Global growth stability is key for investor sentiment

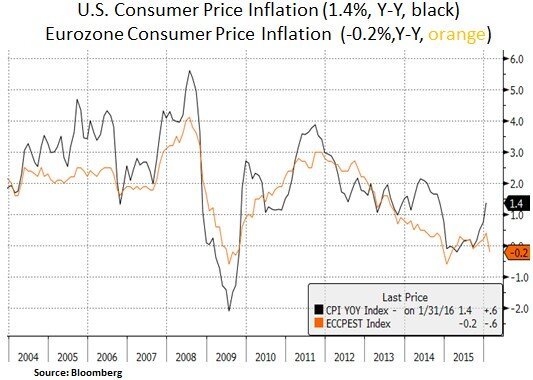

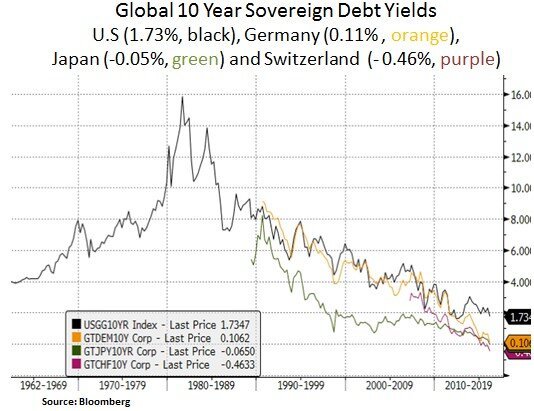

Financial market participants are seeking signs for stabilization in global growth and inflation expectations. Moreover, global credit market stability requires a reduction in oil/commodity price volatility and emerging market currency volatility. Investors are also looking for more dovish signals from Central Banks on their upcoming March meetings. For example, after a negative headline inflation reading (-0.2%, Y-Y) and soft European economic data, investors are anticipating further accommodation by the ECB on March 10th. Some investors expect a reduction in the ECB’s interbank deposit rate from -0.3% to -0.4% and an expansion of monthly asset purchases from the current 60bn EUR pace until Mar 2017. As a result, the 10 year German Bund yield hit an all-time low at 0.10%. On the U.S. front, investors are expecting the Federal Reserve to lower its interest rate hike trajectory on its Mar 15-16th FOMC meeting. From our perspective, we continue to focus on a balanced portfolio of income generation and selective equity themes in the mega-cap U.S. equity spectrum.

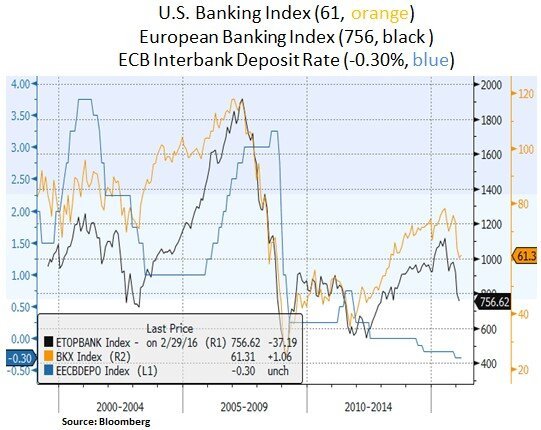

Realistically, Central Bank policies are pushing on a string after years of extraordinary accommodation. In addition, negative interest rates carry risks to credit extension as global banks shift the increased cost on excess reserves to wider loan credit spreads. This is disruptive to credit creation at a time whereby global liquidity has been tightening. We note that the transition to a negative interest rate backdrop (e.g. ECB, Bank of Japan) has increased global bank share price volatility. This elevated volatility is increasing the banking system’s cost of capital. In our view, Central Banks need to be careful as banking instability can be detrimental to credit transmission. We also note below that recent divergence between Eurozone and U.S. growth/inflation data has led to a firming up of the U.S. dollar. U.S. equities have benefited in the past month from stabilization in oil prices and some reduction in U.S. growth uncertainty.

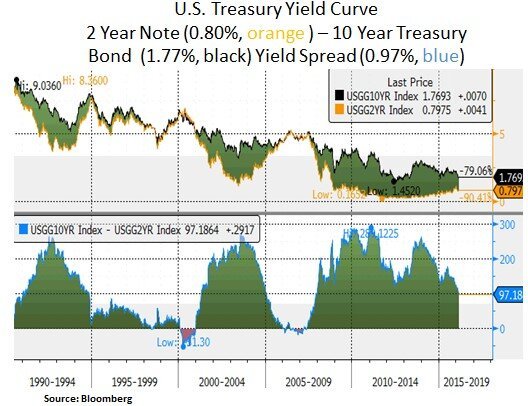

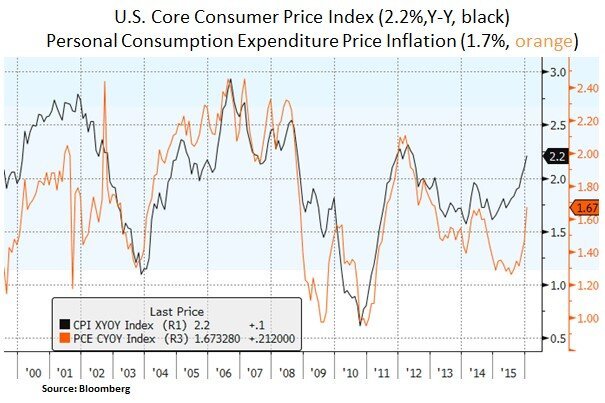

The U.S. Treasury Yield curve has continued to flatten in the past month. Depressed global sovereign yields have increased demand for long-term U.S. Treasury debt. As opposed to European inflation data, U.S. consumer price inflation readings have been firmer. A pick-up in wage, rent and healthcare inflation has been supportive of core inflation metrics. The upcoming U.S. non-farm payroll report on March 4th is likely to give further indications with regard to a firming of wage inflation. In our view, stability in oil prices will be critical in unhinging global deflationary concerns. In addition, stability in the Chinese renmimbi is also an important element. Last night, the PBOC has eased bank reserve requirements which are freeing $107bn in funds for banks to make loans. After facing a cash squeeze due to a sharp rise in money leaving the country, the PBOC has chosen to ease liquidity at the expense of currency stability. In the near-term, credit easing in China is a positive for global growth and U.S. multinationals operating in Asia. Currency stability needs to be safeguarded however. Hence, the Yuan deflationary risk is still in play as rampant Chinese credit expansion gradually winds down. As such, we do not see a material pick-up in global inflation. This backdrop lends support for income generating themes and related financial instruments such as Mortgage Backed Securities (MBS) and large-cap equity dividend growers.

Perhaps the best support for global growth and inflation expectations is a reduction in oil price volatility. A recently agreed freeze in OPEC/Russian supply has led to some stabilization in global oil prices. In the U.S., the oil rig count has reached a level last seen in the late 90s. The recent U.S. earnings season has indicated that Exploration & Production (E&P) companies are cutting their capital investment programs very aggressively for 2016-7 (~40-50%). Incrementally, E&P companies are pointing to a reduction in their oil/gas production. Living within their means is a positive for energy credit market metrics and oil price stability is a positive for investor sentiment i.e. as deflationary concerns wane. Moreover, emerging markets exposed to energy/commodities are likely to see some credit relief. This benefits U.S. multinationals, as emerging market demand finds a footing.

With regard to U.S. equity valuations, after a strong rebound in recent weeks (e.g. +9% from an intra-day low on Feb 11th for the S&P 500) we are likely back to the fair value zone. After a lackluster 2015 earnings/sales backdrop, global growth needs to accelerate if market expectations for a 2016-17 earnings/sales rebound is to materialize. Hence, we continue to be selective with a bias towards mega-cap equities in sectors that have strong balance sheets and more visible earnings outlooks e.g. technology, healthcare and selective industrials.

In conclusion, we continue to assess the global growth and credit market backdrop. In our view, the negative interest rate backdrop is not conducive to the functioning of the global banking system and its credit transmission. We are cautiously optimistic that a gradual rebalancing in sectors that have suffered from overcapacity (e.g. oil/natural gas) will help put a floor to deflationary concerns. From a portfolio perspective, we continue to assess our asset allocation, valuations and stock specific fundamentals.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.