Long road for monetary policy normalization

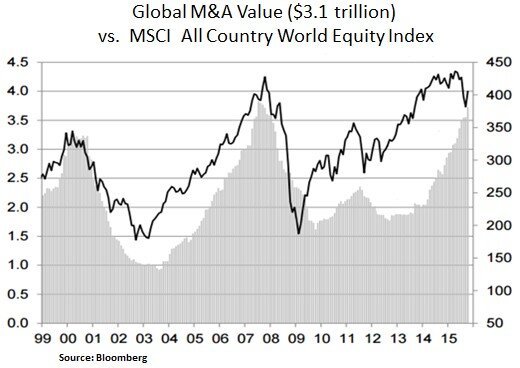

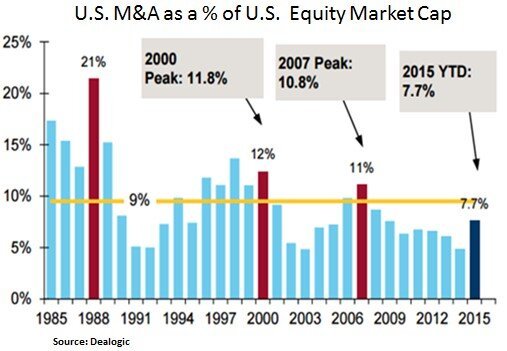

Global investor sentiment and equity prices recovered in October, on the back of further accommodation promises by Chinese and European Central Banks. Moreover, the Federal Reserve downplayed in its Oct 28th FOMC meeting Chinese and global growth concerns; reversing its September meeting cautiousness and re-introducing the prospect for a December interest rate hike. As such, U.S. Treasury yields rose e.g. the 10 Year Treasury yield now stands at 2.21% (21 basis points rise for the month). In addition, resilient M&A activity and an improvement in corporate credit spreads contributed to risk sentiment. We note that U.S. equity benchmarks such as the S&P 500 rose 8.2% in October. From our perspective, we continue to be selective with a preference for sectors that offer earnings visibility e.g. healthcare and attractive value opportunities e.g. energy, financials. We also maintain our focus for income generation via short duration fixed income instruments (non-agency MBS), equity dividend growers and quasi fixed income instruments.

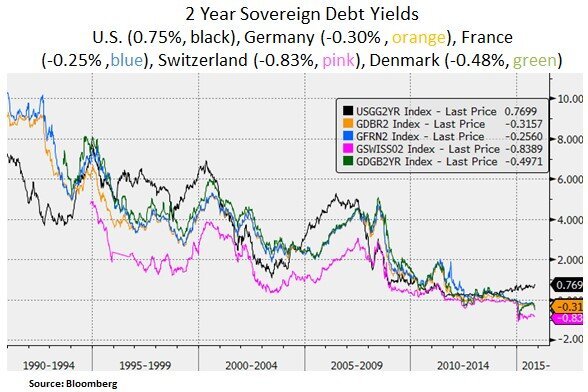

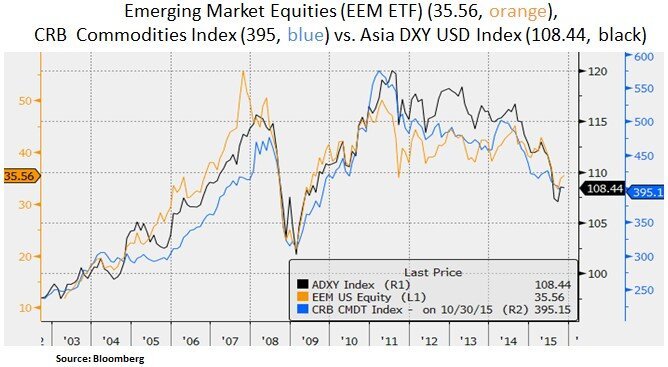

Looking into 2016, we are keen to see if the Fed will be successful in engineering a policy divergence from other Central Banks; especially as a stronger USD can weigh on global liquidity and credit conditions. Thus, we expect an elongated and shallow normalization path for the Fed, especially at a time whereby China is embarking on a forceful monetary easing path and the ECB is still focusing on negative interest rates as a policy tool to lift inflation expectations in the Eurozone.

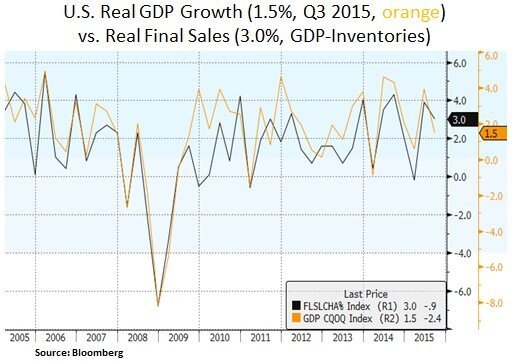

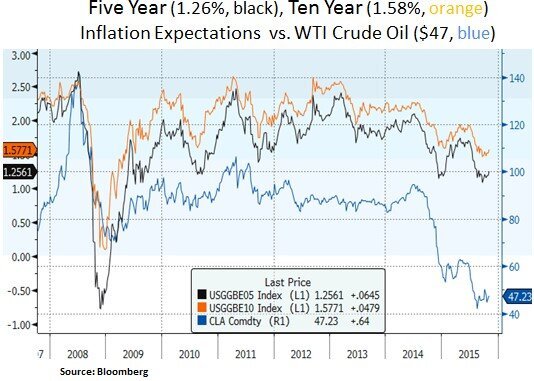

Given the Fed’s language shift in October, the market will likely scrutinize U.S. data such as the labor market report on Nov. 6th (especially as the Sept and Aug reports were sub-par). On the underlying growth front, the Q3 GDP report came in at 1.5% Q-Q annualized growth rate as an inventory overhang weighed. Yet, real final sales still indicate a stable demand backdrop. The ISM manufacturing report continued to show softness with a weak employment component. However, new orders indicated some green shoots in U.S. manufacturing. In our view, the Fed has to be careful not to compromise growth at this stage in the business and profit cycle. As we can see below, inflation expectations are still undershooting the Fed’s 2% target. We also note that subdued U.S. productivity growth is an ongoing point of discussion in the economist community i.e. whether low productivity growth will continue to be a structural drag on trend GDP growth rate. Therefore, given this mixed domestic outlook, we expect an elongated Fed policy normalization path. The market is assigning a 50/50 chance for a December interest rate hike.

In our view, the energy sector could potentially be a swing factor in 2016 for global inflation expectations and underlying growth in commodity exposed countries (especially Canada and challenged emerging markets e.g. Russia, Brazil and Mexico). We note that the fiscal outlook is on the decline for Saudi Arabia (now a 20% budget deficit). The IMF is expecting the country to deplete its foreign exchange reserves ($660bn) in the next 5 years. Saudi sovereign debt insurance costs have risen recently. S&P lowered its credit rating to A+ from AA- for Saudi debt. It is plausible that Saudi Arabia will modify its oil supply output in an attempt to stem this fiscal deterioration. As such, this could be a market surprise as we head into 2016. With depressed sentiment, attractive valuations & dividends and cautious market positioning; we maintain our positive bias towards the energy sector. Energy and production companies have already shelved +$200bn in capital expenditures and have been becoming leaner via labor cuts. This has been alleviating cash flow and credit pressures.

In conclusion, we currently see the potential for a policy divergence by the Fed which will likely cause frictions in global asset prices, bond yields and FX prices. As such, we remain nimble as opportunities arise. We continue to focus on selective sector exposures and bottoms-up valuations.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.