The Federal Reserve Still Faces A Low Inflation Backdrop

Financial markets are reconciling a global backdrop that features ongoing disinflation and uneven growth. Expectations are still high with regard to timely policy interventions and avoidance of policy errors; in order to promote growth and price stability. The Federal Reserve currently faces a diverging set of domestic and external factors as it continues to normalize its monetary policy. On the one hand, the U.S. labor market is showing signs of cyclical tightness and household net worth is at record highs. Most likely, the Fed wishes to normalize its interest rate policy in order to keep some dry powder for future times of economic duress. On the other hand however, the Fed is facing a soft and disinflationary global backdrop. In a dollar dominated global credit market, the Fed still plays a pivotal role in influencing the global cost of credit. Therefore, the Fed will likely lean on the side of cautiousness in the interim as it balances domestic and external factors.

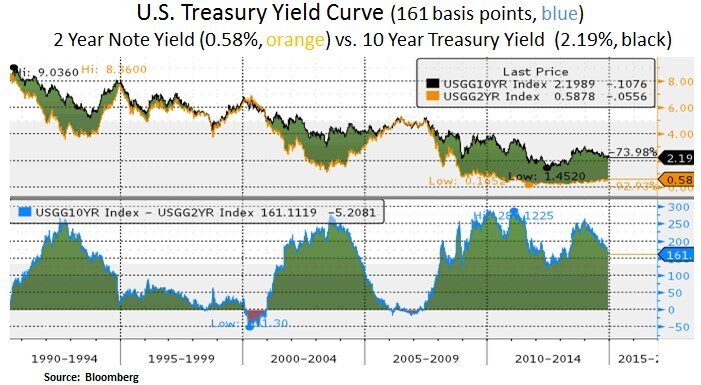

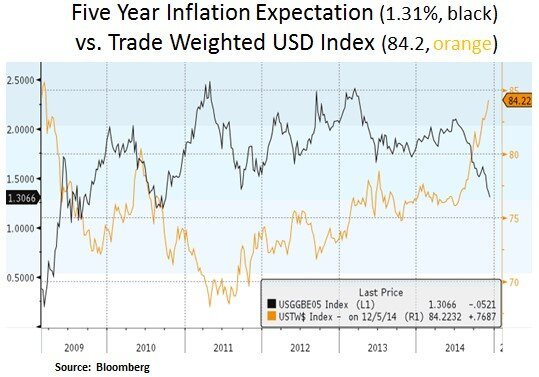

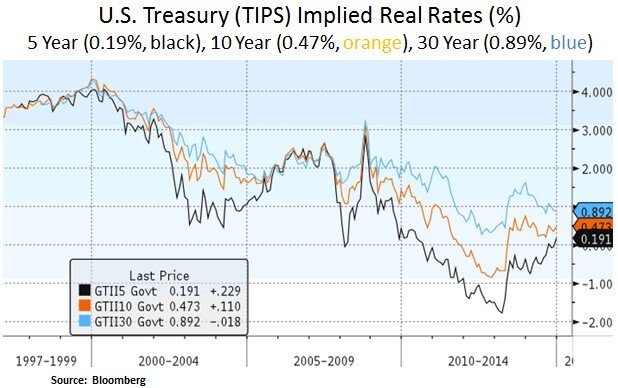

As we can see below, the recent decline in energy prices has weighed on inflation expectations. Apart from crude oil supply/demand dynamics, the USD strength has also been a headwind for inflation expectations. In Treasuries, yields on the front-end have been firm and the curve experienced a bull flattener in recent days as demand for long-term Treasuries increased. In inflation adjusted terms, the TIPS market suggests a gradual departure from ‘financial repression’ policies i.e. negative real interest rates.

After ending its quantitative easing (QE) policy in October, the Fed will likely continue to monitor U.S. and global money supply trends i.e. as a leading indicator for underlying economic growth. Domestically, the Fed will likely monitor the private sector’s capacity to generate liquidity via corporate debt issuance. Moreover, demand for consumer credit will also garner attention as households have been repairing their balance sheets. In our view, households and corporations are key sources of credit demand as the U.S. government balance sheet became fairly geared following the 2009 crisis (now at 103% debt/GDP). Therefore, the Fed is likely to take baby steps in normalizing its interest rate policy i.e. at a pace that does not disrupt credit demand.

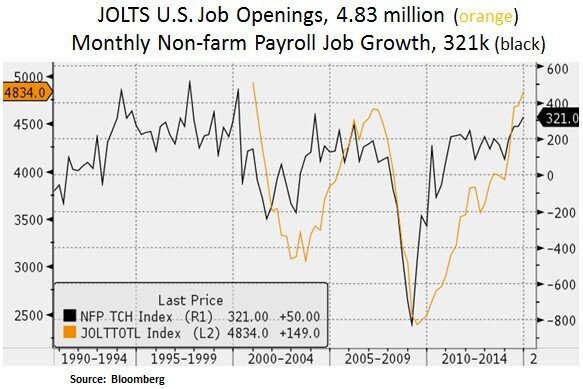

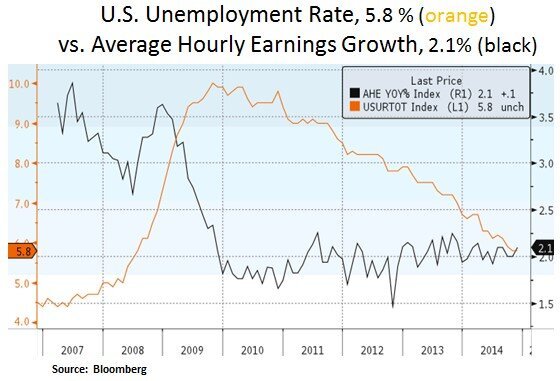

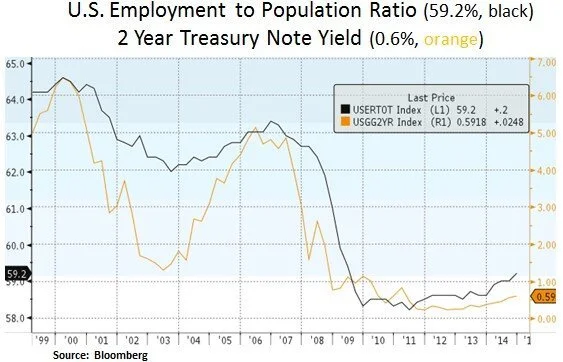

The U.S. labor market continues to show signs of cyclical tightness. Demand for labor remains robust at 4.8m vacancies and supply of labor is gradually improving. Wage inflation should gradually pick up as a skills mismatch becomes more prevalent; particularly for high-end jobs. The current labor market recovery has generally been dominated by job creation in low paying professions.

In conclusion, wage inflation may not be as rampant until labor force participation improves for the younger labor cohorts; which are a key source of aggregate demand in the U.S. economy. Therefore, the Fed may still have time on its side; until wage inflation truly becomes an obstacle for the current business and profit cycle. An elongated monetary policy cycle is generally supportive for housing and financial asset prices.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.