Higher for Longer

There are several critical catalysts between now and the Federal Reserve’s March 22nd meeting which will be key drivers of market direction. Topping the list are Fed Chair Jerome Powell’s semiannual testimony before congress yesterday and today, the February jobs data release on Friday, followed by the latest CPI figures on Tuesday. In Powell’s testimony to the Senate Banking Committee he struck a more hawkish tone, noting that inflation risks are tilted to the upside, that the labor market remains stubbornly tight, and that policymakers are prepared to increase the pace of rate hikes if warranted. This opened the door to lifting the benchmark rate by a half percentage point at the next meeting if upcoming reports on jobs and prices show little progress in cooling the economy. Powell stated “the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated…if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.” In the wake of these comments, terminal rate expectations gapped higher to 5.6% with the odds of 0.50% rate hikes in the March and May meetings climbing to 50% and 36% respectively.

While the Fed controls short-term interest rates, long-term rates are influenced by broader market conditions. Long rates moved lower between October and February, leading to borrowing costs to ease marginally with the 30-year fixed rate mortgage rate falling to around 6% from 7% last fall. This generates a negative feedback loop where expectations that the economy will falter are holding down long-term rates, which can stimulate activity and prevent the economy from slowing. Long-term Treasury yields have since moved higher as investors become more concerned about inflation and now believe that the Fed will not be cutting rates anytime soon. The inversion of the yield curve has steepened, however, as the front end has moved up along with terminal rate expectations. The spread between 2-and 10-year yields are showing a discount of more that 1% for the first time since 1981, when then Fed Chair Volcker was fighting double-digit inflation. Over the decades, the yield curve inversion indicator has anticipated recessions in the wake of aggressive monetary policy campaigns.

Excess savings has been one of the pillars in the argument for a “soft-landing” or “no-landing” where the economy avoids recession and inflation moderates. It may not be as straight-forward as an elevated savings rate suggests however. Increased reliance on consumer credit suggests many households, likely lower income ones, are already starting to face spending constraints. According to the Washington Post, 20.5 million people are behind on their utility payments, and almost 25 million people are behind on their credit card, auto loan, or personal loan payments - a figure that hasn’t been seen since 2009. Credit card debt has jumped 17% year-over-year. This is not the hallmark of a healthy consumer, and this will only be exacerbated once the labor market finally softens.

More participants are seeking refuge in credit markets. According to EPFR Global, global investment grade credit funds have taken in almost $70 billion in 2023, making it the largest inflow for this part of the year since they stated tracking the data in 2017. This has caused spreads to narrow to historically tight levels suggesting investors are more concerned about absolute yield rather than relative valuation. With rates rising and corporate profits waning, markets seem apathetic to credit risk.

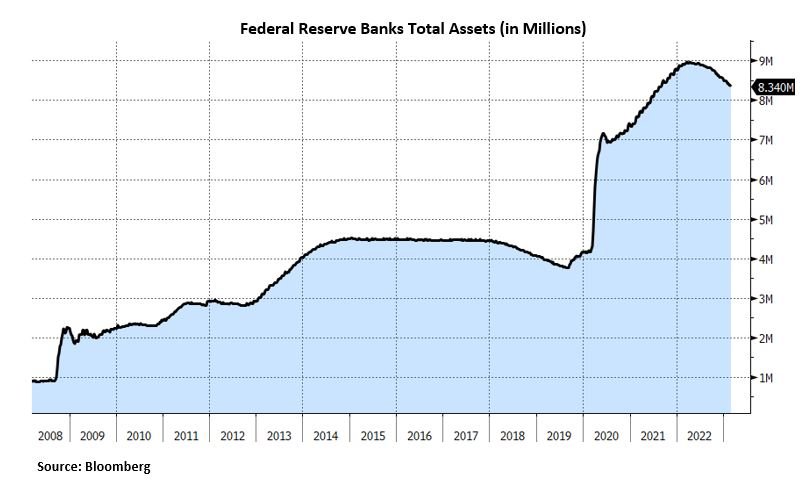

The Fed has been reducing its balance sheet, but it remains twice as large as it was pre-Covid. In the Federal Reserve’s Senior Loan Officer Survey, we see the velocity with which banks are pulling back from lending. So, we have an escalating issue regarding both the cost and access to borrowing, which runs the risk of more dislocation for the economy than markets are currently discounting.

Monetary policy operates with long and varied lags, so we are yet to feel the full effects of the most aggressive tightening in over forty years. Upside surprises in Friday’s payrolls report and Tuesday’s CPI could solidify the Fed ramping back up to a 0.50% hike next Wednesday, with more to come at subsequent meetings. The economy’s resilience to more hikes remains to be seen, but the Fed has made it clear that they continue to favor the risks of over-tightening. As investors, we must recognize these risks and navigate them accordingly.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product directly or indirectly referenced will be profitable, equal any corresponding indicated historical performance level, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. This content does not serve as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. If you have any questions about the applicability of any content to your individual situation, we encourage you to consult with the professional advisor of your choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request or by selecting “Part 2 Brochures” here.