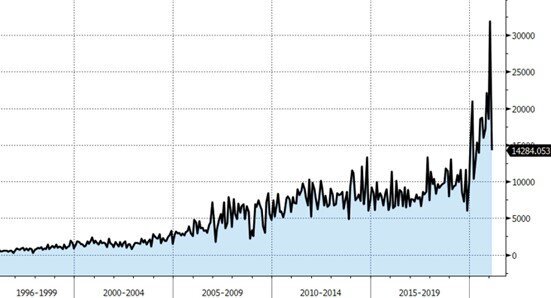

Retail Traders Making a Loud Statement

January concluded in truly extraordinary fashion last week as retail traders banded together to spark historic short squeezes in select stocks, prompting technical deleveraging in the broader market as a result. The remarkable rise in the share prices of the retail-targeted companies triggered forced selling in other stocks as some investors sought to cover their short positions. Fears of contagion of an ensuing liquidity crisis similar to the Long-Term Capital Management selloff of 1998 exacerbated the move to the downside, causing the S&P 500 to decline 3.31% on the week.

While the events of last week were eye-opening for many reasons and increased volatility should linger, the phenomenon has likely subsided. Market participants are now refocusing on many of the same themes of 2020. That is improving earnings, vaccine rollouts, and additional fiscal support. With more than 30% of S&P 500 companies having reported fourth-quarter earnings, and over 80% of them beating expectations according to Refinitiv, the trajectory of the earnings recovery remains intact. This coupled with news that Senate Democrats are introducing a budget resolution, which is the first step required to use a budget reconciliation procedure that would allow much of Biden’s $1.9T stimulus plan to pass the Senate with only 51 votes.

U.S. Total Option Call Volumes (in thousands) - Source: Bloomberg

Amidst the frenzy last week there was also an FOMC meeting. What was notable was that the members acknowledged that the economic recovery has moderated and emphasized the importance of progress on vaccinations to the path of the economy. Chair Powell again stressed that talking about the Fed’s exit is premature, and that the focus of the FOMC is giving the economy the support it needs. On inflation, he believes any price effects from the potential burst of spending when the economy reopens will be fleeting. He said that he doesn’t expect the disinflationary forces of ageing demographics, advances in technology, and globalization that the Fed has struggled with for years to change quickly. The market does not believe it will be that easy to reverse course however, with inflation expectations via the 5-year breakeven rate significantly outpacing actual overall price increases. The real focus of the Fed at this point in time is the employment picture. Powell commented in regards to maximum employment that the Fed will not only look at the headline unemployment rate, but also different demographics as well. The participation rate continues to fall and there are still millions of Americans out of work or underemployed. The labor market has a long way to go, so Fed policy is likely to remain unchanged for some time.

U.S. 5-Year Breakeven Inflation Rate (Black), U.S. Personal Consumption Expenditure Core Price Index YoY% (Orange) - Source: Bloomberg

U.S. Labor Force Participation Rate (Black), U.S. Continuing Jobless Claims (Orange, in Thousands), U.S. U-6 Unemployed & Part Time/Marginally Attached % of Labor Force (Blue) - Source: Bloomberg

Although stocks have regained their positive momentum, as noted earlier we expect elevated volatility to remain. The S&P 500 option skew, representing the difference in cost between the index’s puts versus calls, rose last week to the highest level in 3 years; indicating investors are concerned about further market dislocations ahead. On the geopolitical front, tensions with China appear to be heating up again. In a speech yesterday, China’s top diplomat, Yang Jiechi, warned the U.S. not to cross the country’s “red line.” He pushed back against early moves by the Biden administration in continuing the pressure from the Trump administration on Beijing over human rights and trade. It is important that the new administration tactfully maintain this pressure and not be seen as “giving in” to the Chinese Communist Party in what has become one of the few items both sides of the aisle can agree on. Further, close attention must be paid to the military coup in Burma, and will pose a significant challenge to the new administration as they try to effectively navigate a complex situation.

S&P 500 2nd Month Options Skew Ratio - Source: Bloomberg

From a portfolio perspective we continue to favor exposure to quality stocks in technology and healthcare enjoying structural transformations thanks to long-term technological trends. Balanced with this, we also have select cyclical exposure to take advantage of the continued economic recovery.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request