Inflation in the Fed’s New Policy Framework

Despite strong economic data, markets remained relatively subdued in the month of May with the S&P 500 gaining 0.55% after an already strong start to the year. Investor sentiment has oscillated between inflation angst and optimism regarding economies reopening. The continued vaccine rollout and considerable fiscal support has buoyed a surge in economic activity, but markets were guarded in May by concerns that upside data surprises may result in more persistent inflation, which in turn could force central banks to bring about an untimely end to the growth recovery.

U.S. corporate earnings for the first quarter were far stronger than expected with S&P 500 companies reporting earnings growth of 47% year-over-year relative to consensus expectations for 20% growth. With continued vaccinations allowing economies to reopen prompting a rapid rebound in demand, and supply chain bottlenecks making it difficult for manufacturers to fulfill their orders, the conditions are ripe for materially higher inflation in the coming months. The critical question is, will this inflation ultimately be transitory, or will it remain sticky? This debate hinges in large part on labor dynamics. U.S. businesses are struggling to fill jobs, which are competing with generous government benefits, meaning many companies may be forced into paying higher wages to entice employees back to work. Once the supplemental unemployment benefits expire in the coming months, wage growth should be determined by the amount of slack in the labor market.

The true test will be now that the Fed has altered course to be more reactionary, will they be able to normalize policy at the correct time? Many of the larger structural disinflationary forces like automation and globalization that have been at work for the last decade will continue. The Fed is tasked with an exceedingly difficult mission of threading that needle amidst a backdrop of exploding fiscal deficits and a rapidly changing global economic landscape. The market may force their hand before they are ready, and one potential example of this is the recent Federal Reserve overnight reverse repo facility usage. This program lets eligible financial firms park cash overnight at the Fed. The most recent surge, due to too much cash in the system and a declining Treasury bill supply, are signaling to the Fed that their $120 billion per month bond-buying program is no longer working as intended.

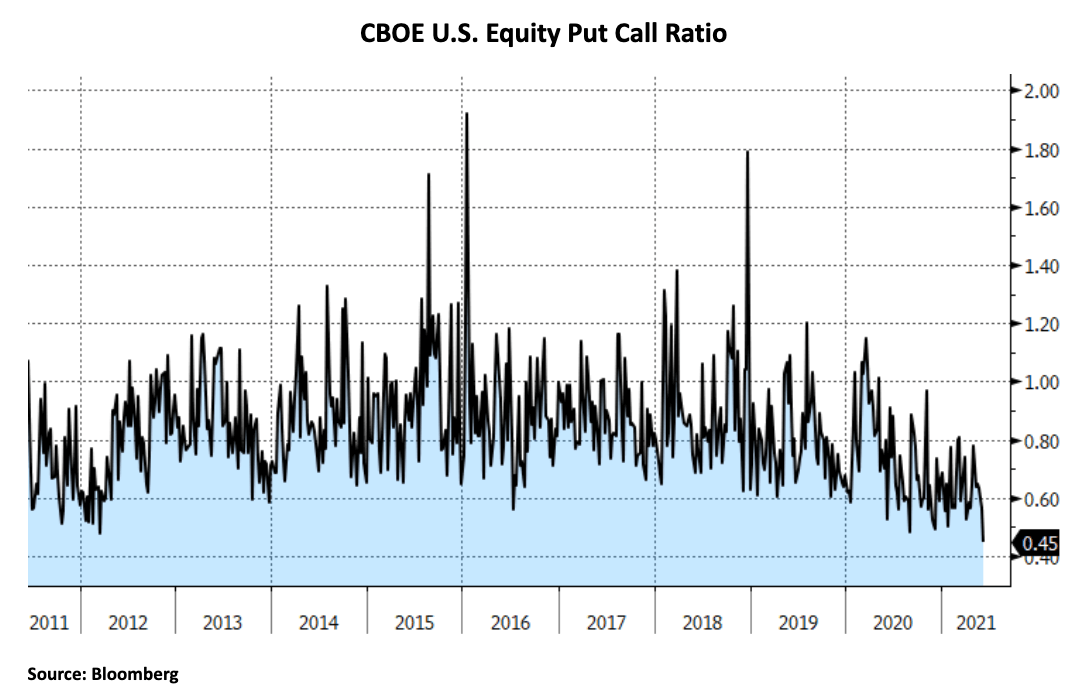

If inflation does remain persistent, equities should do well in a modestly inflationary environment as higher revenues generally offset higher input prices. Equities have had an admirable start to the year, and while some market turbulence is expected, we remain constructive on equity markets and the overall outlook of the economy. From a positioning standpoint, a data point worth taking note of is the Put/Call Ratio. The Put/Call ratio is the ratio of the trading volume of put options to call options which falls as bearish bets/hedges decline, and it is now at its lowest level in almost 10 years, begging the question if some near-term complacency has crept into markets.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request