Uneven Late Cycle Backdrop

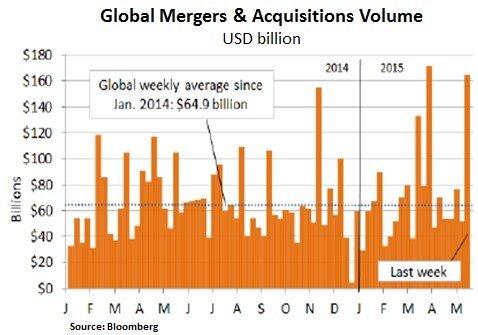

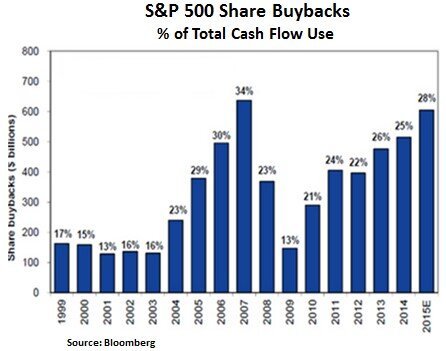

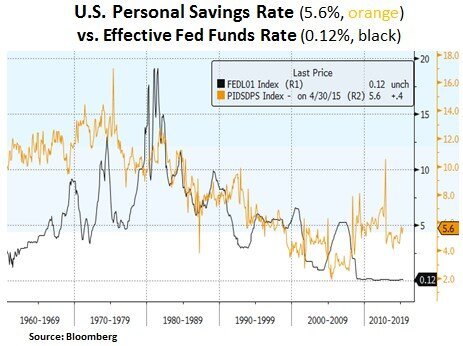

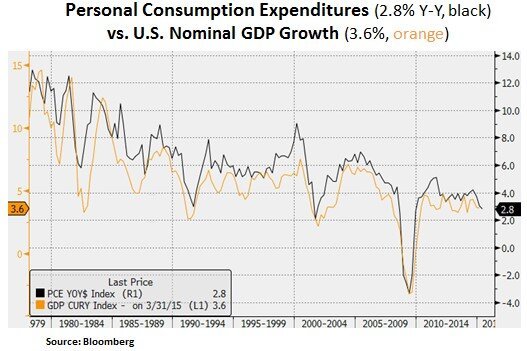

Financial market participants are witnessing increasing late market cycle signals, such as elevated M&A and share buyback activity by U.S. corporations. Cyclically, six years into the economic recovery, measures such as the U.S. unemployment rate (5.4%) and the current level of U.S. industrial production, also indicate a late-cycle setting. Yet, trend GDP growth in the U.S. (~2%) and globally (~3%) appears to be subpar by historical standards. Structural headwinds such as aging demographics, excess global capacity and elevated debt levels are often cited as causes of the shift down in trend growth and inflation. The U.S. consumer is also exhibiting conservative spending patterns. Given this uneven growth backdrop, global Central Banks continue to be very accommodative and the Federal Reserve is still in the early innings of its monetary tightening cycle. Therefore, there may be limits to the expected U.S. interest rate adjustment. As such, we seek to be opportunistic as there may be a mismatch between perception and reality on the extent of Fed policy tightening.

In the near-term, investors are looking for a resolution to the ongoing funding impasse between Greece and its creditors (IMF, EU, ECB). With Greek bank deposits reaching a new low (EUR 134bn from EUR 250bn in 2009) and pension payments accounting for 16% of GDP, pressure is increasing on the Greek government to compromise on its election promises; that negate a set of structural reforms e.g. pension eligibility. In addition, the Greek banking system is increasingly reliant on ECB funding; which now accounts for 29% of monetary financial institution (MFI) assets. Greece is facing a fairly demanding debt redemption schedule. Long-term debt sustainability is clearly an issue (at 175% debt/GDP) but we are hopeful that European bank balance sheet repair and recent credit expansion can ultimately withstand any Greek induced market jitters. As we can see below, Eurozone money supply has shown promising growth (+5% Y-Y) on the back of suppressed borrowing costs; largely as a result of the ECB’s quantitative easing program.

On the U.S. corporate front, CEOs are continuing to seek further returns to shareholders by engaging in industry consolidations. The overall value of deals in US-bound mergers and acquisitions activity amounted to $243bn in May compared to $226bn during the same month in 2007 and $213bn in January 2000. Notable deals include the $79bn takeover of Time Warner Cable by Charter Communications and the $37bn purchase of Broadcom by Avago in the semiconductor space. We also note that there has been more than $100bn of corporate bond issuance every month for the past four months as treasurers lock in cheap, longer-term funding ahead of an expected interest rate rise by the Federal Reserve. In our view, elevated M&A activity, share buybacks and corporate re-leveraging are late-cycle signs. Yet, as we noted earlier, this is a somewhat unusual cycle as the Fed is still in the early innings of its policy tightening and underlying U.S. growth fundamentals face cyclical and structural headwinds.

As we can see below, there is still some cyclical ambiguity in the U.S., even after certain idiosyncratic factors in Q1 of 2015 which led growth to -0.7%. It appears that USD headwinds, disruption in the energy sector and a cautious consumer are holding growth back. We note that the U.S. savings rate is ticking up.

On a more positive note, income growth is picking up and we believe it will improve household finances up and down the income distribution. In addition, households have progressed with their balance sheet repair. Given the subdued level of inventory in the housing market and the low historical level in home ownership, we remain constructive on household formation and a pick-up in housing related consumer expenditures.

In conclusion, we see signs of late-cycle corporate behavior e.g. elevated M&A and share buybacks. However, we do not see late cycle signs of rampant economic growth and price inflation due to cyclical and structural headwinds. Moreover, the Fed is still in the early innings of its monetary tightening. From a portfolio perspective, we continue to favor secular growth themes, income generating instruments and micro driven stock picks.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.