The Federal Reserve faces tightening financial conditions

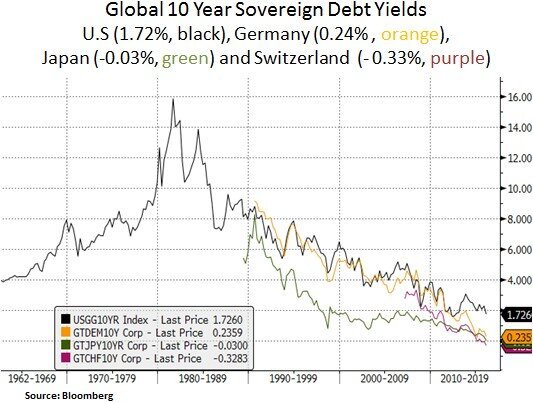

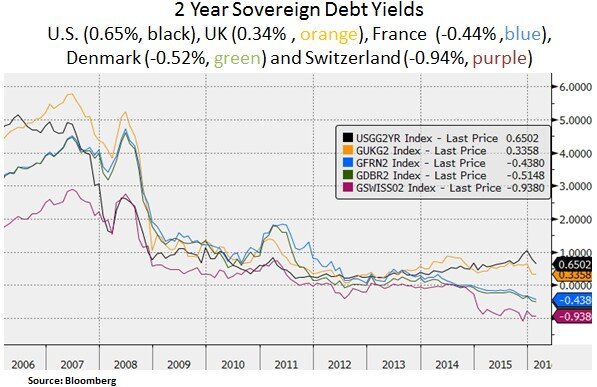

Global financial markets have been experiencing elevated volatility since the beginning of the year. U.S. equity indices such as the S&P 500, NASDAQ and Russell 2000 have declined by 9.5%, 14.9% and 15.0% respectively (year- to-date). European (MSCI Europe) and Japanese (NIKKEI) equity indices have declined by 13.7% and 15.5%. In the past month, sovereign bond yields have had material declines e.g. 10 Yr Treasury (2.12% to 1.73%), German 10 Yr Bund (0.51% to 0.20%) and Japanese 10 Yr Bond (0.22% to -0.03%). Apart from ongoing global growth (2.3% Y-Y growth in Q4) and credit concerns, the decision by the Bank of Japan to adopt negative interest rates on excess banking reserves was a big factor in driving global bond yields lower and even into negative area. We note that close to $7 trillion (or 30%) of the sovereign bond spectrum now has a negative yield. Since the Fed raised interest rates in December financial conditions have tightened. The Fed funds futures market is now pricing in no rate hikes in 2016. From our portfolio perspective, we continue to have a preference for income generating instruments and mega-cap equities with solid balance sheets and more visible cash flow profiles.

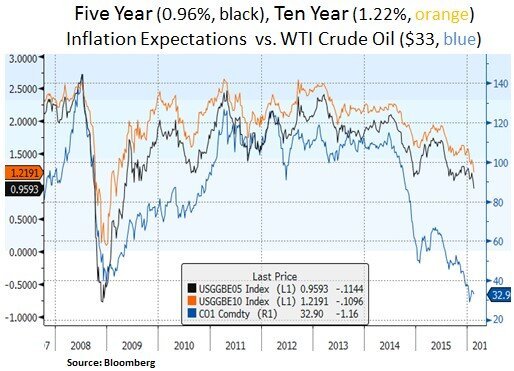

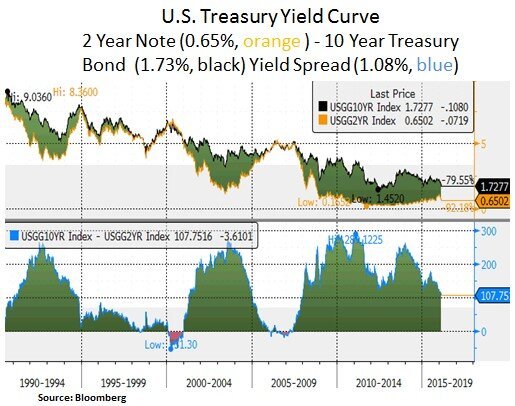

In our view, the Federal Reserve needs to dial back its objective for 12 interest rate hikes by 2018. We note below that implied inflation expectations are at lower levels than when the Fed originally launched its quantitative easing programs. The U.S. yield curve has continued to flatten; thus signaling future growth concerns. In a global context, if the negative interest rate trend continues this will likely bring in more buyers into the U.S. Treasury market; especially as the yield spread is fairly attractive vs. other main bond peers. With such a poor backdrop for savers, demand for sustainable income generation will likely increase.

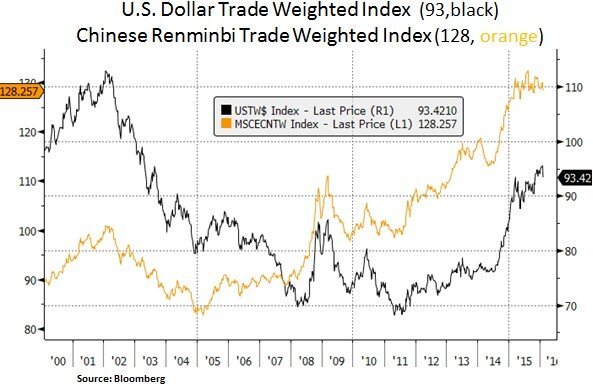

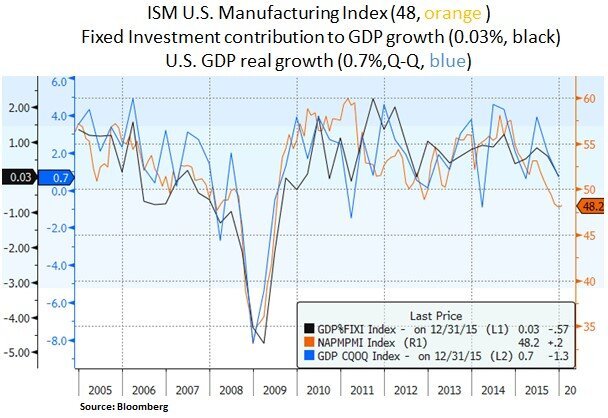

Perhaps two of the key questions for global investors and U.S. corporations are: what are the outlooks for the USD and the Chinese Renminbi. Excessive USD strength has been a deflationary agent and a material issue for U.S. multinationals and the energy/materials/emerging market complex. Given the role of the USD as a global funding currency, we continue to think that the Fed has to at least dial back its tightening plans. A weaker dollar could support U.S. manufacturing (currently in contraction), help stabilize oil prices (and related credit strains) and allow China’s FX to weaken naturally (given the semi-peg to the USD). A weaker dollar could also support inflation expectations. The PBOC has thus far devalued the Renminbi by 8% vs. the USD since 2014. A material Renminbi devaluation could add to deflationary concerns i.e. due to global price wars.

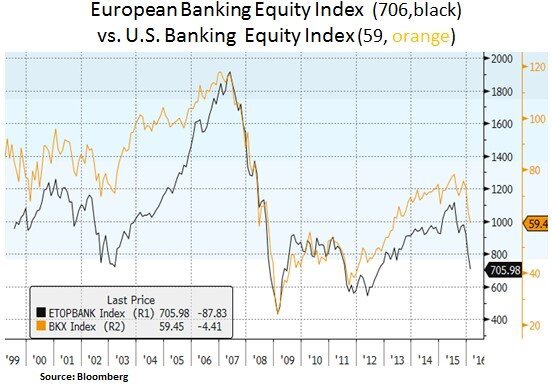

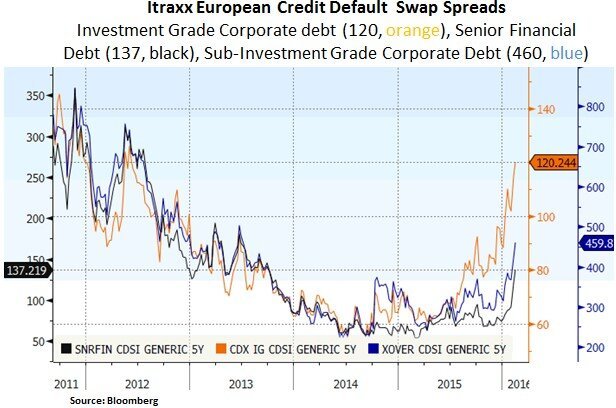

In our view, global investors need three elements for asset price volatility to subside 1. U.S. avoids recession – Fed on hold, 2. China stabilizes its currency/economy/stock market and 3. Commodities/Emerging Markets bottoming. We also note that volatility in the trans-Atlantic banking sector has been on the rise. For European banks in particular (e.g. Credit Suisse, Deutsche Bank) there are calls for further capital increases. Their U.S. peers have stronger balance sheets and higher capital ratios. Moreover, credit default swap costs have been on the rise in the European corporate debt sector. Therefore, we expect global banking jitters to be an additional element for the Fed’s policy route.

Lastly, on a more positive note, the U.S. consumer should continue to enjoy low mortgage costs; particularly as the U.S. 10 Yr Treasury yield may continue to converge towards its global peers. Along with low gasoline prices and wage increases, consumer disposable income should get an additional reprieve; offsetting to a degree rising healthcare and rental costs. U.S. households are at an advanced stage in their balance sheet repair process and most recently the employment to population ratio has been on the rise. Therefore, a more resilient consumer could shield the U.S. economy from a growth scare.

In conclusion, we continue to focus on a balanced portfolio that offers income generation and visible cash flow profiles. We seek to be nimble as cyclical/credit/policy concerns create value opportunities. In our view, in a negative sovereign debt yield backdrop, the Federal Reserve will be forced to converge towards other Central Bank policies; as further USD strength will likely continue to be a headwind to financial conditions, U.S. exports and U.S. multinational earnings. The Fed also needs to lift inflation expectations, especially at a time whereby energy/commodity prices are depressed and global credit strains are on the rise.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.