US Inflation Expectations Are On The Mend

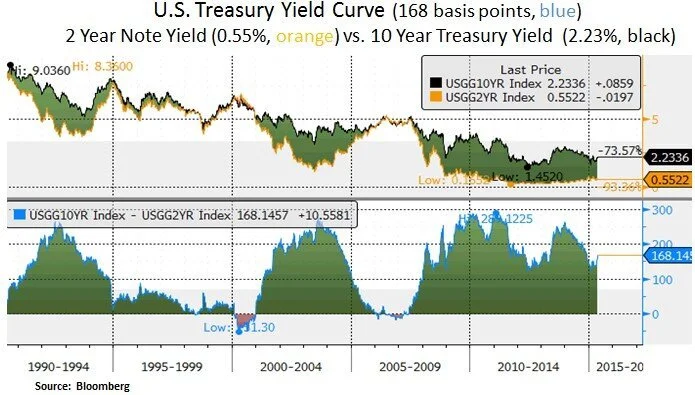

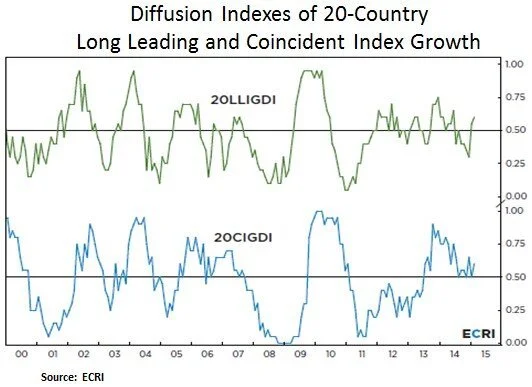

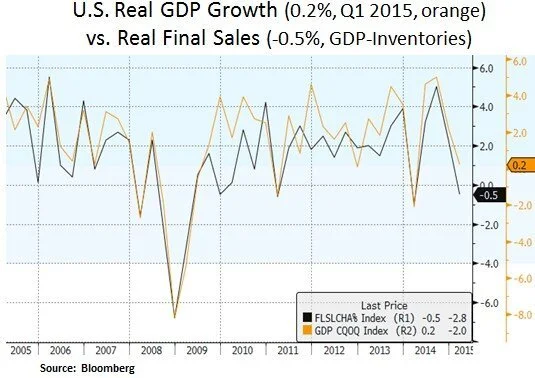

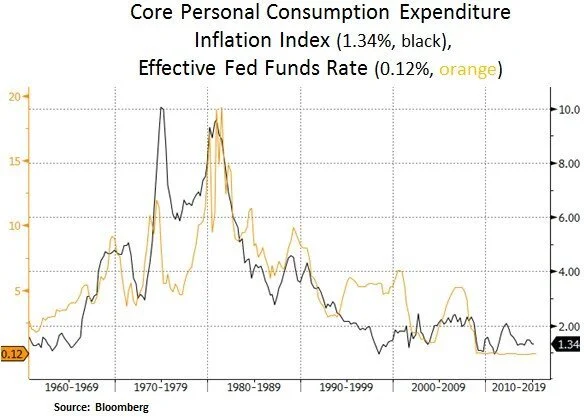

Financial markets have been looking for signs of stability in global growth and inflation metrics. Global sovereign bond yields have risen in the past month; especially in Europe after reaching historic lows. The U.S. Treasury curve has also steepened with the 10 year and 30 year bond yields rising 0.33% and 0.51% respectively to 2.23% and 3.05%. In U.S. equities, the S&P 500 has traded near its all-time highs at 2121 (vs. 2125 intraday high on April 27th). After facing significant USD headwinds and soft U.S. GDP growth in Q1, S&P 500 earnings estimates for 2015 are now showing signs of stability. The DXY USD index has weakened as of late from 100 to 93.4. Despite a weak start for U.S. growth in 2015, global leading growth indicators (ECRI) are showing signs of improvement. As far as Fed policy is concerned, an ambiguous labor market report in April has shifted market expectations for interest rate hikes to Q4 of 2015. Yet, there are nascent signs of wage inflation. As such, along with recovering energy prices, inflation expectations have been rebounding. From a portfolio perspective, we have sought to balance our interest rate sensitivity by increasing our exposure to the financials sector.

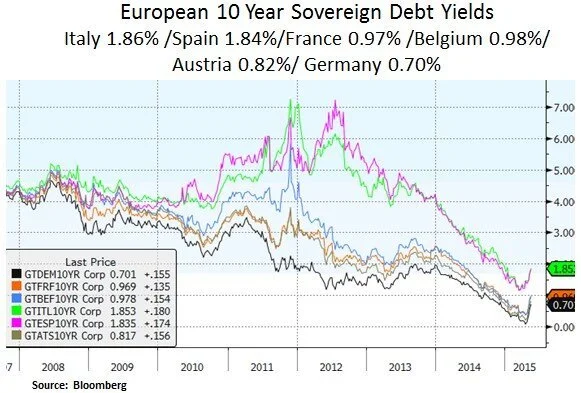

As we can see below, European bond yields have experienced a reversal after hitting historic lows. Fundamentally, growth and credit metrics have been improving in the Eurozone; particularly as the Euro has depreciated sharply in recent months on the back of the ECB’s quantitative easing program. On the energy front, after drilling cutbacks in U.S. shale basins, WTI energy prices have staged a rebound. Along with a weakening USD, TIPS implied inflation expectations have been recovering.

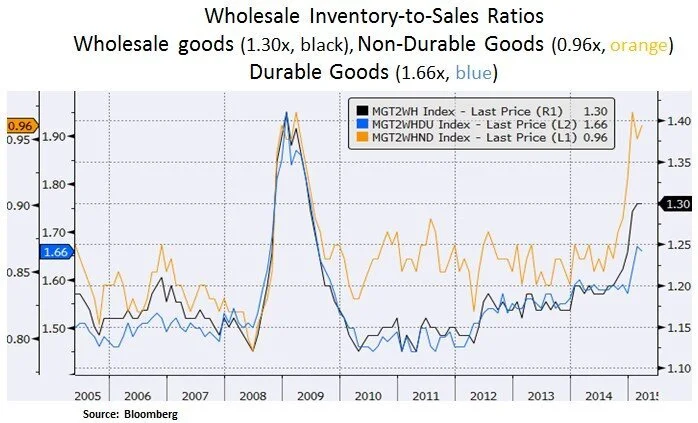

In our view, recent USD weakness can be attributed to weak U.S. growth data and a mixed April labor report. Moreover, recent retail sales and consumer spending data have pointed to a reserved U.S. consumer and somewhat higher wholesale inventory levels. As discussed in our recent articles, USD market positioning has been quite bullish. A check to USD strength is likely to bode well for U.S. multinational earnings and broad global USD liquidity to emerging markets. Given the rise in global USD denominated debt in recent years, the global economy remains structurally ‘short’ the USD. Thus, a soft dollar bodes well for global liquidity.

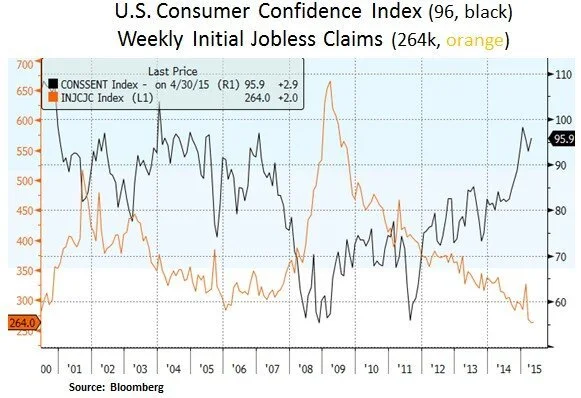

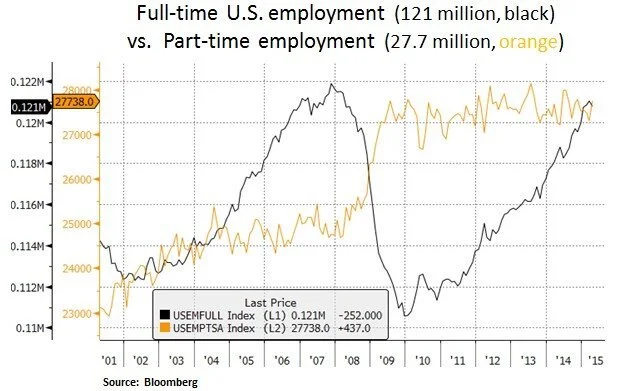

Looking ahead, the market will likely scrutinize U.S. labor market data more closely; especially after six years into the economic and labor market recovery. The quality of the recent April labor market report has been somewhat weak; especially as March witnessed downward revisions (from 126k to 85k). In addition, labor market growth was dominated by part-time workers. Yet, weekly jobless claims have hit a multi-decade low at 264k and the U.S. unemployment rate has ticked down to 5.4%.

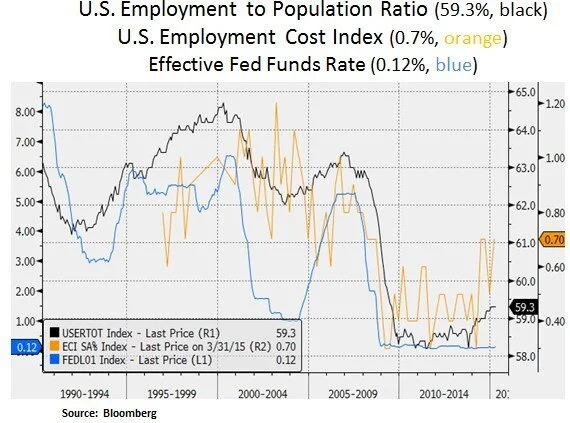

As discussed in recent articles, we see a persistent skills gap in the U.S. labor force. As such, wage inflation should pick up gradually as we enter the later part of the current business cycle. The closely watched Employment Cost Index is starting to show nascent signs of diminishing labor market slack. Wages for all workers increased 2.6% from the year-ago period after rising 2.1% in the fourth quarter. Private wages jumped 2.8%, the largest gain since the third quarter of 2008. Along with asset price inflation, wage inflation expectations should drive the Fed to normalize its monetary policy to an equilibrium level that protects consumer purchasing power but at the same time does not compromise U.S. growth i.e. in the context of aging demographics and high debt levels. Hence, we do not expect an excessive monetary tightening cycle in the next 2-3 years. Soft aggregate demand should keep inflation pressures and interest rates in check.

Therefore, as the Fed gradually progresses in its normalization strategy, we seek to be opportunistic in selectively increasing our exposure to quasi-fixed instruments e.g. utilities, REITS, MLPs and preferred shares. We also seek opportunities in the broader equity spectrum i.e. in investment themes that offer a good balance of capital appreciation and income growth. At this stage in the market cycle, we retain our preference for secular growth themes e.g. in the healthcare and technology sectors.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.