Credit Market Constrains Degree of U.S. Fiscal Expansion

Post U.S. election market action can be described by two words – reflationary rotation. Higher growth/inflation expectations drove capital flows into cyclical and out of defensive U.S. equity sectors. For example, industrials and financials outperformed the consumer staples and utilities sectors. The total return (year to date) for U.S. equities is as follows: S&P 500 +10.2%, DOW JONES +13.1% and NASDAQ +7.4%. Perhaps more crucially for global funding costs, the 10 Year Treasury yield rose from 1.85% to 2.39% currently. Moreover, the U.S. Treasury curve steepened and the U.S. dollar exhibited further strength. The latter has been a headwind for emerging market asset performance. We also note that the recent pick-up in U.S. economic data has further fueled Fed interest rate hike expectations. The market is currently pricing in a 2% Fed funds rate on a 2 year forward basis; which is still below the median Fed member long-run projection of 2.8%. In our view, after several years of ‘reaching for yield’ due to Central Bank policies, there is still room for global capital ‘duration’ re-positioning i.e. portfolio adjustments away from interest rate sensitive exposures.

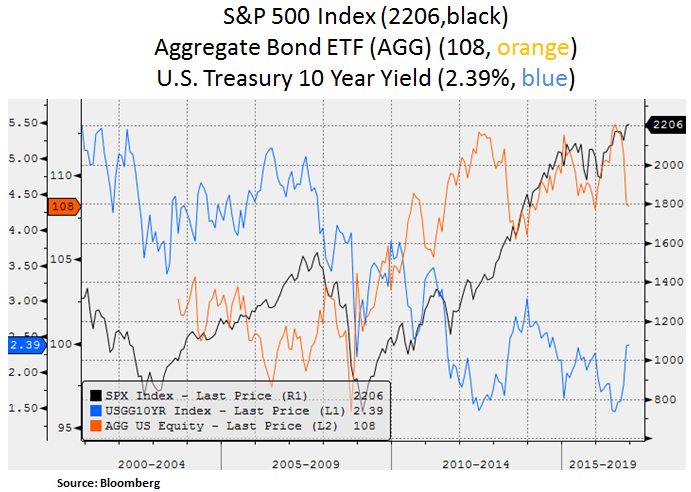

From a U.S. perspective, deregulation, lack of congressional gridlock, tax/healthcare reforms and a pro-business Federal attitude should be beneficial to the real economy, even at a later stage in the business cycle. However, the magnitude of fiscal expansion is constrained by elevated Federal and local government debt levels. The risk of higher borrowing costs and an even stronger USD will likely keep the fiscal hawks in Congress on alert. Therefore, given currently high pro-cyclical expectations, we favor lagging sectors such as tech and healthcare into 2017. We also favor attractively valued U.S. telecoms that sport attractive dividends and which can benefit meaningfully from lower corporate tax rates. As we can see below, U.S. equities have outperformed the broader U.S. bond complex but this decoupling is unlikely to be sustained if the bond market experiences more disruption. Moreover, Fed interest rate hikes are likely to be an uphill battle given domestic and asset price sensitivities to global borrowing costs and the USD as a global funding currency. Therefore, we remain opportunistic as the reflationary re-positioning challenges the bond spectrum and bond proxies such as municipal bonds, REITs and preferred shares that carry longer ‘duration’ profiles.

On the inflation front, we note that inflation expectations have risen; partly due to a recovery in oil prices following the recent OPEC meeting supply cuts and partly due to higher commodity prices and labor costs. After aggressive fiscal stimulus in China, producer price inflation has finally exited its dis-inflationary state. As credit creation continues to outpace underlying economic growth, we still retain our concern about the Chinese banking system and a further weakening of the Chinese currency in 2017. It is plausible that further USD strength and a fading Chinese fiscal stimulus put a lid on global inflation metrics by mid-2017. We also note that U.S. shale oil industry economics have improved materially following the recent energy sector downturn. Lower marginal costs of production suggest that global oil production is economic in the $50-60 range. Over the long-run, range bound oil prices should keep a lid on energy inflation risks. If one considers global aging demographics, low productivity trends and elevated global debt levels, then one should expect base interest rates to remain in a low range vs. their history. As a side note, we continue to favor the technology sector as an agent of productivity growth. Innovative technologies such as cloud computing, deep learning and artificial intelligence will help increase business productivity and thus keep a lid on unit labor costs.

From an earnings perspective, U.S. domestic corporations are the bigger beneficiaries of upcoming tax reform. We note that corporate credit spreads have tightened since the U.S. election outcome. Yet, one of the reasons the market is pricing in 6-7 interest rate hikes in the next 2 years is wage inflation. Fiscal stimulus and a pick-up in investment expenditures will likely create pockets of wage inflation; especially in areas of skilled labor shortages e.g. construction, engineering, oil/gas. Thus, a cyclically tight labor force may be a partial headwind for corporate profits. As non-financial corporate debt has risen in the past few years, the Fed will likely be cautious and avoid overly tight financial conditions.

Lastly, we note that the Fed will likely be very sensitive to the state of the U.S. housing market. Even though supply/demand is fairly favorable for housing prices, rising mortgage costs will likely be an impediment to the next leg in the housing recovery; especially for households with lower credit profiles. Domestic and global financial conditions are likely to dictate the pace of Fed interest rate hikes. Therefore, after years of ultra-easy monetary policy, ‘normalizing’ interest rates will not be an easy task. Thus, we will be on the look-out for opportunities as the Fed may hesitate over the course of its normalizing cycle.

In conclusion, financial markets are currently surfing on a reflationary wave. In our view, concerns about credit market stability will be a pivotal factor in determining the magnitude of the upcoming budget deficit expansion. The incoming administration’s policies towards globalization and protectionism will also be a factor for global trade and business conditions for U.S. multi-nationals. We suspect that Congress will be a check and balance mechanism to the anti-globalization election rhetoric. We remain opportunistic as buying opportunities in large-cap U.S. multinationals arise in 2017 and beyond.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.