Easing expectations for a 2015 Fed rate hike

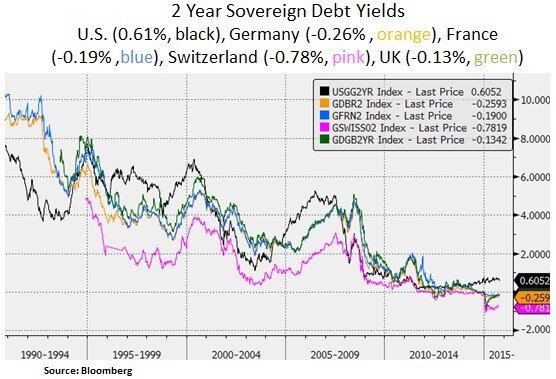

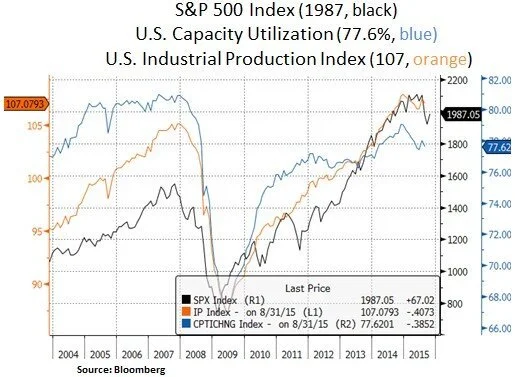

Financial markets continue to gauge the moderating outlook for global growth, inflation and the consequent global policymaker path. Soft inflation data in the Eurozone and Japan have led to market expectations for further quantitative easing measures by the ECB and the Bank of Japan. In the U.S., underwhelming labor market data on Oct 2nd for September (142k vs. 200k non-farm payroll) and August (-37k downward payroll revision) contributed to easing expectations for interest rate hikes by the Fed in 2015. As such, Treasury yields at the front-end of the yield curve declined e.g. the 2 Year note yield declined from 0.7% to 0.6%. Moreover, U.S. equities experienced one of the biggest reversals in 4 years on Oct 2nd (e.g. the S&P 500 rose 3% to 1951 from an intraday low of 1893). As discussed in recent articles, the Fed and other Central Banks face a number of constraints to normalizing their easy policies. Central Bank (CB) credibility is currently being questioned as despite very low interest rates (and substantial CB balance sheet expansions) global inflation remains subdued.

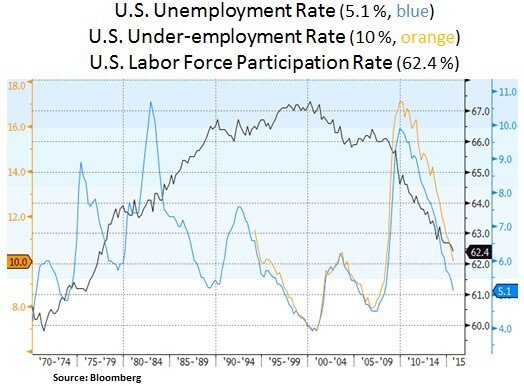

From an investment perspective, a ‘lower for longer’ interest rate backdrop maintains the high demand for income generating instruments (e.g. non-agency MBS, preferred shares) and equity instruments that offer more visible cash flow profiles. A subpar labor force expansion is likely to ease the urgency for meaningful Fed rate hikes. With labor force participation hitting a low last seen in 1977 and an increasing skills-gap issue (i.e. job openings outpacing hires), it’s unlikely that broad demand driven inflation will be an issue. On the contrary, negative short-term yielding notes and low long-term sovereign bond yields signal low inflation expectations.

One key driver for global risk assets and emerging market credit conditions is the outlook for the U.S. dollar (due to its global reserve currency and funding status). For 2015, a stronger USD has been a headwind for U.S. corporate earnings (mainly impacting energy, materials and internationally exposed equities). As it pertains to the Fed’s inflation mandate, a strong dollar is a deflationary headwind because it contributes to imported global deflation (e.g. via lower oil and global goods prices).

Despite ample money supply growth, global inflation metrics remain very low and the recent widening of corporate credit spreads should be a yellow flag for the Fed. As we move towards the later part of the current profit and business cycle, the Fed is likely to exercise further caution; especially if financial and credit conditions become less favorable.

At a minimum, a pause to the USD’s recent strong momentum is likely to alleviate some of the energy/commodity and Emerging Market credit pressures. At the sector level, we remain constructive on the outlook for the energy sector as supply/demand of oil/gas gradually gets rebalanced. Moreover, large-cap healthcare and technology names with international sales exposures are also likely to face better earnings and sales profiles in 2016 as FX volatility gradually eases. Clearly, a softening of the Fed’s policy normalization language is key to this scenario. Better visibility from China’s upcoming 5 year growth plan in mid-October may also improve corporate sentiment and support capital spending plans into 2016.

In conclusion, we continue to witness ongoing expectations for policy accommodation and reflation policies as global growth and inflation get rebalanced. After a severe financial crisis in 2009 and a healthy recovery in asset prices, we still see pent-up demand as consumers repair their balance sheets in the U.S. and Europe. The latter consumers likely offer more pent-up demand potential as Eurozone unemployment is still high (i.e. 11% vs. 5.1% in the U.S.). In addition, European equities should gradually benefit from M&A and share buyback activity. Broadly speaking, we view U.S. equities as fairly valued. As such, we remain highly selective and nimble as stock picking opportunities arise.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.