Elevated Global Reflationary Expectations

Happy New Year. Investors enter 2017 with elevated expectations for higher domestic growth in the U.S. and a modest pick-up in global GDP. Global inflation metrics have recovered as of late in regions such as the Eurozone and China; where deflation and over-capacity concerns lingered respectively. This swing from dis-inflation to reflation has been keeping sentiment and investor positioning negative regarding U.S. Treasuries; with the market pricing in close to a 3% Fed funds rate on a 5-year forward basis. For U.S. equities, expectations for corporate tax cuts, fiscal stimulus and deregulation have lifted earnings expectations; particularly for 2018. After strong post-election performance in cyclical sectors, such as industrials and financials, we currently see better risk-reward opportunities in mega-cap technology and healthcare equities. These sectors are also likely to benefit from repatriation of foreign cash which can boost capital returns in 2017-18. Across our equity portfolio, we retain our preference for companies with leading industry positioning and strong balance sheets. Bigger picture, there are some under appreciated risks for 2017 due to major U.S. policy shifts such as fiscal spending, trade policy and healthcare coverage. The timing and impact of these policy shifts may not live up to the currently high expectations. Global reflation also depends on growth stability in China. Lastly, rising populism and a busy election calendar in Europe may also create volatility episodes; especially at a time when Global Central Banks attempt to normalize their monetary policies and global financial conditions tighten. Excluding financials, we note below that median corporate debt has been on the rise, albeit with heavier fixed rate financing.

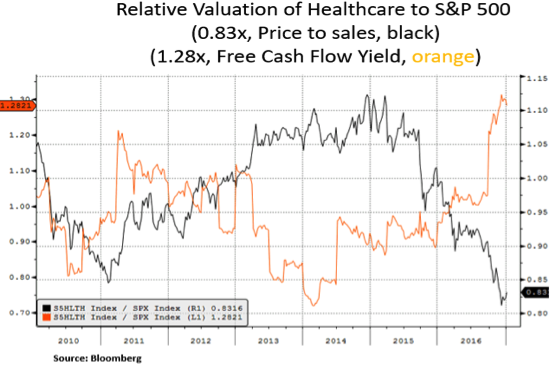

As we can see below, growth oriented equities witnessed deeper outflows after the U.S. election i.e. as investors rotated into domestic growth and high tax rate names that would benefit the most by the new U.S. administration. Yet, this rotation has created a relative opportunity in sectors such as technology that offers exposure to higher growth earnings via exposure to secular themes such as cloud computing, artificial intelligence and e-commerce. Drug pricing headlines have created a better value proposition in the healthcare sector – we favor exposure to select pharmaceuticals due to better growth potential; stemming from global aging demographics and better organic growth from rejuvenated drug pipelines.

Part of the pick-up in U.S. inflation expectations rests on higher wage growth. Applying aggressive fiscal stimulus at a time whereby the unemployment gap is closing can trigger wage inflation due to a lack of supply of skilled labor. As we can see below, per the JOLTS survey, job openings are near record highs. Baby Boomer retirements and a shortage of skilled labor likely explains the unmet labor demand. The Fed is likely to stay on course with its interest rate hike cycle as its inflation targets are met or exceeded. A further rise in bond yields will likely create a buying opportunity across the bond spectrum and in quasi fixed income instruments that have high interest rate sensitivity e.g. utilities, telecoms, REITS and preferred shares.

From a global inflation perspective, the supply/demand balance for oil and petroleum products is likely to be a key determinant by year-end, as non-OPEC ‘shale’ U.S. producers ramp up production. Capital expenditure expectations have risen in the energy sector and the U.S. rig count has started to rebound as oil prices recovered after the recent downcycle. The question is whether OPEC members will fully comply with the agreed Nov production cuts while U.S. oil production rises. This is a risk for global inflation expectations by year end. Global growth recovery also rests on commodity/energy exposed countries such as Brazil and Russia. To some degree, U.S. credit conditions have been recovering in the past months in the U.S. as the energy sector recovered along with energy prices.

Lastly, we note that Chinese currency devaluation is a key deflationary risk. In 2016, China has been successful in implementing supply-side reforms that reduced over-capacity in sectors such as coal and steel. Producer price inflation has finally exited its deflationary state. Yet, after a rapid expansion of the Chinese banking system risks remain. High corporate indebtedness and an overheated housing market are key challenges for Chinese leaders. Trade frictions with the new U.S. administration is also another Chinese challenge for 2017. Currency instability in Asia and an eventual debt deleveraging phase may hamper the Fed’s rate hike plan.

In conclusion, reflationary expectations are currently on the high side. As we enter 2017, we seek to deploy capital opportunistically as several big policy shifts create risks and opportunities. Policy missteps may create buying opportunities in both the fixed income and equity spectrums.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.