U.S Interest Rate Normalization Likely To Face Headwinds

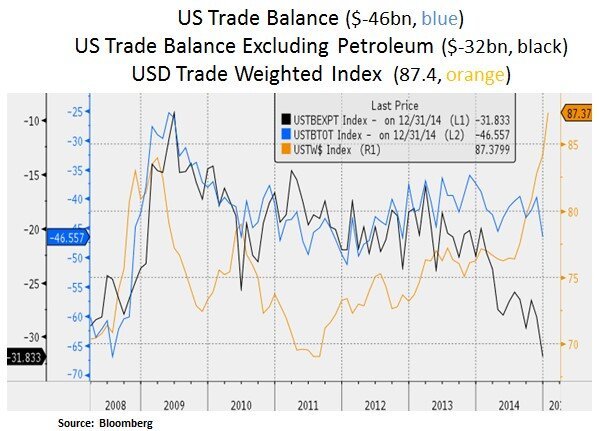

Financial markets continue to witness an accommodative stance by global Central Banks. Thus far this year, 21 Central Banks have cut their base interest rates. Apart from the upcoming quantitative easing program by the ECB, major economies such as China and India have reduced interest rates. In the context of a suppressed yield environment, corporate debt issuance remains robust. For example, pharmaceutical company Actavis recently sold the second biggest corporate bond offering in history, for $21 billion; with a 10 year bond yield at 3.64% (vs. the 10 Year Treasury at 2.13%) and a low investment grade credit rating of BBB-. The bond issue was 4x oversubscribed. In U.S. equity markets, indices made new recent highs in the past month, with the NASDAQ reaching 5,000 (just shy of the 5,048 level in Mar 2000). The S&P 500 and the Dow Jones hit 2,017 and 18,288 respectively (all-time highs). Looking ahead, the market is focusing on the timing and impact of the Fed’s attempt to normalize its interest rate policy. From our perspective, we are keen to see how this policy divergence (vis-a-vis other Central Banks) and a stronger USD will impact the U.S. competitive position in global trade and the earnings outlook for U.S. multinationals.

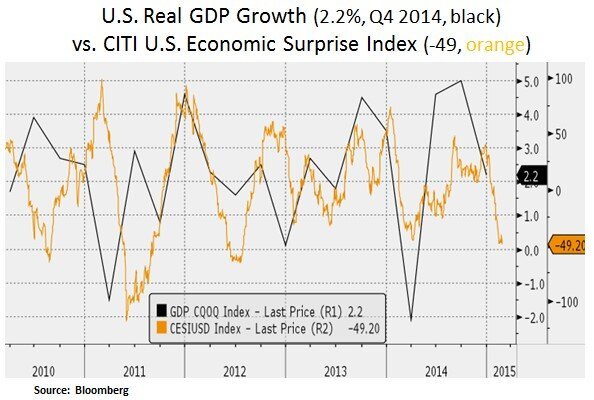

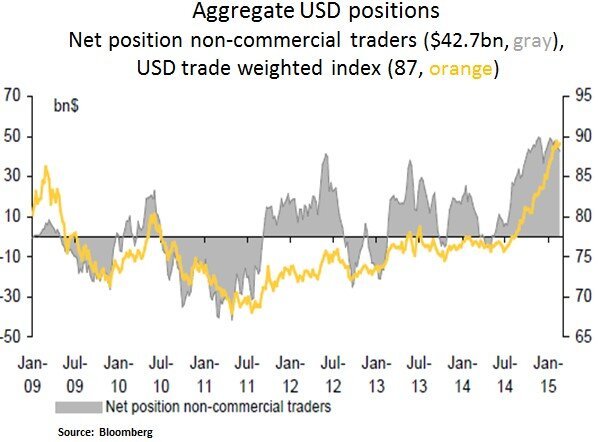

As we can see below, there has been some softness on the U.S. macroeconomic front. Part of this softness can be attributed to inclement weather, a standstill at West Coast ports and lower capital expenditures (due to lower oil prices). The stronger USD however appears to be a more durable trend, as Fed policy is diverging; especially versus the Euro and other major currencies such as the Yen and the Chinese Yuan. Therefore, the Fed may have to respond to softer business investment spending (inventory de-stocking) and soft net exports. In such a scenario, the market’s bullish positioning in the USD may get challenged. From an investment point of view, we would look for opportunities in interest rate and USD sensitive assets if the Fed’s policy normalization course takes a pause.

With regard to inflation, the Treasury market’s long-term expectations have recovered as of late. In our view, the market is seeing through the near-term drop in energy prices and instead is focusing on wage inflation. Companies such as Wal-Mart have recently pledged to raise starting wages to at least $9/hour by April (up from $7.25) and $10 by next February. Other retailers such as TJ Maxx, Marshalls, IKEA and Gap appear to have followed suit with pay increases.

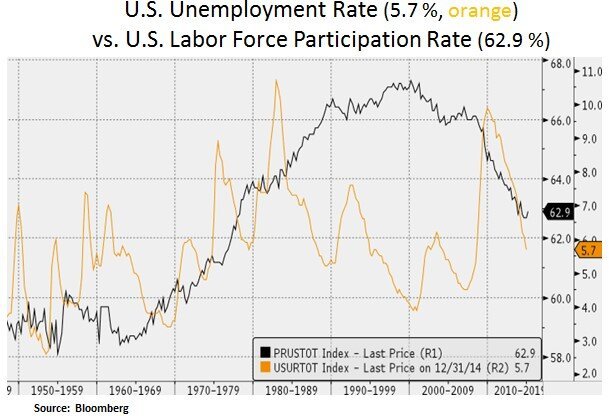

The question is how tight is the U.S. labor market and what will be the impact on permanent income expectations and corporate profit margins. Cyclically and structurally the labor market is gradually becoming tighter. With 5 million job openings, there seems to be a pervasive skills gap which has probably weighed on labor force participation rate. On the other hand, automation and technological advancements have kept a lid on the labor force’s bargaining power; particularly for low wage professions. In our view, the Fed may have some flexibility to tolerate higher wage inflation as labor costs are at historically subdued levels; especially as a percentage of U.S. GDP.

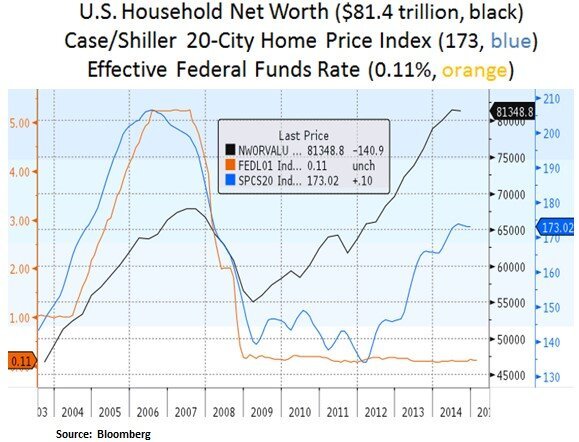

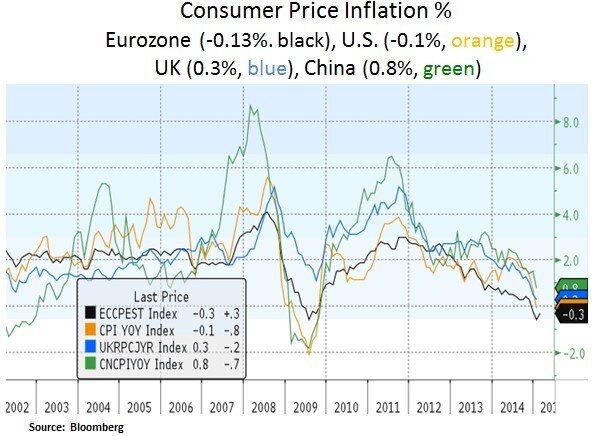

Perhaps more critically, the Fed may have to weigh the dichotomy between asset price inflation in the U.S. and global disinflationary price trends. It is worth noting that despite aggressive quantitative easing programs, inflation in the U.S. and the U.K. is not dissimilar to inflation levels in the Eurozone and China that have lagged in their monetary policies. Thus, it appears that expansion in monetary bases contributes to asset price reflation but not underlying price inflation trends. To a certain degree, global disinflation can be explained by a. household balance sheet repair in the U.S. b. balance sheet repair by European Banks and Eurozone austerity measures c. commodity deflation emanating from a growth slowdown in China.

Therefore, the magnitude of interest rate normalization by the Fed may come into question throughout 2015 and beyond; if domestic and foreign growth & inflation measures do not support a meaningfully tighter U.S. monetary policy. As such, a ‘lower for longer’ interest rate backdrop will likely support income oriented investment themes. We look to be opportunistic as asset classes respond to any shifts in the Fed’s policy language.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.