 jobs, keeping the unemployment rate steady at 3.6% as swift wage growth also boosted labor force participation. Median wages are up 6.0% year-over-year as businesses continue to struggle to fill job openings. Weaker economic growth and rising labor participation should ultimately ease wage pressures and consumer price inflation. The Fed’s preferred measure of inflation, core personal consumption expenditures (PCE), rose 4.9% year-over-year for April, down from 5.2% the previous month, providing signs that U.S. inflation could be peaking or has already peaked. We’ll have further clarity in this regard on Friday when May’s headline CPI figure is released.

U.S. Personal Consumption Expenditure Core Price Index YoY

Markets have already done a lot of the Fed's job even before the Fed actually makes more progress on its rate hike path and shrinks the balance sheet. This has also had the impact of tightening financial conditions across the economy. Mortgage rates are sharply higher, interest rates and credit have moved higher, and money supply growth is slowing. After getting to neutral in short-term rates, the Fed will likely want to see how all this tightening is impacting the overall economy. These tighter conditions should temper growth momentum in the latter half of the year. Going forward, confidence in the corporate earnings outlook should be the driver of equities from here, not further recession fear or Fed induced multiple compression.

Bankrate.com U.S. Home Mortgage 30 Year Fixed National Average

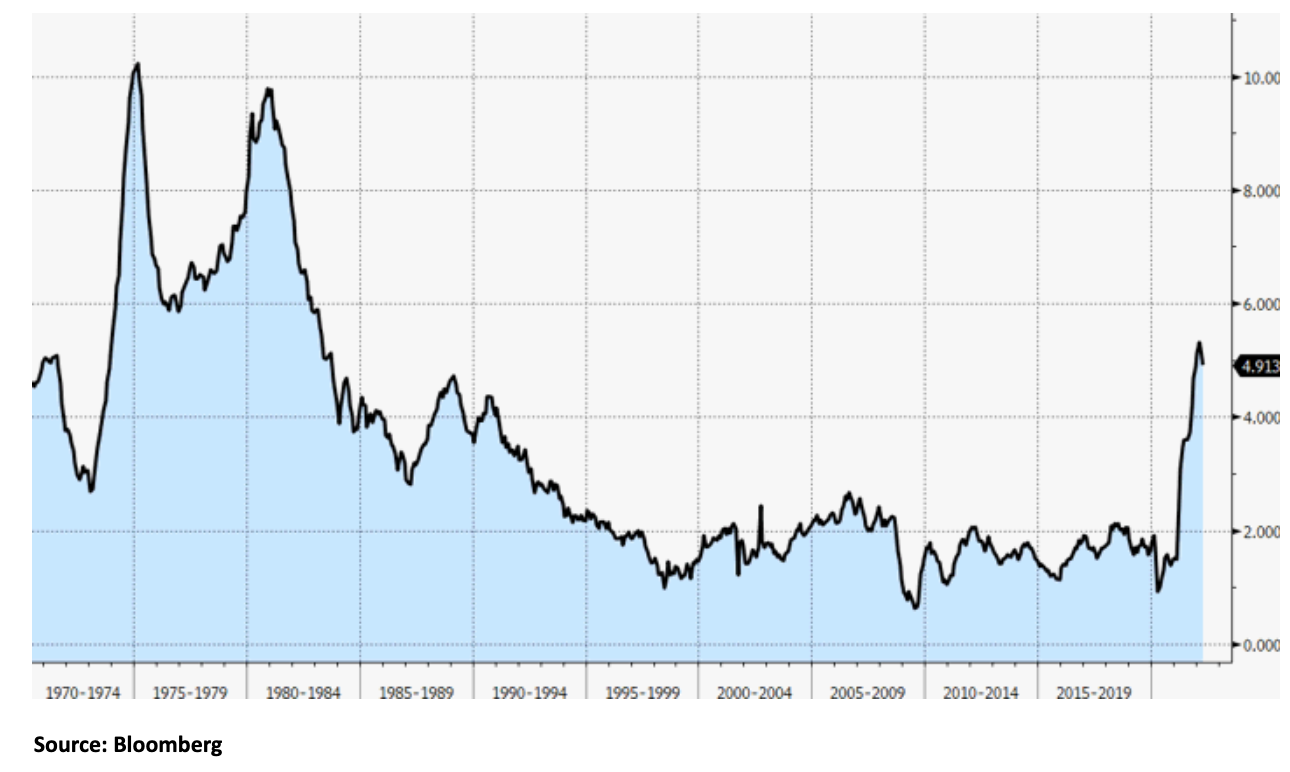

Federal Reserve Money Supply M2 YoY % Change

Central banks are facing a growth-inflation trade-off. Hiking interest rates too much risks triggering a recession, while not tightening enough risks causing unanchored inflation expectations. The Fed has made clear it is ready to stifle growth. It has projected a significant and hasty increase in rates over the next two years, and raised rates by 0.50% in May - the largest increase since 2000. The Fed is scheduled once again to hike interest rates by 0.50% next Wednesday, but with inflation largely a result of commodity prices and supply bottlenecks, and not the demand for money, the Fed’s efforts may fall short. The cost of money will have to rise considerably higher for the Fed to address a problem that isn’t entirely a monetary policy issue, but one that is partially fiscal in nature and partly driven by supply and demand imbalances. Pressure on risk assets is likely to remain until supply and demand balance returns to the economy, easing inflation and allowing the Fed to halt its rate increases.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request