Global credit market stability is key for 2016

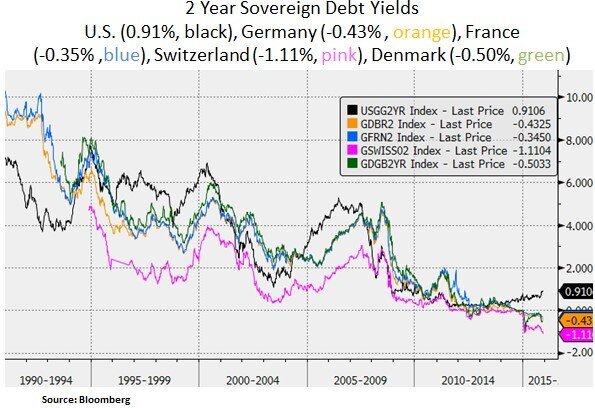

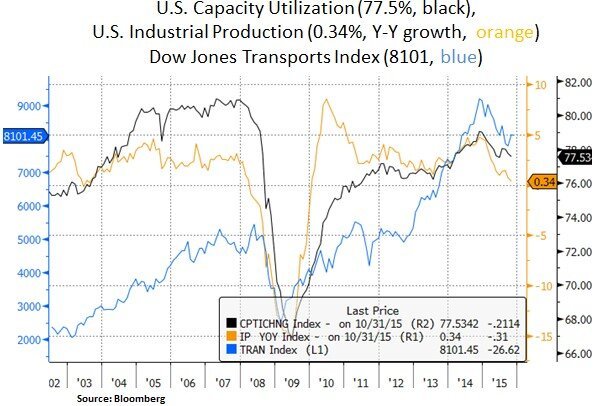

Financial markets are anticipating a policy turning point by the Federal Reserve on Dec 16th as it is poised to raise interest rates for the first time since 2006. At the same time the ECB has signaled further monetary easing on Dec 3rd by cutting its deposit rate by e.g. 0.1% to -0.30% and by increasing its monthly sovereign debt purchases by e.g. 10bn EUR to 70bn EUR/month. This policy divergence has been more evident in the widening of sovereign debt yield spreads of European bonds vs. the Treasury market. For example, the 10 Year Treasury yields 2.15% vs. 0.47% for the 10 Year German Bund. Negative yields persist at the short-end of the European yield curves. As we look into 2016, the question is whether this Fed-ECB policy divergence will persist and whether USD strength vs. other global currencies can be sustained. In the past year, USD strength has been a headwind to U.S. corporate profits, emerging market capital flows and the energy/commodity complex. Moreover, the global carry trade (yield arbitrage with emerging market assets) is being unwound as the USD is no longer a cheap funding currency. Therefore, the global credit market outlook for 2016 and global liquidity conditions depend partly on whether this policy divergence can persist without compromising global growth.

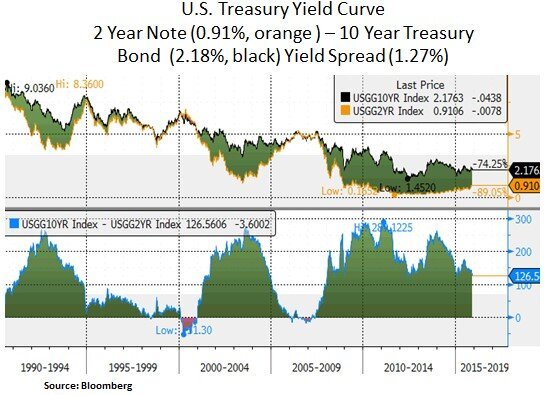

In our view, it is likely that the Fed will take a more gradual and shallower normalization path as excessive USD strength can have a deflationary impact. Thus, we look for opportunities in interest rate sensitive securities and USD sensitive sectors such as energy and large-cap equities with higher international exposure. We doubt that the Fed will be willing to commit to an aggressive tightening path that would compromise the current business and credit cycle. We are keen to see in 2016 whether long-term Treasury yields will signal slower growth/inflation (via a flatter yield curve) as the Fed attempts to exit its ultra-easy policies and real (inflation adjusted) interest rates rise.

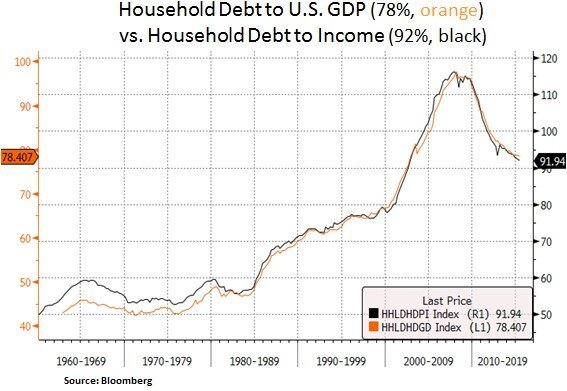

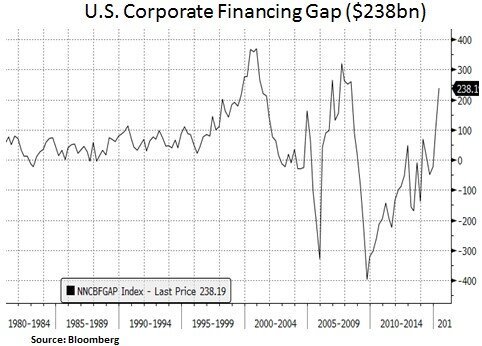

On a more positive note, the U.S. consumer is gradually repairing its balance sheet and should enjoy some wage increases at the later part of the labor cycle. Across the pond, we see more pent-up demand potential from European consumers as the Eurozone unemployment rate is still high (10.7% vs. 5.1% in the U.S.). On the corporate balance sheet side, we like the U.S. debt maturity profile as most companies has refinanced and reprofiled their debt repayment schedules. We expect however the corporate buyback activity to ease somewhat as there is an increasing financing gap developing i.e. corporate outflows are exceeding operating and financing inflows.

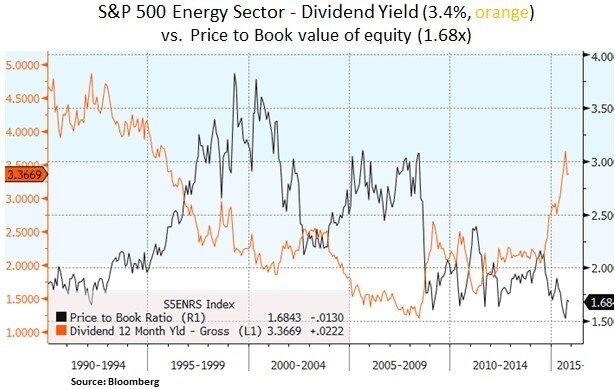

By and large, the U.S. energy sector has been the poster child for negative cash flow profiles by excessive capital spending. As of late however, we note that due to the drop in energy prices, a large number of energy & exploration companies are starting to spend within their means (particularly as credit spreads widened in the sector as profits fell). We retain our preference for mega-cap U.S. equities that have ample balance sheet and cash flow capacity. In a low yield environment, we also lean on consistent dividend growers; for example selective telecom (e.g. AT&T), healthcare (e.g. J&J) and consumer staple names (e.g. P&G).

From an asset allocation perspective, we remain selective in U.S. equities; which in our view are fairly valued. At the sector level, we see value opportunities in energy as valuations have hit multi-decade lows. We expect a gradual improvement in oil supply/demand in 2016 as the sector curtails capital expenditures and uneconomic drilling activity. We also remain constructive on large-cap financials where capital returns are likely to be a positive catalyst to fairly benign valuations. Lastly, we continue to favor large-cap healthcare names that have rich drug pipelines and that benefit from secular growth tailwinds e.g. global aging and increasing life expectancy trends.

In conclusion, we continue to favor a balanced portfolio of income generating instruments and thematic exposures. As the Federal Reserve attempts to normalize its easy monetary policies, we look for value opportunities in interest rate sensitive securities. Lastly, we look for opportunities in internationally exposed securities that have faced foreign currency translation headwinds in 2015.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.