Breaching The Zero Yield Frontier

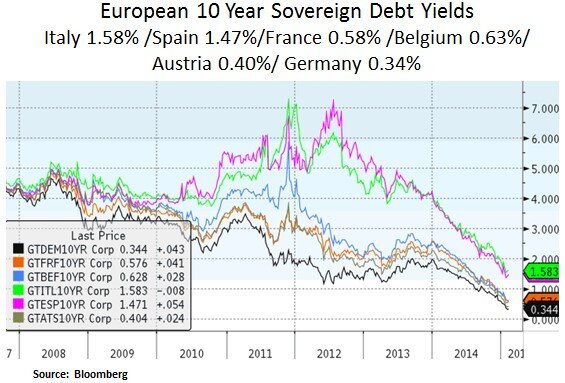

Financial markets are reconciling a global backdrop that features low growth and deflationary undertones. In response to these concerns, global Central Banks have eased even further their monetary policies in January; led by the ECB’s 1.2 trillion EUR quantitative easing program through Sep 2016. Central Banks in Denmark and Switzerland introduced negative deposit rates at -0.50% and -0.75% respectively; in an attempt to prevent their currencies from appreciating against the Euro. The ECB itself has a negative deposit rate at -0.20%. Given the above setting, European sovereign bond yields moved even lower in January, with about 1.5 trillion EUR of euro area debt (maturing more than a year) paying a negative yield. After the Swiss National bank abandoned its peg to the Euro, Swiss bonds have negative yields up to 13 years. Moreover, the German 10 year Bund yields 0.36%; which is lower than the 10 year Japanese bond yield at 0.37%. The 10 Year U.S. Treasury yields 1.82%. Lastly, the People’s Bank China has cut the bank reserve requirement ratio by 0.5% to 19.5%; which allows for a $100bn injection into the banking system.

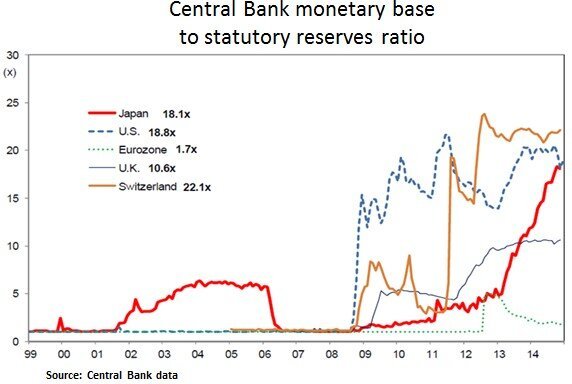

From an investment perspective, suppressed interest rates and financial repression policies support our focus on income generation from non-agency MBS, quasi-fixed income instruments (such as preferred equities, REITs, energy infrastructure MLPs) and dividend paying common equities (e.g. healthcare, telecom, technology and selective industrials). The corporate sector will likely continue to benefit from low funding costs, at the expense of savers. On a more cautious note, we are cognizant of the diminishing returns to the Central Bank monetary cycles and the limits to their own balance sheet expansion; especially as sovereign bonds have now started to breach the zero yield boundaries. In the medium-term, the acid test for these policies is whether ample monetary liquidity will translate to meaningful credit expansion and further upside to the global business cycle.

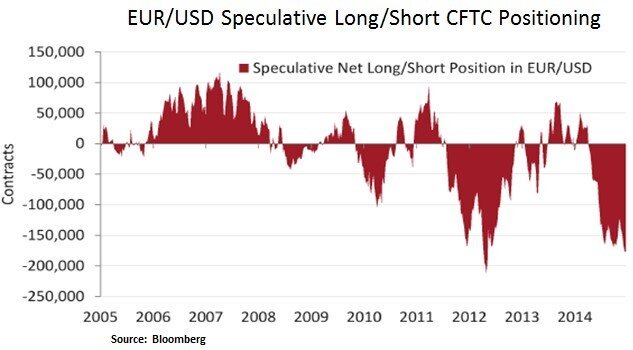

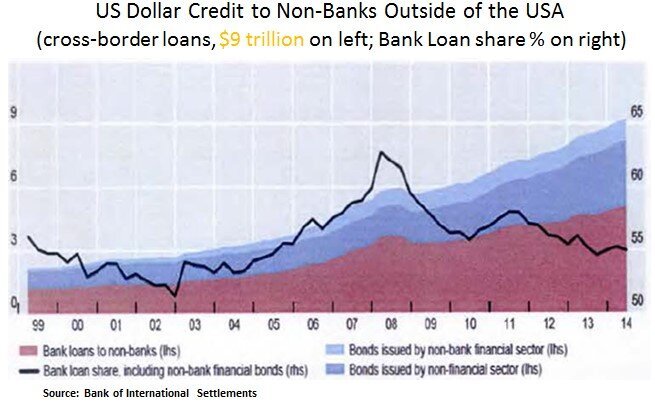

Market participants continue to debate the sustainability of the currently crowded USD positioning; particularly against the Euro which accounts for 58% in the DXY USD Index. To be sure, the Euro has already experienced a large decline from $1.40 to $1.14. Further downside is not out of the question, especially as ECB and Fed policies continue to diverge. Moreover, as we can see above, technically the ECB’s balance sheet has ample expansion capacity. At the global level, we would also highlight the structurally ‘short’ USD position that non-U.S. institutions and corporates have accumulated. These USD denominated liabilities have now reached $9 trillion according to the Bank of International Settlements. Therefore, any change in Fed policies matters for global liquidity, FX rates, funding costs and Emerging Market capital flows.

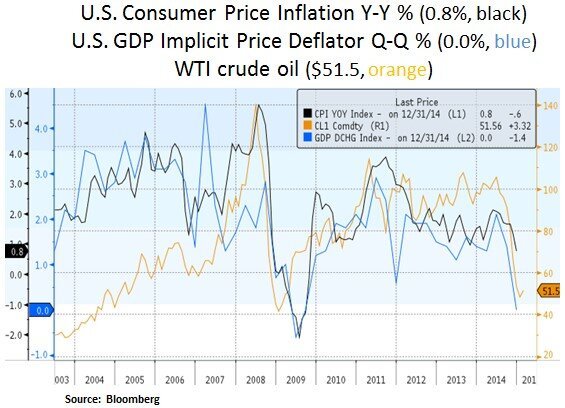

At its Jan 28th FOMC meeting, the Federal Reserve expressed optimism with regard to U.S. economic growth and traction in the labor force. They indicated that underutilization of labor resources continues to diminish. As we can see below, the U.S. unemployment gap is becoming negative. As we discussed in past articles, a skills mismatch is starting to become an issue for corporations; with unfilled job openings reaching new highs at 4.97 million. The most recent Q4 2014 GDP report pointed to soft pace of growth (2.6% real GDP growth) and subdued inflation i.e. a GDP price deflator at 0% and a core Personal Consumption Expenditures (PCE) price inflation at 1.1%. The latter is lower than the 2% Fed target. Lastly, with regard to the recent decline in energy prices, the Fed pointed to a transitory impact on inflation.

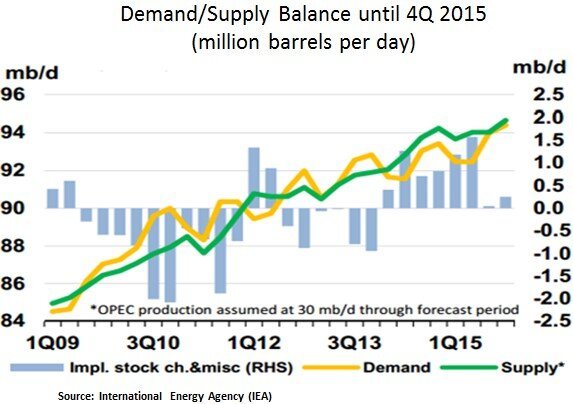

According to the International Energy Agency, expectations for non-OPEC supply growth for 2015 are now been downgraded; led by Canada and Colombia. Energy producers such as Chevron, BP and Conoco have recently pointed to sizable cuts in their drilling expenditures. At the global level, more than $100bn energy related capital expenditures have been cancelled for 2015. Therefore, energy related deflation will likely be checked as oil/gas supply is curtailed.

In our view, the Fed has to consider domestic and international factors in determining the timing and magnitude of its policy normalization; even after more than six years of zero interest rates and a quintupling of its balance sheet. As global Central banks are engaged in competitive currency devaluations, we suspect that the Fed will take baby steps in meaningfully tightening its policies. Therefore, the ‘lower for longer’ interest rate backdrop may persist.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.