Financial Conditions Still Support The Business Cycle

Financial market participants entered 2015 facing muted global growth and inflation expectations. Sovereign bond markets have been pricing in this fundamental backdrop and expectations for sovereign bond purchases by the ECB. Headline Eurozone inflation moved into deflation territory in December of 2014 i.e. -0.2% Y-Y. At the global level, there are ongoing question marks with regard to aggregate demand trends (e.g. Eurozone, China, Japan and commodity driven Emerging Markets). On the other hand however, the subdued price levels of input costs such as energy and base metals support elongated global monetary policy cycles and further cyclical runway for the global business cycle. To be sure, there are concentrated areas of distress e.g. in Russia but large importers of energy (such as India, China, Japan, Europe) will likely benefit in 2015. In the U.S., the global and domestic disinflationary backdrop can extend the timeline for meaningful interest rate hikes. Thus, the above components can feed the next leg of the current global business cycle. The subdued interest rate environment bodes well for income oriented and late-cycle investment positioning.

As we can see below, sovereign debt yields have continued their downward trajectory. The German 10 Year Bund hit a record low at 0.44% and yields at the front-end of the German yield curve have entered a negative area i.e. -0.11% for the 2 Year note and -0.01% for the 5 Year Bund. In the U.S. Treasury market, the 10 Year yield is at 1.97% (a 96 basis point decline Y-Y) and the 30 year long bond yield is at 2.54% (a 134 basis point decline Y-Y). Subdued borrowing costs should promote further credit growth; especially in the Eurozone.

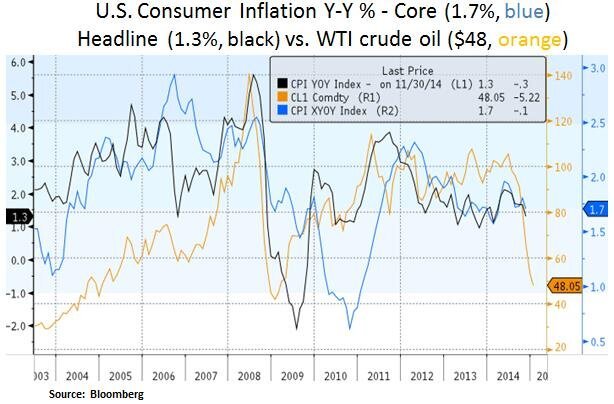

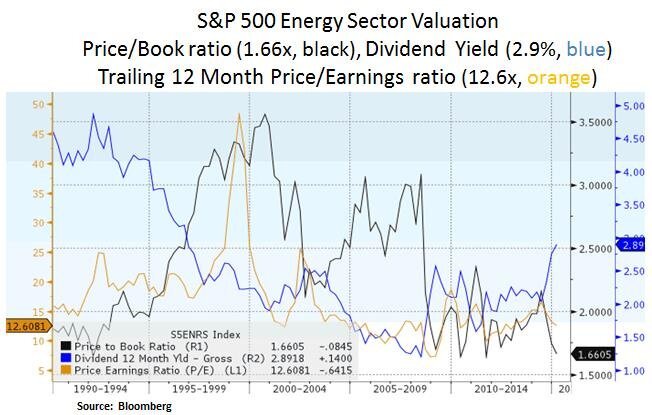

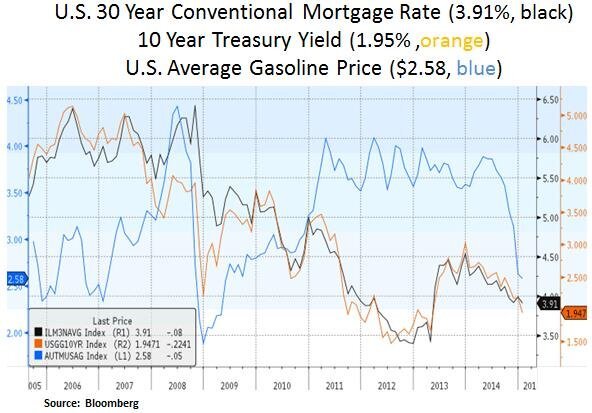

The Federal Reserve enters 2015 facing a timing dilemma for its goal for interest rate normalization. On the one hand, asset price inflation has been promoted quite successfully e.g. in the U.S. credit, equity and housing markets. On the other hand, the recent decline in energy prices (crude oil, gasoline and natural gas) will likely dampen headline U.S. inflation numbers in the coming months. Moreover, global goods competition and a strong USD are weighing on imported inflation. Therefore, if the Fed is undershooting its inflation target (~2%) it may elongate the timeline for interest rate hikes; at least towards Q4 2015 or Q1 2016. USD strength has been a headwind for USD traded commodity and energy prices. Moreover, as the world’s funding currency, USD strength has been an overhang for emerging market borrowing costs. At this juncture, market positioning is decisively bullish on USD performance vs. other main currencies such as the Euro and the Yen. The Fed recognizes the USD’s deflationary impact. If the Fed softens its language for interest rate hikes, a medium-term pause in the USD trend may benefit recently impacted sectors such as U.S. energy equities. In our view, energy sector valuations are becoming attractive on a historical basis.

In a consumer driven U.S. economy, we expect the recent decline in gasoline prices to support early 2015 U.S. GDP growth. Beyond the first half of 2015 however, traction in the labor market will likely be the main driver for consumer confidence i.e. expectations for permanent income growth.

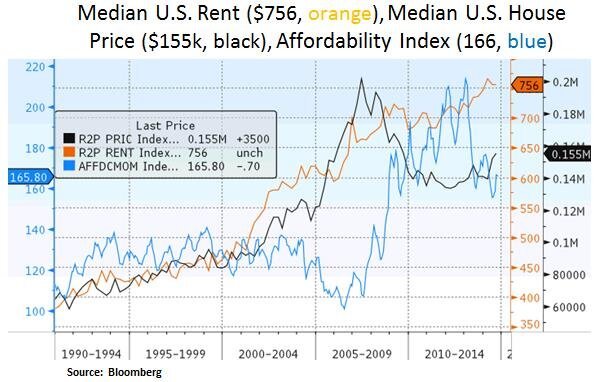

Lastly, with regard to U.S. housing, contained mortgage costs are likely to support our ‘slow and steady’ U.S. housing recovery scenario. Rising rental inflation and well managed housing inventory levels should also support homeownership and house prices.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.