Low long-run U.S. interest rates likely to persist

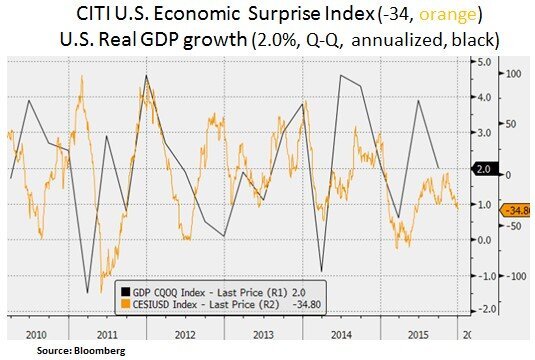

Financial market participants enter 2016 facing a backdrop that still features low global growth and inflation expectations. Developed market sovereign bond yields remain in check e.g. the German 10 year Bund Yield is at 0.50% (down 0.18% in the past month). Despite the Fed’s first interest rate hike (0.25%) since 2006 on Dec 16th, the U.S. 10 Year Treasury yield is at 2.18% (-0.09%, month-month). Moreover, the U.S. Treasury yield curve has been flattening since the Fed’s attempt to get off the zero interest rate policy. The Fed projects rate increases of 1% in 2016. In our view this projection is likely at risk. Despite a very low U.S. unemployment rate of 5.1%, U.S. inflation isn’t just driven by U.S. factors. Global factors are likely to impact the Fed’s decisions in the medium-term. Growing output gaps in emerging markets point to ongoing global deflationary headwinds and global corporate credit spreads are on the rise. In addition, U.S. GDP growth remains relatively uninspiring (~1-1.5% in Q4 2015). Thus, the Fed is likely to tread very carefully in order to avoid a policy reversal. From a portfolio perspective, at this juncture in the market and profit cycle, we are focused on a balanced portfolio that offers sustainable income generation and a margin of safety in terms of valuation.

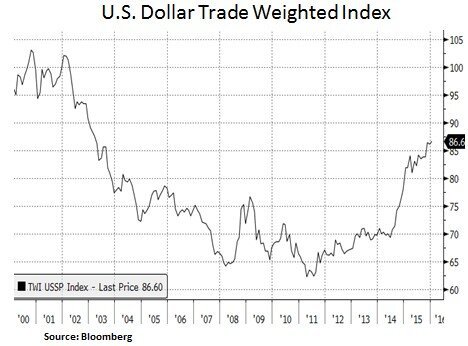

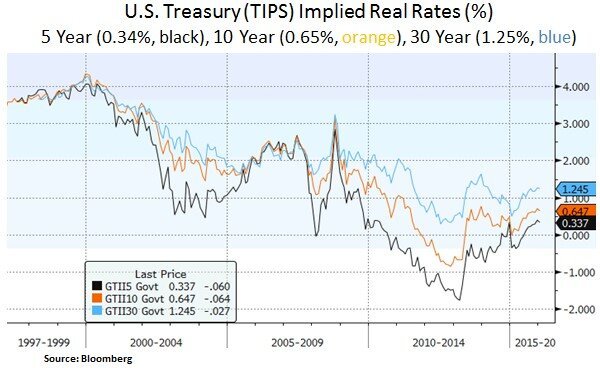

We highlight below two key events that have taken place since 2014 as a result of the Fed’s exit from unconventional monetary measures. The rise of the U.S. dollar vs. main trading partners (e.g. EUR, JPY) and the rise of inflation adjusted or ‘real’ U.S. interest rates. Further increases in these two components are likely to compromise the Fed’s view of a recovery in U.S. inflation (~2%). Coincident measures show a low pace of GDP growth in Q4 2015 (1-1.5%) and the flattening of the U.S. Treasury yield curve is signaling some caution on future growth and inflation expectations. In this context, we still believe that income oriented themes are going to be a key focus for investors in 2016 and beyond. Companies with solid balance sheets and cash flows are likely to be in demand.

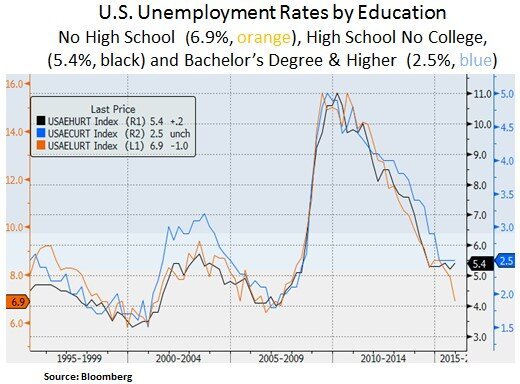

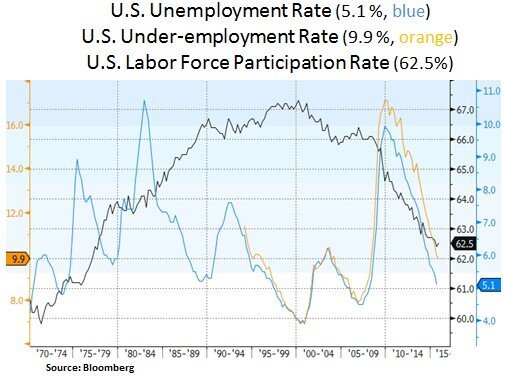

In our view, a one-dimensional focus on the U.S. unemployment rate is misleading. Cyclically, the U.S. labor market is indeed tightening across all major education segments. The labor force should gain some pricing power at this point in the labor market recovery. Yet, the reason we haven’t seen a broad pick-up in core inflation metrics is the fact that the labor force participation rate has exhibited a structural downward move (a function of demographics and skill gaps). It is plausible that the official unemployment rate may hit ~4.5% before this labor cycle is complete. Such a rate or ‘full employment’ may be sustained even with a 100k monthly growth rate in U.S. non-farm payrolls (down from an average of ~200k). Thus, even though we can see pockets of wage inflation, this slow late-cycle expansion of the labor force is likely to be a headwind for overall GDP growth. More critically, we believe investors should be focusing on leading indicators such as corporate credit spreads and the pace of revenue and earnings growth. Most likely, the Fed will be considering broad financial conditions (e.g. asset prices) and external factors (e.g. commodity prices and emerging market growth prospects). Therefore, we look for opportunities in interest sensitive assets as the Fed juxtaposes these domestic and external factors.

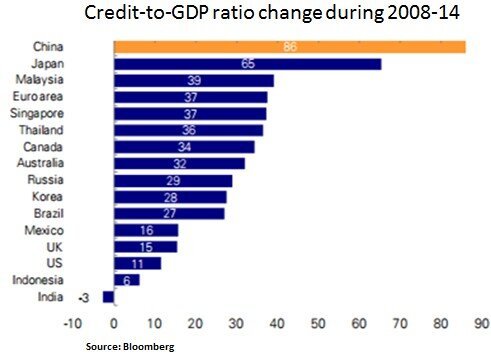

Investors are also focusing on China’s policy response to its growth challenges. As we can see above, deflationary pressures are still an issue for China – particularly as it is dealing with overcapacity issues. After a rapid credit expansion since 2008 (especially at the corporate level), China is seeking ways to cushion the transition from an infrastructure driven to a consumer spending led economy. On a positive note, household and government balance sheets remain in good shape. The challenge is likely to be at the corporate debt level and a potential non-performing loan (NPL) cycle that may weigh on the Chinese banking system. In addition, concerns are on the rise that China will likely devalue its currency – especially after a broad rise vs. main trading partners. The prospect of Chinese currency devaluation will likely create deflationary pressures for export driven competitors, especially within Asia. Broadly speaking, we are still cautious on emerging market assets as credit and pricing pressures may increase.

In conclusion, the above domestic and external factors are likely to be a headwind for the Fed’s policy normalization path. As other Central Banks remain in an easing mode, we don’t believe a material policy divergence by the Fed is realistic – particularly if China gives into the temptation to devalue its currency in order to revive exports. U.S. dollar strength is likely to be an ongoing issue for U.S. manufacturing and U.S. corporate earnings – unless the Fed pares back its interest rate hike projections; which at the moment are more aggressive than market expectations. As these big picture issues play out, we look to deploy capital selectively in financial instruments that generate income and in equities that have strong balance sheets, sustainable cash flows and company specific catalysts.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.