Is the Federal Reserve at a Crossroads?

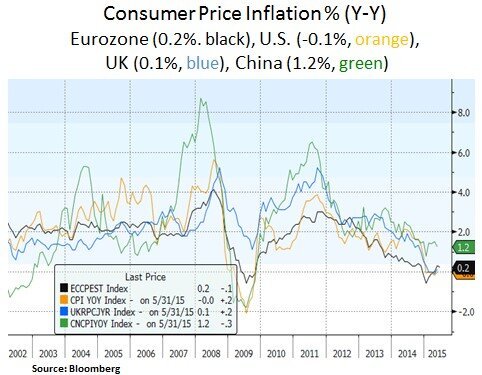

Financial markets are currently facing a backdrop that features political uncertainty in the Eurozone (due to Greek exit fears), market jitters in Chinese equities and an uneven global growth landscape. These external factors are taking place at a time whereby the Federal Reserve seeks to normalize its monetary policy i.e. after six years of zero interest rates and a $4.5 trillion balance sheet. At this stage in the U.S. asset and labor market cycle, there are valid reasons for the Fed to normalize its policy interest rates; albeit at a more gradual pace as GDP growth (~2% run rate) and inflation are at sub-par levels from a historical perspective. The question is whether global deflationary headwinds will influence the timing and the extent of the Fed’s interest rate hike trajectory. Market expectations call for at least one interest hike in 2015 (either in September or December). Given the Fed’s influence on global liquidity, via the cost of U.S. dollar denominated debt funding, we suspect the Fed may be careful in avoiding a policy mistake; at least on a tactical basis. We note that the 10 Year U.S. Treasury yield has declined by 0.20% to 2.20% in the past month.

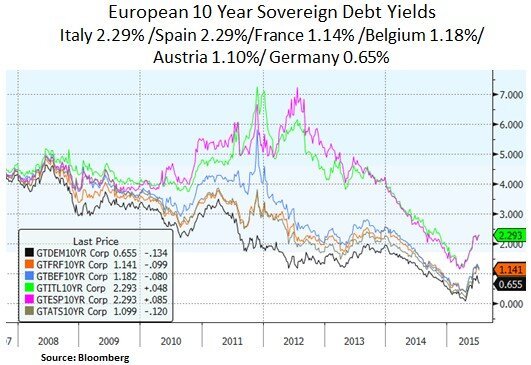

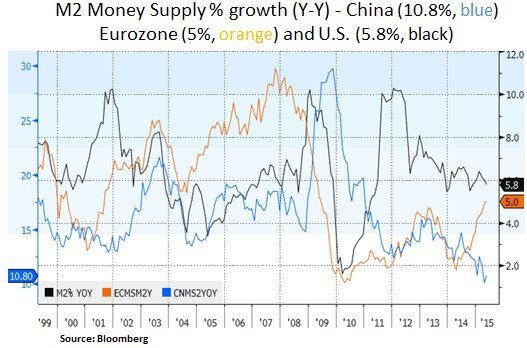

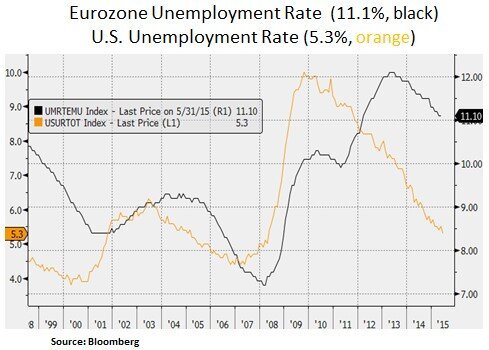

Following the recent Greek referendum outcome against an austerity defined bail-out plan, the Eurozone finds itself at a political impasse. With a Greek banking system and an economy under severe duress, a sustainable solution needs to be achieved with regard to the Greek debt load (~185% debt/GDP). The IMF suggested that at least a 30% debt/GDP debt write-off may be necessary. On a more positive perspective, the current uncertainty will likely keep the ECB even more committed to its quantitative easing program (60bn EUR monthly sovereign debt purchases). We are cautiously optimistic that the current European recovery is still in its early stages. Money supply is expanding at a 5% pace and there is pent-up consumer and business demand across the Eurozone; due to high unemployment rates and fiscal austerity.

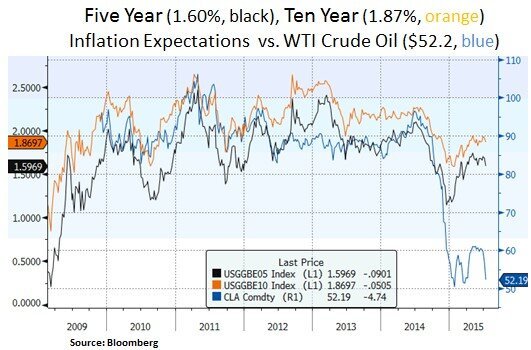

With regard to U.S. inflation, we note that the recent decline in oil prices has dampened TIPS implied inflation expectations. As we can see above, the global inflation backdrop remains fairly subdued. Apart from U.S. wage inflation, the Fed is likely to consider the global big picture on inflation. In our view, the Fed is well aware that apart from soft global aggregate demand, strength in the U.S. dollar acts as a deflationary agent i.e. as commodities/energy trade in USD and emerging markets issue USD denominated debt. Therefore, after six years of an ultra-accommodative stance, the Fed has the tricky task of balancing external and domestic factors as it attempts to fine tune its exit strategy.

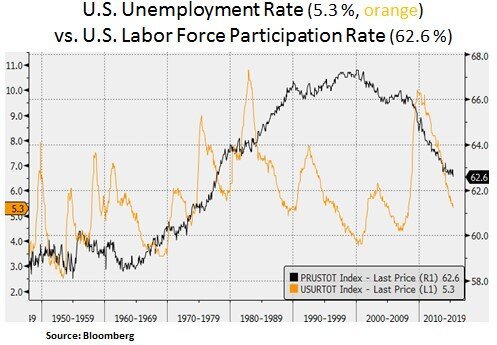

On the U.S. labor front, the June U.S. non-farm payroll report indicated muted wage inflation (2.0%). Despite a 5.3% unemployment rate, the labor force participation rate declined to a level (62.6%) last seen in 1977. Unemployment rates by education levels indicate that cyclically the labor market recovery is at an advanced stage. Due to the 2.5% unemployment rate for college educated professionals, most likely we’ll witness wage inflation for highly skilled professions. Moreover, when we look at labor force participation by age groups, the decline in the 25-34 years cohort probably indicates a skills mismatch in the labor market. This can explain why in the past 15 years participation has been increasing in the 55-64 age group, which most likely carries a better skill-set. In a consumer driven economy (72% of GDP), we need higher labor force participation rates in order to drive more robust consumer spending; and thus higher GDP and inflation growth rates. Hence, partly due to these domestic structural issues, we maintain the view that the Fed’s interest rate normalization will be more gradual and not on a pre-set course.

In conclusion, the above discussion calls for a balanced portfolio of income generating instruments and selective growth oriented themes e.g. in healthcare and technology. With regard to Fed policy, it is plausible that the Fed has to balance external and domestic factors in setting its policy normalization trajectory. Moreover, in the medium-term, a relatively benign interest rate backdrop bodes well for the ongoing U.S. housing recovery and household formation. Lastly, from a global perspective, Central Banks are likely to remain accommodative as they attempt to promote growth in the Eurozone and assist China’s economic model transition to a consumer spending driven economy.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.