Inflation Remains in Focus as the Recovery Marches On

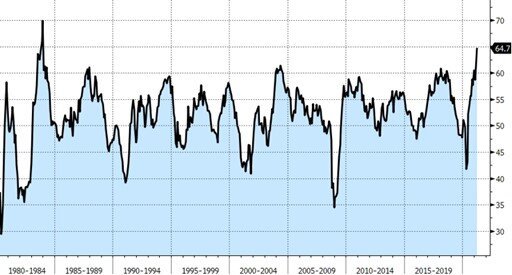

U.S. equities capped off an impressive first quarter on the heels of continued vaccine rollouts and improving economic data. This was headlined by Thursday’s ISM Manufacturing PMI which rose to its highest levels since 1983, and a strong jobs report on Friday which saw nonfarm payrolls surprise to the upside with a gain of 916,000. The rebound from February’s winter storms, more reopenings, and stimulus impacts lead to widespread job gains.

ISM Manufacturing PMI - Source: Bloomberg

In corporate debt markets, U.S. high-grade sales wrapped up the second highest-volume first quarter on record, while junk bonds saw their busiest quarter ever with sales of about $145 billion. This pace is expected to continue as companies look to lock in low yields as longer-term rates climb higher on the back of mounting fears of inflation.

After recently passing the $1.9 trillion stimulus package, the Biden administration is now turning its focus to infrastructure. The $2.25 trillion plan is divided into two components. The first phase is aimed at physical infrastructure such as roads, high-speed internet, and utility grids. The second part focuses on broader access to education, healthcare, and child-care. With the Federal Reserve committed to maintaining its low-rate policy and the scale of fiscal spending, fears of future inflation have begun to ripple through markets. Leadership in the stock market is rotating based on fears of inflation and ultimately what the Fed will do if inflation does rise. Fed Chair Powell made it clear in his most recent testimony on Capitol Hill that he is not concerned about the rise in long-term bond yields. He argued that the move has been orderly, and that the Fed would only react if it becomes disorderly.

Putting spare capacity back to work over a short period of time will likely lead to strong growth for the balance of 2021. The reopening will likely also be supported by continued easy monetary policy and unprecedented government spending. Despite this strong growth outlook, the Federal Reserve has signaled its intention to remain very stimulative and to keep interest rates close to zero for the foreseeable future. Strong growth and a tighter labor market should keep upward pressure on the longer end of the yield curve, but there will likely be some support for longer duration bonds from a global relative value perspective, with much of the global developed bond markets yields still negative. This dynamic is likely to keep fixed income volatility high.

U.S. 10 Year Treasury/German Bund Yield Spread - Source: Bloomberg

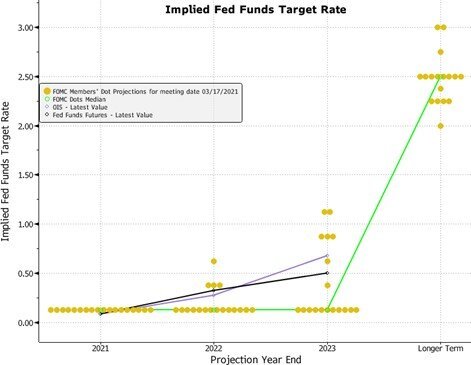

The measured inflation rate in the U.S. will increase meaningfully in the coming months due in part to “base effects”- meaning when compared to an exceptionally low number in a previous period- which in this case is last year’s figure that was distorted by Covid-related lockdowns. When this is coupled with recent increases in economic activity, input prices, and persistent supply chain fragility (as evidenced by the weeklong Suez Canal blockage and semiconductor shortages), the Fed will be tasked with deciphering the persistence of price levels and convincing markets that any increases will be transitory. While those at the Fed are viewing any inflation spike through a longer lens, markets likely won’t take that same perspective and could rapidly take bond yields higher, destabilizing risk assets along the way. Fed funds futures now price in four rate rises by the end of 2023, this is far more hawkish than the Fed’s “dot plot” of forecasts from its governors, so the markets are betting that the Fed will be forced to tighten before it wants to.

Source: Bloomberg

While higher inflation over the coming months appears likely, the Fed’s broadened interpretation of full employment remains elusive. They will be hesitant to move off their current path of 2% average inflation targeting and inclusive maximum employment.

African American Unemployment Rate (Orange), Hispanic Unemployment Rate (Black), White Unemployment Rate (Blue) - Source: Bloomberg

This is a notably different economic cycle coming out of a recession driven by lockdowns as opposed to underlying economic and financial strains. Company fundamentals remain generally sound as indicated by the most recent earnings season and corporate earnings guidance. Markets will continue to remain focused on upside inflation risks in the near term and volatility will remain elevated. Sector and security selection in this environment remain crucial and we continue to look for opportunities in a potential new rate regime.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request