Central Bank Reflation Policies Likely To Continue

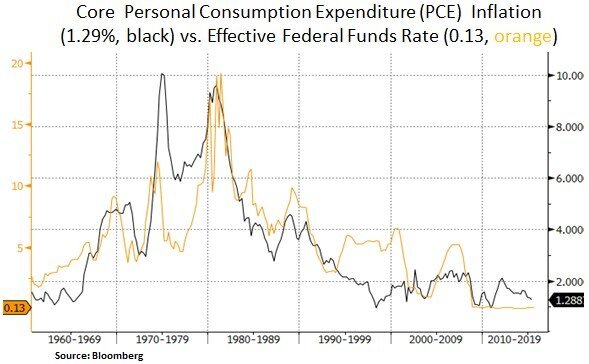

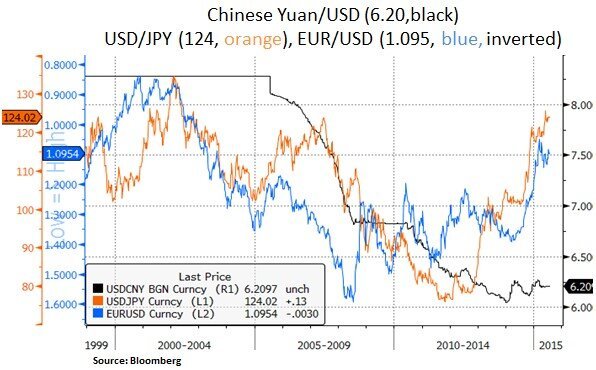

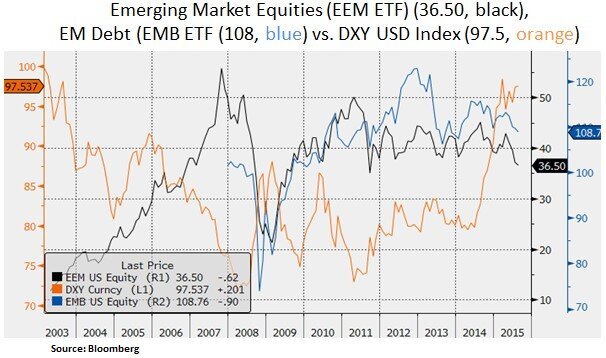

Financial markets are navigating a global backdrop that continues to feature deflationary undertones. Fundamentally, slower growth in China and a stronger U.S. dollar have weighed directly on energy and the broader commodity/metals complex. Lower global growth and inflation expectations have been reflected by recent price action in long-term government bonds. For example, the 30 Year Treasury yield has declined by 0.31% in the past month to 2.88%. On the policy front, in the past year, FX and government bond markets have been pricing in a policy divergence between the Federal Reserve and its global peers. Expectations for a Fed interest rate hiking cycle and capital outflows in emerging markets have kept strong demand for U.S. dollars. In our view, subdued inflation expectations are likely to keep global Central Banks in an accommodative stance.

Given the USD’s role as the global reserve currency, we expect the Fed to take into account the tightening of global financial conditions due to currency effects. Simply put, USD strength is deflationary. Excessive USD strength is a headwind for U.S. exports, the U.S. energy sector, corporate earnings and to a large degree emerging markets (due to USD denominated debt). We are not proponents of a U.S. zero interest rate environment as it leads to distortions and unintended consequences over the long-run. However, we question the extent of a tightening cycle by the Federal Reserve. We note that in past occasions when TIPS implied inflation expectations dropped below 1.5% (5 Year TIPS note), the Fed was actually launching its quantitative easing programs.

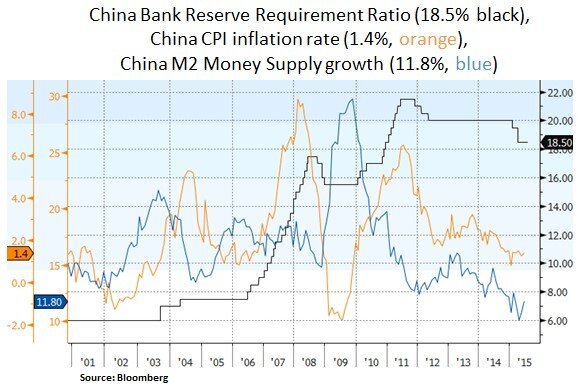

One of the current FX market debates is the outlook for the Chinese Yuan. The question is whether China will be tempted to devalue its currency or whether it will abandon at some point its peg to the USD (and other main currencies). Such a prospect would be another deflationary headwind for global trade as China would turn from a main customer to a competitor via its cheaper currency. Yet, China is currently aiming to achieve global reserve currency status for the yuan. An IMF decision is expected by year end. Given its quest for reserve currency status, China is more likely to ease banking capital restrictions (via reserve requirement ratio cuts) as a way to avoid a credit crunch and as a cushion to the transition from investment to a consumer led economy.

As the global economy seeks demand engines, we expect the Fed to balance external risks along with domestic demand drivers. The outlook for U.S. consumer spending in particular has to be safeguarded. Given the advanced stage in the household balance sheet repair, we remain constructive on the U.S. housing market recovery. In addition, given the relatively tight housing supply/demand balance, we expect related consumption expenditures to be additive to GDP growth. Thus, we doubt that the Fed would be willing to jeopardize this domestic demand engine via an aggressive interest rate hiking cycle.

In conclusion, as long as global inflation and growth expectations remain challenged, we expect reflation efforts by the majority of Central Banks to continue. The Federal Reserve in particular has to balance external risks, USD strength and domestic demand factors as it proceeds with its efforts to normalize its monetary policy. As such, we expect a rather elongated normalization cycle by the Fed. From our portfolio perspective, we retain our preference for a balanced mix of income generating instruments and selective exposure to sectors with better earnings profiles e.g. healthcare, technology and financials.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.