Constraints to the Fed's exit strategy

Financial markets have witnessed elevated volatility in the past month, primarily due to Chinese and global growth concerns. Uncertainty over Chinese capital outflows and risks associated with a potential Chinese currency devaluation also weighed on investor sentiment. For example, both the S&P 500 and the Dow Jones indices declined by ~11% in August. After recovering some of their recent declines, year to date total returns currently stand at -2.8% and -5.6% for the S&P 500 and the Dow Jones respectively. With regard to Fed policy, notable institutions such as the IMF and the World Bank have warned against a Fed interest rate hike in the medium-term; due to uncertainty over global growth. In our view, as the U.S. business cycle and the labor market are maturing, zero interest rates are hard to justify. However, soft global growth, subdued inflation expectations, elevated global debt levels and a strong U.S. dollar are constraints to the Fed’s policy normalization path.

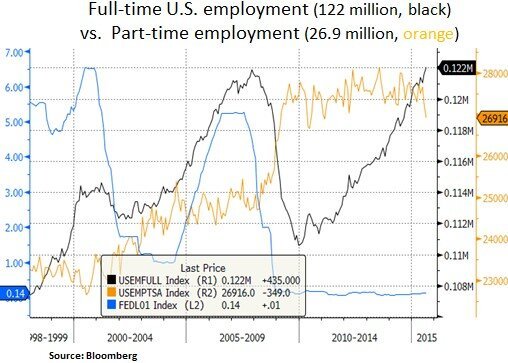

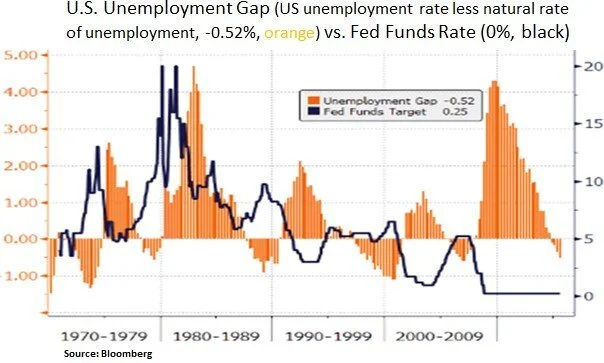

The most recent U.S. labor report indicated that the unemployment rate hit a post-recession low of 5.1%. Wage inflation was firm at 2.2%. As the labor market is getting cyclically and structurally tighter, the Fed’s employment mandate appears to be fulfilled. In inflation adjusted terms, we note that real interest rates have already been on the rise. After the aforementioned asset price volatility, recent financial conditions metrics have become somewhat tighter. Perhaps the main sticking point for the Fed is low broader inflation expectations; mainly due to subdued commodity and energy prices.

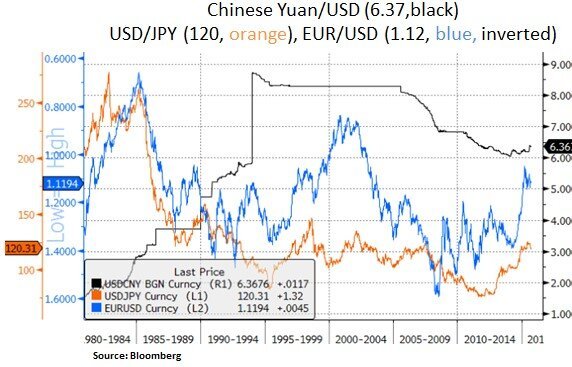

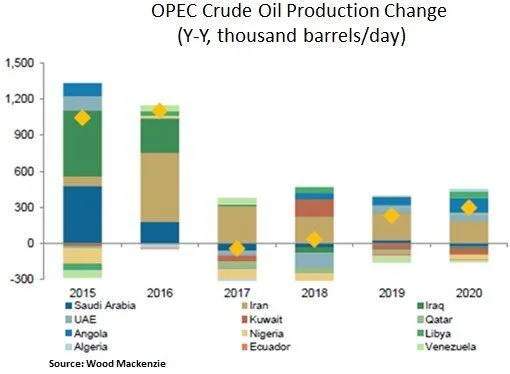

After a multi-year increase in global foreign currency reserves to $12 trillion (e.g. U.S. Treasurys and other developed market sovereign debt) the Fed will have to take a measured and gradual approach in its exit strategy. As we can see below, China has been paring down its FX reserve balance in an attempt to stem a steep decline in its currency. The unexpected devaluation of the Yuan by the PBOC on Aug 11th stoked market concerns of a Chinese hard landing and raised the concern of Emerging Market capital outflows. As a result, Emerging Market currencies and EM equity prices came under pressure. In our view, apart from Chinese reform measures, a supply/demand rebalancing in crude oil markets is likely to be a key swing factor for a number of emerging and developed countries that have been impacted by excess crude supply. A gradual recovery in oil prices is likely to lead to a more stable credit backdrop (e.g. tighter credit spreads for the energy sector and at the sovereign debt level for energy exporting countries i.e. Canada, Mexico et al.). Therefore, global external factors are likely to influence the Fed’s exit strategy; especially as China may further pare down its Treasury holdings.

Lastly, we highlight below some of the divergences between U.S. Treasury and European sovereign bond yields. The 10 Year German Bund is currently yielding 0.69% vs. 2.23% for the 10 Year Treasury. The ECB recently hinted that they will be increasing their quantitative easing program by buying higher proportions of each euro area member’s debt (limit raised to 33% from 25%). The front-end of the sovereign debt yield curves may be more impacted by the Fed’s normalization intentions; particularly as certain 2 year notes in Europe have negative yields. As such, we envision a more gradual rise in U.S. interest rates as we don’t believe the Fed would like to contribute to a rising global yield backdrop that would tighten global financial conditions. Moreover, we don’t think the Fed would like to undermine U.S. consumer confidence; which is still a key driver behind U.S. growth and big-ticket purchases such as housing and autos.

In conclusion, from our portfolio perspective, we remain nimble as value opportunities arise. We currently see favorable risk-reward profiles in the energy, financials sectors and selective technology, healthcare and late-cycle industrials names. We retain our balanced focus between income generating instruments and thematic exposures in U.S. and European equities.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.