Financial Stability Challenges Fed Policy

Major U.S. indices have continued their climb higher, shrugging off everything from a global banking crisis to a 20+% move higher in oil. Much of the move higher in the S&P 500, however, has been powered by a very small number of mega-cap technology stocks. The gains come on the heels of lower interest rates due to concern about recession, and rather than being attracted by solid growth prospects, investors see these companies as offering a safe-haven.

Markets were roiled in March when Silicon Valley Bank (SVB) went under, marking the largest banking collapse in America since Washington Mutual in 2008. SVB’s demise came as they were forced to liquidate long-term U.S. government bonds and agency mortgage-backed securities at a loss in order to pay depositors. This triggered the panic that led to its ultimate downfall as the FDIC was forced to take control. Fear then spread to other banks forcing the FDIC to shut down Signature bank, and a temporary private sector rescue was engineered for First Republic.

The banking sector issues dramatically shifted the backdrop for fixed income markets. In early March, Fed Chair Jerome Powell suggested the central bank might need to raise the Federal Funds rate higher than previously expected to fight inflation. Within days of these comments, the bank failures led to speculation that the Fed will be forced to alter it’s policy in an effort to ensure financial stability. By early March, the 2-Year Treasury Note yield had soared to as high as 5.08% after stronger-than-forecast jobs and inflation readings fueled bets on higher rates, climbing over 100 basis points from its mid-January trough. The bank failures then prompted an explosive flight to bonds that saw the 2-Year yield plunge over 60 basis points in a single session. Given the magnitude of the moves, which were the largest swing in 2-Year yields since 1982, it is no surprise that we saw the MOVE index, a proxy of expected Treasury volatility, climb to its highest level since 2008, more than doubling from the end of January.

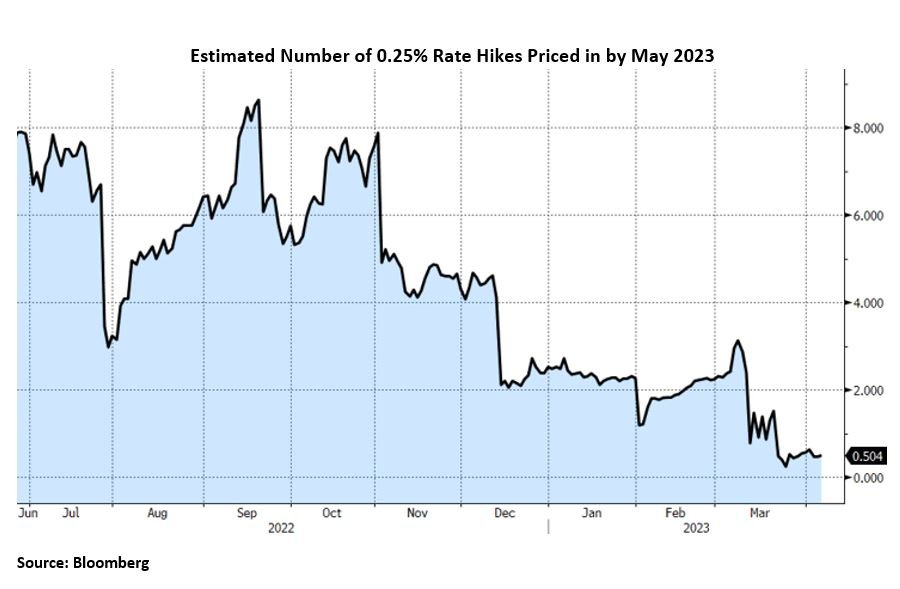

The tumult in banks has complicated monetary policy for the Fed. The FOMC only raised 0.25% in the March 22nd meeting, and the peak of the hiking cycle in the Summary of Economic Projections did not get the upward revision that Powell suggested only shortly before the collapse of SVB. The general message of most major central banks following the turmoil is that high and persistent inflation is still their main concern, but that they are monitoring the risks to financial stability. In times of stress, financial stability concerns often trump the Fed’s two stated mandates of maximum employment and price stability. Powell has suggested that tighter financial conditions could substitute for rate hikes. In order to tame inflation, the Fed wants to increase slack in the labor market to reduce wage and price pressures. However, now that future rate hikes appear off the table, the Fed is relying on credit tightening for the final leg of the cycle, dramatically reducing the probability of a soft landing.

In addition to the strains brought on by the banks, OPEC+ announced a surprise oil production cut of 1.6 million barrels a day on April 2nd, abandoning previous assurances that it would hold supply steady, which poses a new headwind for the global economy. It’s a significant reduction for an already supply-constrained market. Oil futures soared as much as 8% in New York in the wake of the announcement, adding to inflationary pressures that will make the Fed’s job of combating inflation all the more challenging.

The U.S. dollar is currently coming under pressure on market expectations that the Fed could be cutting interest rates by the end of the year. If the Fed is forced to cut rates early, the global economic backdrop is unlikely to be one in which investors have a robust appetite for risk. In that scenario, the USD may find support on safe-haven demand. The U.S. 10-Year note yield is about 74 basis points more than the average of the G-7 counterparts, the tightest spread since 2020.

Within the last week several Fed presidents have reiterated their message about the need to keep raising rates, especially at the May meeting. The market does not believe them however, with the odds of a rate raise currently standing at 50%. The longer the divergence between the markets’ views and the Fed’s views, the more potential for rates markets to continue to be disorderly. The spread between the 10-Year and 3-Month Treasury yield continues to press lower, falling below levels seen during the pandemic, global financial crisis, and tech bubble. The Institute for Supply Management’s gauge of manufacturing activity decreased to 46.3 in March, below the median estimate of 47.5. Readings below 50 indicate contraction. Excluding the pandemic, last month’s reading was the worst since 2009.

Bank turbulence, an oil shock, and slowing growth are poised to present a formidable hurdle for equities in the coming months. The Fed faces extraordinary pressure to balance its policy normalization path with maintaining financial stability. Rates markets have swung wildly and are telling the Fed that they’ll be reversing course far sooner than the Fed is willing to admit. As Jamie Dimon eloquently stated in his 2022 annual letter "interest rates are extraordinarily important—they are the cosmological constant, or the mathematical certainty, that affect all things economic." In such an environment, it is critical to be invested in companies with stable earnings, strong free cash flow, and to have a healthy cash weighting in portfolios to be able to act as markets adjust to the changing rate regime.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product directly or indirectly referenced will be profitable, equal any corresponding indicated historical performance level, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. This content does not serve as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. If you have any questions about the applicability of any content to your individual situation, we encourage you to consult with the professional advisor of your choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request or by selecting “Part 2 Brochures” here.