Markets Running Out of Growth Drivers

A broadening economic restart, strong corporate earnings, and a decline in U.S. Treasury yields are helping to provide support to equity markets, with the S&P 500 gaining approximately 3% over the past month. Investors always pay close attention to corporate earnings, but with limited room for further valuation expansion, participants are looking to earnings to be the key contributor to further stock market returns. Overall, 60% of the companies in the S&P 500 have reported Q1 results with roughly 90% of them beating consensus earnings estimates according to Factset.

Investors are trying to interpret the new dynamic of atypical economic growth and new central bank policy frameworks. The “reflation” trade has renewed vigor after Fed Chair Powell’s comments last week that he needs to see considerable progress in the employment picture before they are willing to even begin to discuss policy normalization. He stressed the desire to see a “string” of jobs reports similar to March’s 916k increase to feel that the U.S. economy is on the right path. The Fed’s unwavering commitment to ultra-loose policy in the face of robust economic data, ebbing Covid infections, and plans for trillions more in fiscal spending are not going unnoticed.

Russell 1000 Value Index vs. Russell 1000 Growth Index (Black), U.S. 10 Yr Treasury Yield (Orange) - Source: Bloomberg

U.S. 5yr 5yr Forward Breakeven - Source: Bloomberg

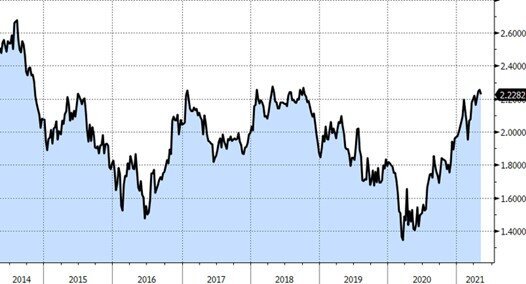

A byproduct of the continued commitment to ultra-low-rate policy previously discussed is forcing participants in search of yield out the risk curve. This is no more evident than in the high yield bond market. Cohorts of investors, like insurers and pension funds that typically focus on the investment grade market, are increasingly allocating more capital into weaker credits. This surge in demand has sent yields on high yield bonds to record lows.

Bloomberg Barclays U.S. Corporate High Yield Bond Index Yield to Worst - Source: Bloomberg

A perfect storm has developed in commodity markets where supply chain disruptions are adding to near-term inflationary pressures by constraining the supply of goods as demand is accelerating. Company leaders across industries have cited supply chain issues on earnings calls citing the long-term impacts of the Suez Canal blockage, overwhelmed U.S. ports, and the worldwide chip shortage. This situation is likely to remain in the medium-term as lead times to increase capacity tend to be long.

% Price Appreciation of Lumber (Black), Lean Hogs (Blue), Corn (Pink), Steel Rebar (Yellow), Gasoline (Green), Copper (Purple), WTI Crude Oil (Orange) - Source: Bloomberg

Expect to see continued bouts of volatility on the heels of strong data as markets test the Fed’s resolve to let the market “run hot.” Any sustained move higher in rates is likely to challenge risk assets. At any point in 2021 equities have seemingly shrugged off everything from a spike in Treasury yields to potentially higher capital gains taxes. This could finally give way as the broader market loses momentum.

CBOE Equity Put/Call Ratio - Source: Bloomberg

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request