Investors "Buying the Dip" Despite Inflationary Pressures

February ended in notable fashion for global markets with sovereign bonds selling off sharply, sending yields of several nations to new multiyear highs. Stocks followed suit with the S&P 500 ending the week down 2.4% and up 2.8% for the month overall. Last week, in prepared remarks before the Senate Banking Committee, Fed Chair Jerome Powell showed no deviation from the tone of recent statements, and the Fed remains unwavering in their policy stance in the face of rising treasury yields. Powell also noted the uncertainty ahead and that the recovery was far from complete, further implying the Fed’s desire to maintain policy support. The bond market then continued to press the issue sending longer-dated yields soaring, with the 10 Year Treasury subsequently rising another 26 basis points to 1.60% amidst weak auctions and lackluster liquidity.

While much of the bond volatility was likely technically-driven, the Fed’s reluctance to acknowledge the upside risks in rates will likely lead to further uneasiness. Without additional guidance, this uneasiness may continue as rising inflation expectations in the wake of astounding fiscal spending causes participants to believe that the Fed is losing control of the yield curve. As a result of this, there are growing expectations that they will resurrect Operation Twist. This is a program last implemented in 2011 that involves selling shorter-dated government notes and buying an equal amount of longer-duration securities, thus flattening the yield curve and alleviating some liquidity issues.

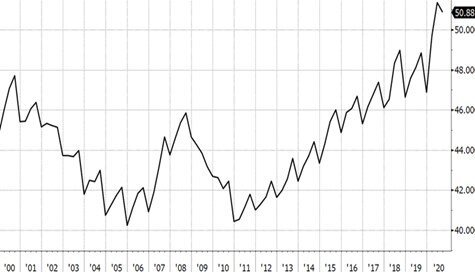

ICE BofA MOVE Index - Source: Bloomberg

While central banks have made their willingness to let inflation “run hot” for a period of time well known, Monday’s ISM manufacturing report showed a significant jump in prices paid which is now at its highest levels since 2008. As companies pass higher costs onto consumers these figures show the disconnect between traditional inflation measures and ones that reflect critical components of consumers’ budgets (i.e. food and energy). This along with an improving copper-to-gold ratio, which traditionally indicates an improving underlying economy as copper prices increase as output is rising, means that rates may have some further room to run. The Fed needs to tread lightly as they attempt to strike the right balance of remaining accommodative while keeping yields under control.

ISM Manufacturing Prices Paid Index (Black), U.S. 10 Year Treasury Yield (Orange) - Source: Bloomberg

Copper/Gold Ratio (Black), U.S. 10 Year Treasury Yield (Orange) - Source: Bloomberg

Markets will continue to be volatile as participants attempt to navigate a quickly shifting landscape. For now, equity markets are focusing on continued improvement on vaccine rollouts and improving corporate earnings. Stocks remain particularly vulnerable to ballooning debt, select speculative bubbles (SPACs, Reddit stocks etc.), and higher rates. We remain constructive and flexible for potential opportunities.

U.S Corporate Debt/GDP - Source: Bloomberg

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request