USD Strength Is A Constraint To The Fed's Exit Plan

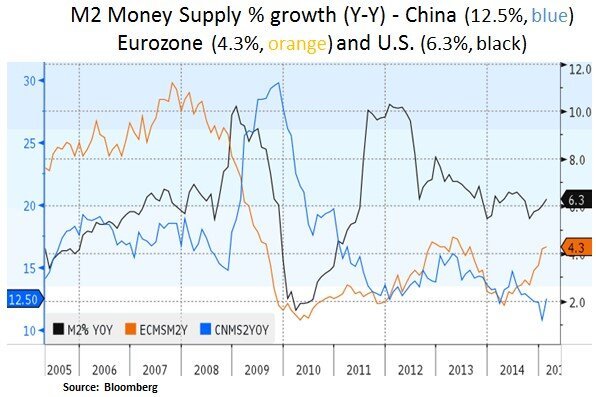

Market participants are focusing on Fed policy in the context of soft U.S. economic growth and a strong U.S. dollar (which has been a headwind to U.S. corporate earnings and global USD liquidity conditions). The market is also reconciling soft U.S. labor data which is one of the Fed’s key objectives. In a world of competitive currency devaluations, several Fed members and businesses have been voicing their concerns of an excessively strong U.S. dollar; that dents U.S. export competitiveness and acts as a headwind to the U.S. corporate profit cycle. In our view, the Fed faces the challenge of preventing future unintended consequences (e.g. asset bubbles and financial instability) and protecting the current business cycle from external threats (e.g. via an uncompetitive USD). In all likelihood, the Fed will lean on the cautious side before meaningfully tightening its policies. Thus, the Fed’s expected interest rate trajectory will likely come down to what the Treasury market is currently pricing in i.e. a more dovish interest rate outlook.

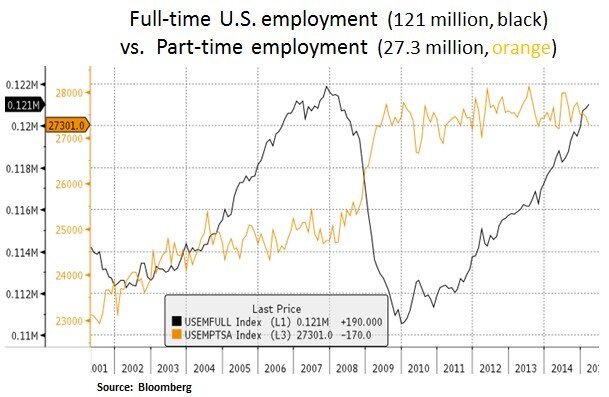

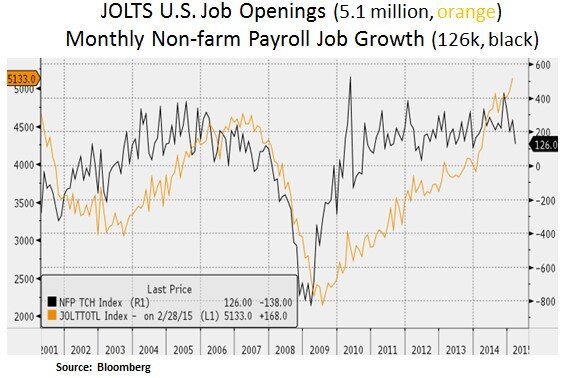

As we can see below, incoming labor data and prior month downward revisions have pointed to a softer than expected labor backdrop. To be sure, the first quarter of 2015 has been impacted by softer demand for durable goods, West port disruptions, energy sector weakness and inclement weather. Market GDP growth expectations for Q1 of 2015 vary from 0 to 1%. Full-time employment has continued to increase (+190k in March). However, part-time employment appears to have been more volatile (-170k in March) and presumably more susceptible to bad weather or other disruptions. Therefore, even though the JOLTS job openings indicator (at 5.1 million openings) has been robust (with a one month lag), the Fed will likely prefer to see firmer labor data before embarking on its first rate hike in nine years.

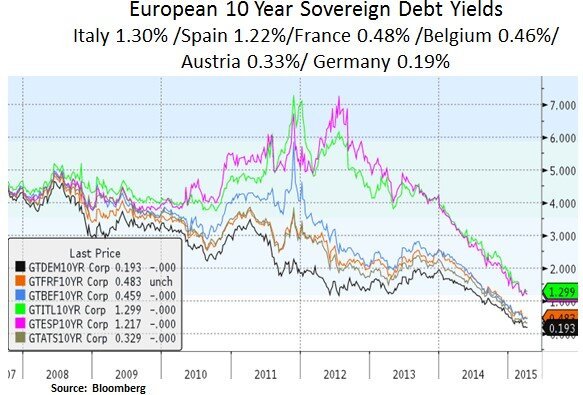

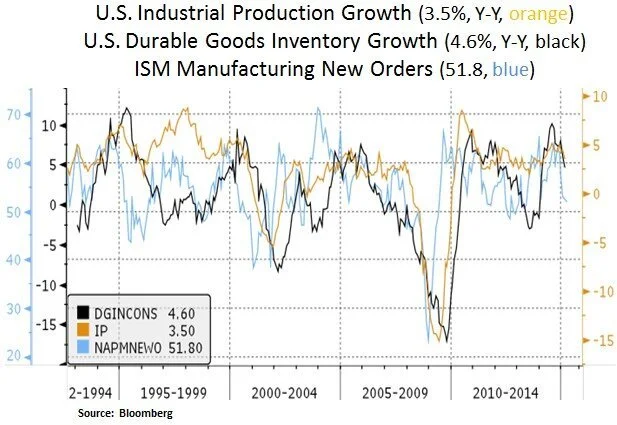

Perhaps the biggest impediment to the Fed’s exit strategy from zero rates is an excessively strong U.S. dollar. Even though a strong dollar bodes well for capital inflows, the manufacturing sector’s trade competitiveness is currently being dented. The U.S. dollar has been strong vs. key developed market currencies (EUR, GBP, and JPY) and commodity exposed currencies (BRL, RUB, CAD, and AUD). In particular, European export peers have been benefiting from a weaker euro and subdued borrowing costs. Further dollar appreciation will likely weigh on U.S. manufacturing new orders. This is an issue for the Fed, as a drop in industrial production and a goods inventory correction would weigh on U.S. corporate earnings (which tend to be closely correlated to industrial production). Therefore, we expect the Fed to continue to voice its recent concerns on USD strength and proceed cautiously in its exit strategy.

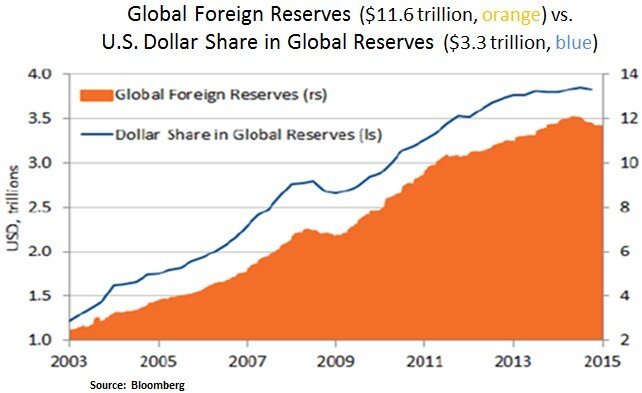

On the global liquidity front, it is worth noting that for the first time in 20 years, foreign FX reserves have started to decline. As USD denominated global debt has become more expensive, emerging markets in particular are selling their FX reserves as a buffer against domestic currency weakness. Thus, even though the credit cycle appears to be in good shape in the U.S. and Europe, we presume that the Fed is also considering international USD liquidity conditions as part of its exit strategy decision making. Only recently, the pace of emerging market capital outflows has started to slow down.

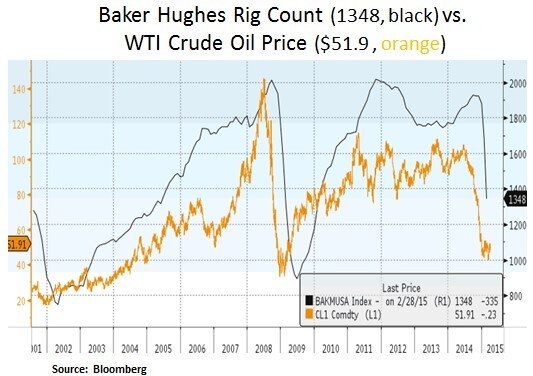

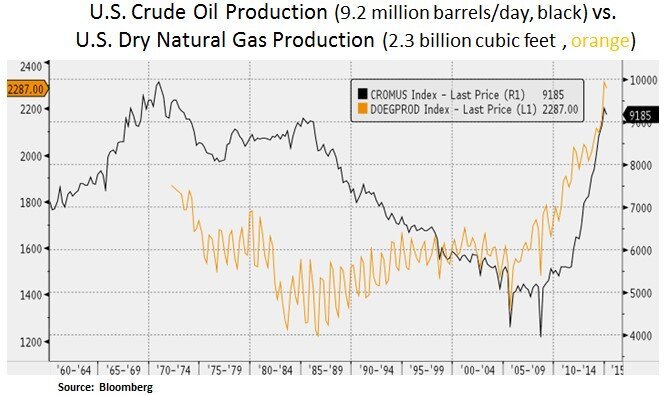

Lastly, we highlight the current rebalancing in the U.S. energy sector. As energy companies curb exploration spending, we are now seeing a steep decline in the U.S. oil/gas rig count. We are optimistic that due to the high production decline rates in existing shale (or unconventional) wells, U.S. production and related petroleum inventories will find an equilibrium level in 2016. If WTI crude oil prices normalize in the $65-75 range, we believe the energy sector can recover after its recent turbulence. A softer U.S. dollar will likely help the sector’s recovery. As such, we expect some of the energy sector credit concerns to be gradually alleviated.

In conclusion, we expect the Fed to take into consideration domestic and external factors as it proceeds to normalize its monetary policy. A pause in the U.S. dollar strength will likely ease some of the manufacturing competitiveness and earnings concerns for U.S. corporations. The energy sector and emerging market exposed U.S. multinationals (e.g. technology) will likely be the biggest beneficiaries.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.